Uranium investments have been some of the best-performing assets in the market over recent months, with exchange-traded funds (ETFs) offering exposure to the nuclear fuel topping the second quarter’s performance tables.

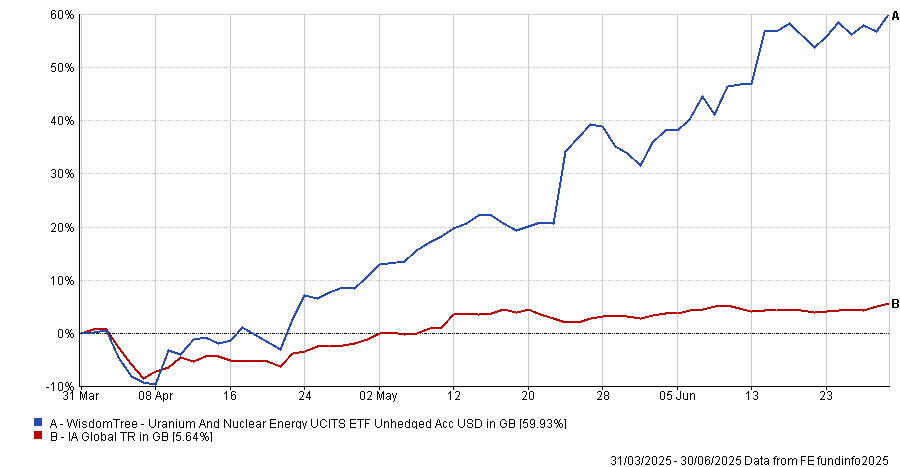

The WisdomTree Uranium And Nuclear Energy UCITS ETF made the highest returns of the entire Investment Association universe last quarter, after gaining close to 60%.

HANetf Sprott Uranium Miners UCITS ETF and HAN Sprott Junior Uranium Miners UCITS ETF also appeared in the top five funds, with respective gains of 38.3% and 37.3%.

Jacob White, ETF product manager at Sprott Asset Management, explained that uranium spot prices jumped 9.99% to $78.56/lb in June, marking their best monthly performance of 2025.

“June’s strong move higher was a continuation of the recovery that began in April and continued into May. Uranium miners benefited even more in June. Uranium miners climbed 18.19% in June and are up 68.18% since their April lows, while junior uranium miners were up 17.94% in June,” he added.

“The magnitude of this move demonstrates the torque uranium miners offer when sentiment finally reconnects with the uranium market’s strong underlying fundamentals.”

Performance of WisdomTree Uranium and Nuclear Energy UCITS ETF vs sector in Q2 2025

Source: FE Analytics

According to WisdomTree, uranium and nuclear energy ETFs are outperforming thanks to a policy shift in the US that has bolstered market sentiment toward the nuclear value chain.

After a slow start to the year, the theme rebounded sharply in the second quarter, buoyed by US president Donald Trump’s May executive orders to expand America’s nuclear capacity.

Mobeen Tahir, director of macroeconomic research & tactical solutions at WisdomTree, said: “Most themes with significant US exposure faced headwinds in the first quarter of the year and ‘uranium and nuclear energy’ was no exception.

“However, the theme’s recovery in the second quarter has been noteworthy. The market reaction to Trump’s executive order has been strikingly positive.”

Trump’s nuclear policy initiative, which is called Reinvigorating the Nuclear Industrial Base, targets a fourfold increase in US nuclear capacity from 100 gigawatts to 400 gigawatts by 2050.

The plan includes construction of 10 large reactors by 2030, faster licensing procedures for new reactors and reforms at the Department of Energy and Nuclear Regulatory Commission.

The orders also prioritise restarting closed nuclear plants, streamlining environmental reviews and accelerating testing of advanced technologies.

“The rationale behind the move is both strategic and economic. The US has seen its share in the global nuclear landscape diminish, with 87% of new reactors since 2017 based on foreign designs,” Tahir said.

“Trump's orders seek to reverse this trend by revitalising domestic fuel cycles, supporting the development of small modular and advanced reactors, and expanding the nuclear workforce.”

