Pension savers are worryingly neglecting their pensions to an extent that represents “a serious national issue”, according to Richard Wilson, chief executive at interactive investor, following the most recent Show Me My Money 2023 pension report.

It revealed that the majority of pension savers don’t know how large their pension pot is, its risk level and fees, and whether risk is being reduced in the run-up to retirement.

Investors will also be better off if they check whether their pension fund is delivering the performance that they expect. As such below we highlight which Standard Life mixed-asset funds have delivered the highest return since 2013.

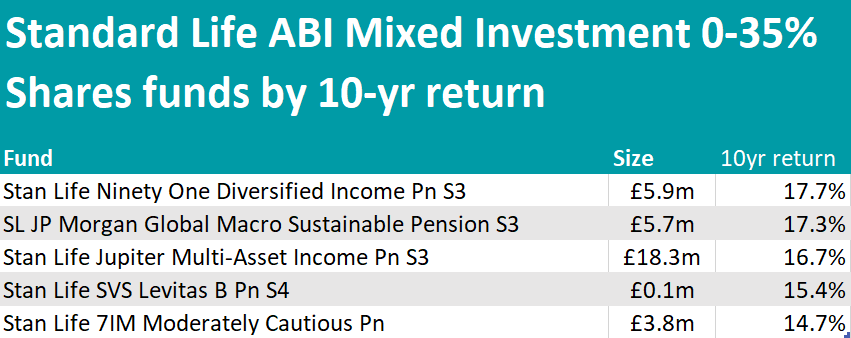

Among the funds in the ABI Mixed Investment 0-35% Shares sector, whose equity allocation is limited to 35%, the best performer was Stan Life Ninety One Diversified Income, which returned 17.7% in the period in analysis.It is Standard Life’s mirror version of a Ninety One vehicle that has been co-managed by Jason Borbora-Sheen and John Stopford since 2020 with a 63.9% versus 25.5% split between international bonds and equities. It prioritises income over growth and consumer products is its largest sector weighting.

Source: FE Analytics

The fund sits below the 22.4% average achieved by non-pension funds in the corresponding IA Mixed Investment 0-35% Share sector.

With £18.3m of assets under management (AUM), the largest fund in the list was Stan Life Jupiter Multi-Asset Income, which made 16.7%.

It is managed by a team of four Jupiter managers and, compared to the previous fund, has a higher allocation to financials and UK-specific investments, while also holding 2.1% in gold.

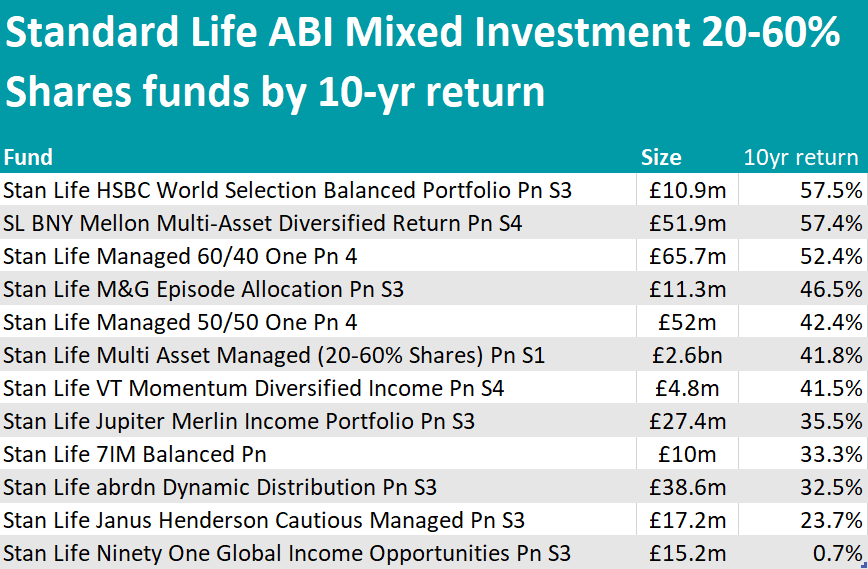

Less conservative funds from the ABI Mixed Investment 20-60% Shares sector made better returns of up to 57.5%, as the table below shows, well above the Investment Association (IA) sector average of 38.7%.

The best performance came from HSBC-managed Stan Life HSBC World Selection Balanced Portfolio. Led by Kate Morrissey, this fund has a global approach and invests 54.1% of its portfolio in international equities, 33.5% in bonds and 5.2% in alternatives – with an additional 2.1% of property.

Source: FE Analytics

It was closely followed by the £51.9m SL BNY Mellon Multi-Asset Diversified Return fund, managed by equity income managers Paul Flood and Bhavin Shah. It aims to return in excess of cash of 3% per annum over five years before fees, and does so with a portfolio of mainly government bonds (15.8%) and companies involved in basic materials (15.4%), consumer products (9.8%) and technology (7.7%).

Its first investment pool is the UK, which makes up 39.5% of the strategy, followed by North America (25%).

