Making the most of your pension also means making sure your money is invested with the right level of risk and that you aren’t stuck in a fund with below-average returns.

In this series, Trustnet looks at the best-performing mixed-asset pension funds per provider. This week we turn our eye to Aegon/Scottish Equitable.

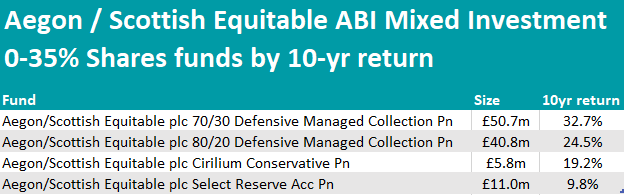

Starting with the ABI Mixed Investment 0-35% Shares sector, featuring four small defensive funds – three Aegon solutions and one managed by third party Quilter.

The house portfolios generally offered the better returns here, with the best being Aegon/Scottish Equitable plc 70/30 Defensive Managed Collection Pn, followed by Aegon/Scottish Equitable plc 80/20 Defensive Managed Collection Pn, as highlighted in the table below.

Source: FE Analytics

They invest 70% and 80% respectively in Aegon’s own UK Fixed Interest fund, and 30% and 20% in global equities through external funds by Baillie Gifford, Invesco, Lazard and GLG Asset Management.

The much smaller Aegon/Scottish Equitable plc Cirilium Conservative Pn mirrors the performance of the Cirilium Conservative fund, managed by Quilter’s Ian Jensen-Humphreys and Sacha Chorley, and was the last fund on the list to have achieved a double-digit return since 2013.

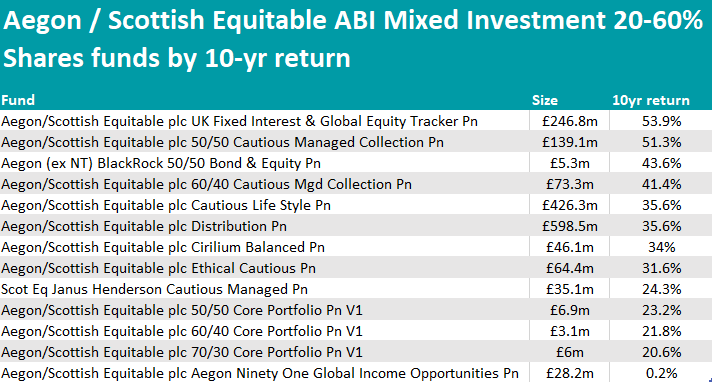

In the next risk bracket, Aegon/Scottish Equitable plc UK Fixed Interest & Global Equity Tracker Pn, a tracker fund, achieved the best performance over 10 years, returning 53.9%. It equally invests in Aegon’s UK Fixed Interest fund and a global equity tracker fund managed by BlackRock, for a total cost of 1.01%.

Source: FE Analytics

At 36%, UK bonds are the largest exposure, followed by UK equity (25.1%). The rest is made up of North American equities (18.1%), global bonds (10.9%) and Asian-Pacific equities (3.9%).

Another fund with a 50/50 split between equities and fixed income, Aegon/Scottish Equitable plc 50/50 Cautious Managed Collection Pn exclusively focuses on the UK. It has returned 51.3% in the past 10 years, but is closed to new investors.

Also noteworthy was Aegon/Scottish Equitable plc Distribution Pn, which, compared with the previous portfolios, has less UK exposure and an additional 8% of European equity, with 18.4% in cash. It is the largest fund on the list and has made 35.6% in the past decade.

The Aegon versions of third-party solutions such as Cirilium Balanced, Janus Henderson Cautious Managed and Ninety One Global Income Opportunities tend to be smaller and are relegated to the lower half of the table.

