Companies that change our world are once-in-a-lifetime opportunities and investors need to get in on them early on, according to Mark Baribeau, manager of the $631.53m PGIM Jennison Global Equity Opportunities.

This it what has shaped his fund, which invests 60% in US growth and the rest mostly in European consumer discretionary and healthcare companies.

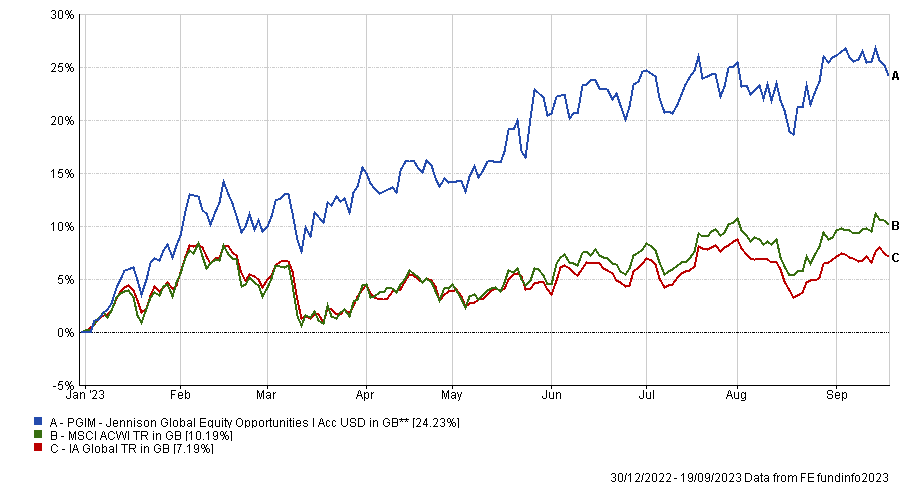

It has been the third-best performer of the IA Global sector over the year to date – largely thanks a portfolio shift towards artificial intelligence (AI) very early on.

Earlier this week, he told Trustnet about his trip to a “bleak” Silicon Valley that helped him get in early to the AI boom.

Below, he argues why managers telling investors to buy stocks for 10 years are “arrogant”, his environmental, social and governance (ESG) concerns around Meta and why the buy-and-hold-forever strategy doesn’t work.

Performance of fund vs sector and index over YTD

Source: FE Analytics

What are your philosophy and process?

We look for companies that are emerging as new market leaders with unique business models. They are usually either at the early phase of the growth of their business or they're a large, successful company that's innovating with new products. In general, we want to focus only on companies that are the structural winners in their industry.

How do you find growth?

We focus on three catalysts for growth. One is disruption, so companies introducing something very disruptive to the marketplace. In this case, the winner doesn’t take all but most of the incremental share of that market as it displaces incumbents. Tesla would be a good example of that in electric vehicles.

Secondly, it is product innovation, or companies that have major new product cycles that are going to materially move the revenue growth and earnings needles, for example Novo Nordisk in diabetes and obesity.

The third catalyst is an expanding market, so maybe companies that are moving into new geographies or product verticals. What we've noticed over time is that the biggest contributors to our return over multiple years are companies that had all three.

How often do you come across all three?

One of the most important secrets of the market is how very few companies account for most of the markets return over time and it is only those that make a big difference. Think Amazon, Google, Apple, Tesla, Netflix, Tencent and Alibaba in China and MercadoLibre in Latin America.

These companies are game changing in the way they're delivering products and services to consumers and literally changed the way we work, live and entertain. By definition, there's only going to be a handful and it's important that we're in them early.

Is it a matter of identifying companies early and then holding them forever?

Nothing can be kept forever. It doesn't work that way. The number one risk for investors is to miss out on these opportunities. Once these companies start on their emerging growth path, ignoring them, saying they're too expensive or taking the easy way out is a classic mistake in financial markets.

Why doesn't everybody own Nvidia? I don't know. What don't they understand? If you think, which we do, that generative AI is going to be the fourth era of computing, bigger than the mobile internet, there's only one way to play it right now and that's Nvidia, because you need the computing power to make this work. That’s why we’re still adding to it.

Now, can I sit here and say you have to own it for the next 10 years? That's a dumb statement. Some growth managers do that, but we would never. We're not that arrogant. I can't tell you that it's good for the next 10 years. It's good for the next year or two and then we will reevaluate.

When do you sell a stock?

All competitive dynamics change over time and the contribution to the market return is a once-in-a-cycle event. You can only buy and hold when the revisions remain very positive and it's clear that the story is not played out, but once it is, you have to move to the next generation.

The mobile internet is not going to repeat itself in the next five years. There's nothing wrong with the companies they're just big and not growing as fast.

When a company’s struggling to grow, but is a blue-chip with a lot of cash and a strong balance sheet, there's nothing wrong with it. It's just that the opportunity set may be elsewhere.

What have been your best and worst performers?

Nvidia was obviously a big chunk. Our total alpha year-to-date is 17.7% net of fees and Nvidia accounted for 5.2% of that. It contributed 516 basis points of excess return through 30 June.

Ferrari was the second-best and returned 1.7% over the year to date.

As for the worst performers, the great thing about a year like this year is there weren’t a lot of them, and a couple of them were stocks we don’t own. We don’t own Meta, and Amazon we were underweight. Astrazeneca and Mobileye made very modest losses. Their contributions were -0.4% and -0.3%, respectively.

Why don’t you own Meta?

For the global products, we think it's largely a cost-cutting story, which has worked nicely for the stock this year, but that's not our primary focus. Secondarily, from an ESG perspective, it is problematic for us for data privacy, data use, abuse on the platform etc.

What do you do outside of fund management?

I’m an active outdoorsman. I ski, I hike. I also raise my own chickens and pigs and make my own prosciutto.