The biggest vehicle in the list is Standard Life’s own Managed 60/40 One portfolio, which returned 52.4% through a significant focus on the UK (64.8%) and North America (21.4%).

Stan Life Ninety One Global Income Opportunities closed the list by a wide gap.

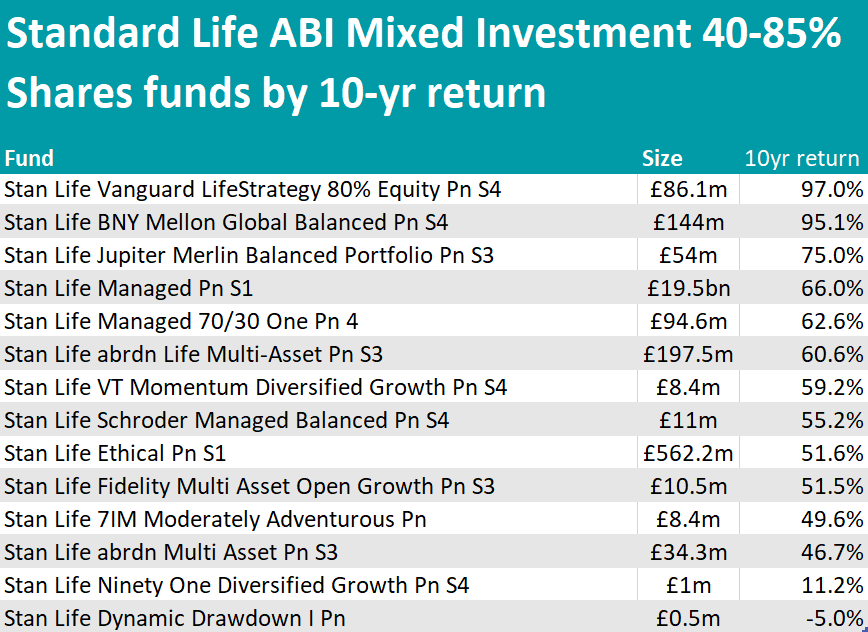

The next sector, ABI Mixed Investment 40-85% Share, contains the largest mixed funds available at Standard Life.

The best performer is the relatively small (£68.1m) Stan Life Vanguard LifeStrategy 80% Equity, the provider’s version of one of the most owned passive vehicles on the market. It returned 97% over the past 10 years.

Source: FE Analytics

By far the first fund in AUM terms, Stan Life Managed (£19.5bn) was only fourth-best with a 66% return. UK companies are its primary focus (25.6%), with 23.8% of global fixed interest and 18.3% in North American stocks. Its first holding, at 2.4%, is a US 3% government bond maturing in 2024.

The ethical version of this strategy, Stan Life Ethical, made investors 51.6% while at the foot of the list Stan Life Dynamic Drawdown has lost 5% since 2013.

Its performance is in line with the 61% average return of the IA funds in the corresponding sector.

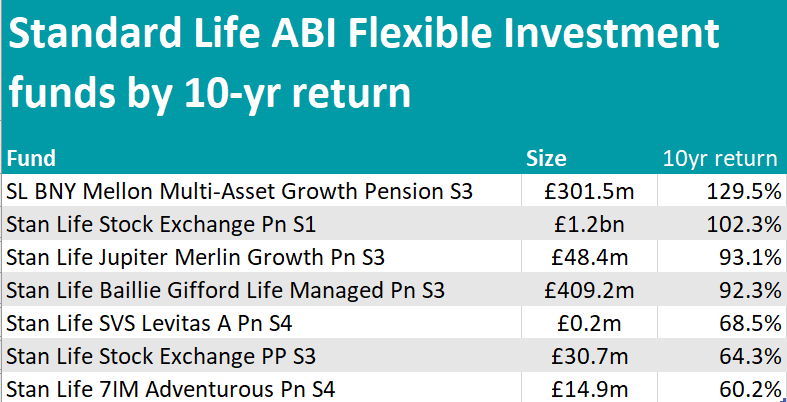

The funds in the ABI Flexible Investment sector are unconstrained and can invest an unlimited amount in equities. Here, we found the most strategies that invest in growing companies.

The comparable IA Flexible Investment sector made an average of 65.2% over the past decade, but the five FE fundinfo Crown-rated SL BNY Mellon Multi-Asset Growth Pension topped the ABI list with a whopping 129.5%.

Source: FE Analytics

Its top-10 holdings include US tech companies Microsoft and Alphabet, UK companies such as RELX and Shell and the European Accenture, Astrazeneca and SAP. Nickel is also present through an exchange-traded commodity (ETC), making up 1.9% of the whole strategy.

In second position was Stan Life Stock Exchange, an FE five-Crown solution with Microsoft, Apple, Amazon and Alphabet alongside the European ASML and NovoNordisk as its top stocks. The fund also has exposure to private equity through the abrdn Private Equity Opportunities trust.

This article is part of an ongoing series on best-performing pension funds by provider. In the previous instalments, we looked at Aegon/Scottish Equitable, Scottish Widows, Aviva and Royal London funds.