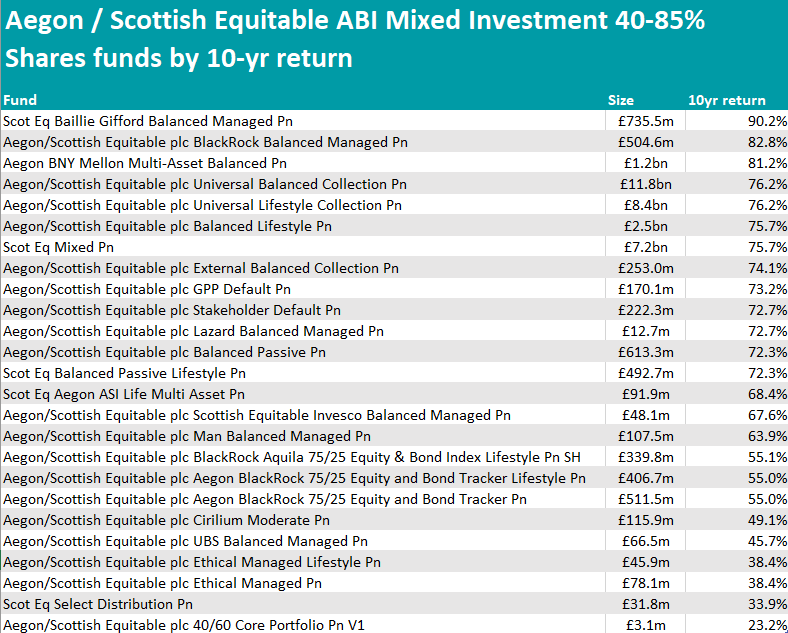

The situation is reversed in the 40-85% Shares sector, where funds run by third parties made up the bulk of those able to achieve stronger performance.

With a 90.2% return, the list is topped by Scot Eq Baillie Gifford Balanced Managed Pn, which is designed as a one-stop shop for fans of growth investing and managed by Ian McCombie and Steven Hay.

They invest in companies such as Nvidia, Amazon, Tesla, Taiwan Semiconductors and Astrazeneca (all of which are among the top 10 holdings), paired up with approximately 20% in global bonds.

Source: FE Analytics

In second place was Aegon/Scottish Equitable plc BlackRock Balanced Managed Pn, managed by Adam Ryan, Conan McKenzie and Jason Byrom with a 80%-20% split of shares and bonds returning 82.8% over the course of the past 10 years.

Another successful third-party solution was Aegon BNY Mellon Multi-Asset Balanced Pn, a five FE fundinfo Crown-rated vehicle co-managed by FE fundinfo Alpha Manager Bhavin Shah, Paul Flood and Simon Nichols, who adopt a growth and income long-term approach by investing in a portfolio of predominantly UK equities and bonds. It returned 82.8% and gained third position in the list.

Aegon/Scottish Equitable own solutions held their own and took over the rest of the list.

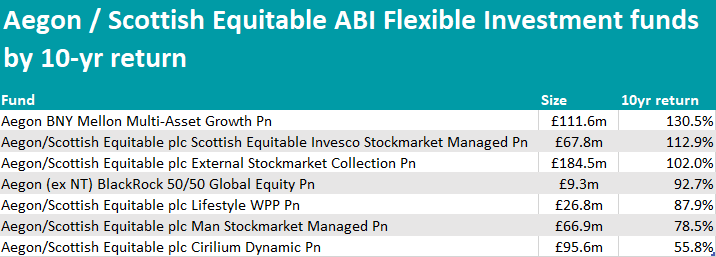

Finally, in the ABI Flexible Investment sector, the best return figure was 130.5%, achieved by Aegon BNY Mellon Multi-Asset Growth Pn managed by the same BNY Mellon team as above. In this fund, the managers have stripped back much of their UK fixed interest exposure (2.3% instead of 14.6%) and added exposure to shares in Asia Pacific and North America especially.

Source: FE Analytics

The second-best performer was Aegon/Scottish Equitable plc Scottish Equitable Invesco Stockmarket Managed Pn, which is entirely invested in two funds, Invesco Global Ex UK Core Equity Index and Invesco UK Enhanced Index.

These funds are designed with an index-like exposure in mind but are actively managed and seek to outperform the index, after fees, over a full market cycle.

Finally, closing the top three was Aegon/Scottish Equitable plc External Stockmarket Collection Pn, which invests in an equal split of Baillie Gifford 60/40 Worldwide Equity Pn, Man Stockmarket Managed Pn, Scottish Equitable Invesco StockMarket Managed and Lazard Managed Equity Pn.

This article is part of an ongoing series on best-performing pension funds by provider. In the previous instalments, we looked at Scottish Widows, Aviva and Royal London funds.