Investors betting the ranch on the ‘magnificent seven’ stocks that have driven so much of US and global equity market performance in 2023 would do well to remember the ending of the classic eponymous American Western film.

Although the seven hired gunfighters in the film succeeded in banishing the marauding bandits from the poor Mexican village they had been exploiting, only three survived the bloody battle. The other four heroes from the ragtag band of misfits assembled to defend the village were fatally shot.

Once the dust has settled on the current commotion in equity markets it’s quite possible that some of the ensemble cast of US mega-cap technology-related stocks galloping ahead of the rest of the pack will suffer a similar fate, or at least serious injury.

The question is: which ones will emerge victorious from the battle for market supremacy? Precedent suggests that it is unlikely to be all seven companies.

If we look back over the history of stock markets, it is striking that the leaders in one period are rarely the same in the next. Corporate Darwinism ensures the winners of tomorrow replace the winners of the past.

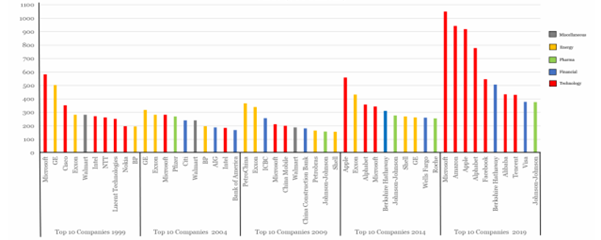

The chart below from the UK-based think-tank Economic Research Council illustrates the dynamic nature of the world’s largest companies over time.

Top 10 global companies by market capitalisation

Source: ERC analysis of FT and Google Finance data via Visual Capitalist

Although the dominance of some companies has persisted over the past 25 years, the prowess of others has proved much more fleeting. It is, therefore, reasonable to suggest that not all the magnificent seven will be as dominant in the future as they are now, and that an active approach to stock selection focusing on the fundamental attributes of the best businesses may prove more profitable in the long run than a passive investment strategy which has market-weight exposure to all of them.

With Apple, Microsoft, Amazon, Alphabet, Nvidia, Tesla and Meta Platforms now accounting for more than 45% of the Russell 1000 Growth Index in the US and 28% of the S&P 500, the broad US stock market is arguably highly vulnerable to a sudden reversal in market leadership if perceptions of their invincibility are undermined by, for example, faltering earnings growth or if investors become generally more risk averse in the face of tougher economic conditions.

Seasoned investors will remember the pain of such reversals in the first TMT (technology, media and telecoms) boom to bust cycle in 2000-2002.

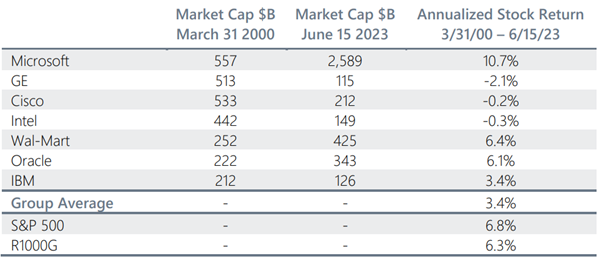

At the time, the market had grown increasingly narrow and concentration levels reached then historic highs in 2000. The seven largest weights in the S&P on 31 March 2000 were Microsoft, GE, Cisco, Intel, Wal-Mark, Oracle and IBM.

Since then, through to 15 June 2023, of the seven only Microsoft has managed to meaningly outperform the S&P 500 and the Russell 1000 Growth Index, according to research by Sustainable Growth Advisors (SGA).

Three of the seven companies (GE, Cisco and Intel) on the other hand have delivered negative absolute returns. The remaining three (Walmart, Oracle and IBM) have delivered positive, but rather lacklustre returns either in line with or below the market returns. As a group, these stocks have delivered only about half the return of the market.

Returns from the seven largest stocks in the S&P 500 as of 31 March 2000

Source: Sustainable Growth Advisers

Source: Sustainable Growth Advisers

George Fraise, portfolio manager at SGA, concluded: “As indicated by the list of winners from 2000 it should not be assumed that the leading names of today will withstand the test of time and maintain the growth that propelled them to the top of the index.

“It should also not be assumed that high compound returns will result from the top index constituents moving forward. Our analysis is a salutary warning about the risks of being overly focused on the winners of today instead of looking for the winners of tomorrow.”

Mark Atkinson is senior client director at Alliance Trust. The views expressed above should not be taken as investment advice.