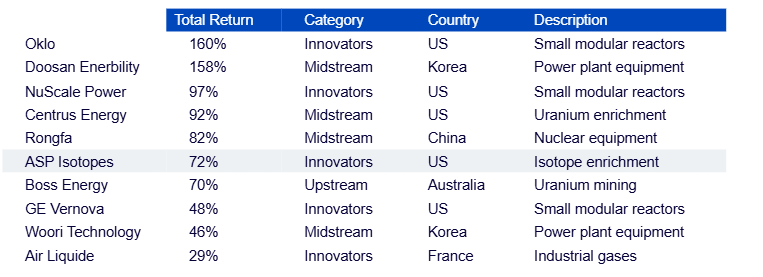

Top-performing stocks in the WisdomTree Uranium and Nuclear Energy UCITS Index by total return YTD

Source: WisdomTree, Bloomberg, as of 28 May 2025. Returns shown in US dollar

The rebound has been broad-based. WisdomTree divides the uranium and nuclear energy value chain into upstream companies (typically miners and producers of nuclear fuels like uranium), midstream players (providers of essential products and services) and innovators (developers of advanced technologies like small modular reactors).

All three segments have seen gains in 2025.

“It’s clear that market interest this year spans a broad range of companies, not just uranium miners,” Tahir said.

Top performers in the WisdomTree Uranium and Nuclear Energy UCITS index include US-based Oklo (up 160% to the end of May) and NuScale Power (up 97%). Both focus on small modular reactors, as well as Korea’s Doosan Enerbility (up 158%) and Centrus Energy (up 92%).

Some of these companies, particularly those classified as innovators, are not yet generating revenue but have seen increased investor attention.

Oklo, for example, is developing small modular reactor technology that remains in the early stages of deployment. While it is not yet generating revenue, as small modular reactors are still in early stages of deployment, there is growing investor interest because of their “transformative potential”.

“Markets are viewing these companies increasingly favourably in light of Trump’s executive order, which is seen as a catalyst that could accelerate development and drive lasting impact,” Tahir said.

The policy shift also aligns with structural energy trends. Demand from artificial intelligence and data centre growth has increased the need for reliable, low-carbon baseload energy. This is seen as an area where nuclear power is well positioned.

Tahir notes that the trend had already begun in 2024, when major tech firms started investing in nuclear assets to meet their long-term power needs.

“Trump’s executive order cements nuclear energy’s place among the mainstream technologies expected to power the world’s rapidly growing energy needs,” Tahir concluded.

“It also marks a clear inflection point in sentiment, building on the momentum that began with tech companies embracing nuclear last year. We believe the market reaction underscores the strong opportunity for investors across the uranium and nuclear energy value chain.”

Sprott Asset Management’s White pointed to other recent tailwinds.

In June, the World Bank reversed its longstanding ban on financing nuclear energy projects, marking a significant policy shift. As a major lender that facilitated $117.5bn in development funding in 2024, the Bank’s move could “reshape the global landscape of nuclear investment”.

It also announced a partnership with the International Atomic Energy Agency (IAEA) to support the extension of existing reactor lifespans. By re-entering nuclear financing, the World Bank is helping to unlock public funding and reduce risk for future nuclear projects.

Nuclear investment in Europe also accelerated recently as support grew among both longstanding advocates and former holdouts. The Czech Republic signed an $18bn deal with South Korea for two new reactors, the UK allocated £14.2bn to expand Sizewell C and Belgium formally abandoned its two-decade-old nuclear phaseout.

These moves reflect a broader shift across Europe, including softening opposition in Germany, Denmark and Spain, as nuclear is increasingly seen as vital for energy security, grid resilience, industrial competitiveness and climate targets.

“The global policy tailwinds supporting nuclear energy strengthened meaningfully in June,” White finished. “International institutions and national governments took concrete steps to back nuclear energy as a core pillar of energy transition and security, reinforcing a more durable demand outlook for uranium.”