Today marks one year from the low point following the disastrous mini-Budget that sent the UK market tumbling.

Former prime minister Liz Truss’ and former chancellor Kwasi Kwarteng’s economic plan plunged the UK stock market to its lowest point since the 2020 downturn 12 months ago – but things have improved markedly since.

Twelve months on, and with a new prime minister and chancellor in charge, the index has recovered from its sharp decline, up 14%.

Total return of FTSE All Share over 1yr

Source: FE Analytics

The same can be said for the pound, which dropped to its lowest point against the US dollar since 1985 after the mini-Budget made global investors lose faith in the UK.

It sunk to a low of $1.08 at the end of September last year, but has since rebounded 13.3% to $1.23 as market conditions in the UK stabilise.

Merchants Trust manager Simon Gergel said the fallout from Liz Truss’ 49 days in power appeared sizable, but was all “seen in the context of a market that has moved broadly sideways for five years”.

Pound sterling to US dollar since start of data (1988)

Source: FE Analytics

Truss intended to reinvigorate the UK after years of slow growth post-Brexit referendum, but it has been improving economic conditions since then that have benefited the UK market, rather than her policies, he added. Despite its uptick in performance however, the UK equity market is still historically cheap.

“In the past year, we have seen UK growth estimates revised up significantly, indicating a similar economic performance to other major European countries since the pandemic,” Gergel explained.

“With the UK stock market trading on a historically low valuation, and many of the more domestically focused medium-sized and smaller companies even cheaper, we see considerable value in the UK stock market.”

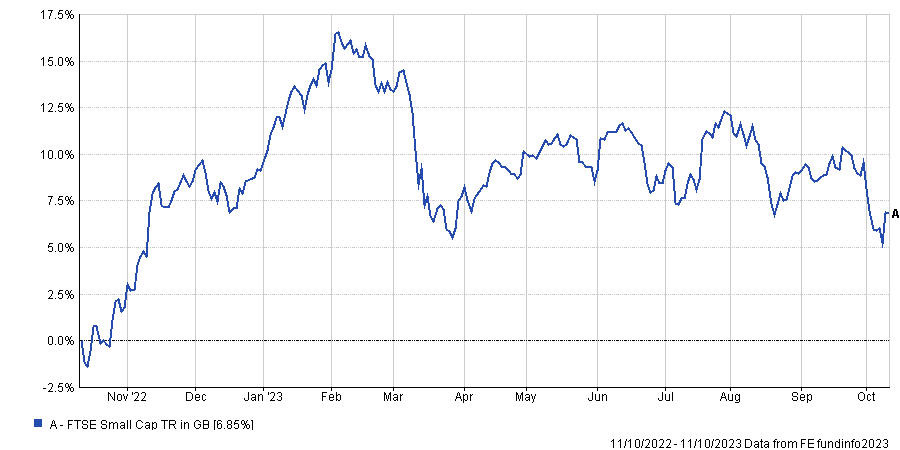

Small and mid-cap companies have been particularly vulnerable to rising interest rates, with the FTSE Small Cap index making a more modest recovery of 6.9% over the past year.

Total return of FTSE Small Cap over the past year

Source: FE Analytics

This hostile environment for smaller companies was particularly felt by FE fundinfo Alpha Manager Alex Wright, who holds almost a third (32.9%) of his Fidelity Special Situations in FTSE Small Cap or non-FTSE companies.

However, there are still many companies at the lower end of the market-cap spectrum that are very resilient to tighter monetary conditions.

“UK smaller companies have incurred severe deratings over the past year as they are thought to be more cyclical and thus more susceptible to an economic slowdown or recession,” Wright said. “However, some of the share price declines have been indiscriminate.

“The uncertain economic environment has negatively impacted the fundamental operating environment for some companies, but not all. Some companies have significantly lower levels of debt and possess the resilience to navigate a tough macro environment.”

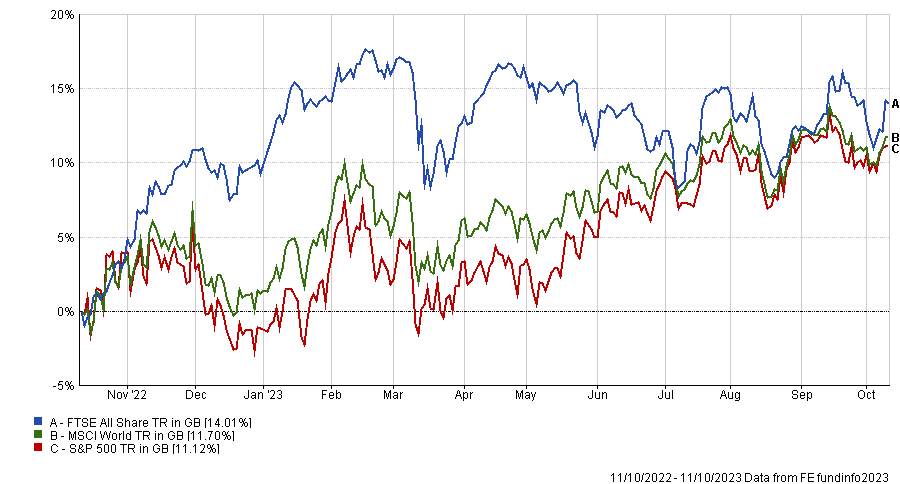

Although interest rates remain a lingering concern for markets, Jamie Seaton, chief executive of GVQIM, said the UK has been a “spectacular place to invest” over the past year when compared to other global markets.

He highlighted the S&P 500 and MSCI World indices, which both underperformed the FTSE All Share with return of 11.1% and 11.7% over the past year.

Total return of indices over the past year

Source: FE Analytics

“At an index level, those invested in the FTSE All Share were shielded from far steeper loses in both the S&P 500 and MSCI World last year as markets woke up to resurgent inflation,” Seaton added.