Recent market volatility has led to the Royal London Global Equity Diversified fund buying stocks that it would typically avoid, according to co-manager Finn Provan.

“We’re not narrative driven, but when markets are throwing you around, you’ve got to make some short-term decisions,” Provan said.

Tesla is one of the biggest examples of this recently, she explained, which the fund purchased for the very first time this year.

Tesla and other members of the ‘Magnificent Seven’ (Apple, Nvidia, Meta, Alphabet, Amazon and Microsoft) currently dominate the global markets, representing almost 20% of the MSCI World index (the fund’s comparative benchmark).

Provan said the Magnificent Seven’s large weighting in the market means these are stocks that the team, as “benchmark-relative” investors, had to be willing to adjust its view on.

“When you’ve got large idiosyncratic names such as Amazon or Tesla that belong to a small group of companies occupying a large portion of the benchmark, if we don’t own them, that is our largest risk position,” she said.

Sometimes the team is comfortable with that, but as relative investors, it needs to have a position on these stocks, whether as an overweight or underweight.

Tesla has proven particularly challenging to justify holding, even for a benchmark-relative investor, because “it is almost entirely narrative driven”. While the Royal London Global Equity Diversified team has considered the company in the past, it has generally found that it doesn’t match the criteria for wealth creation and particularly valuation.

However, by not owning it, the managers were using almost all their tracking error and risk budget on a single stock, which was limiting their ability to take risks elsewhere, according to Provan.

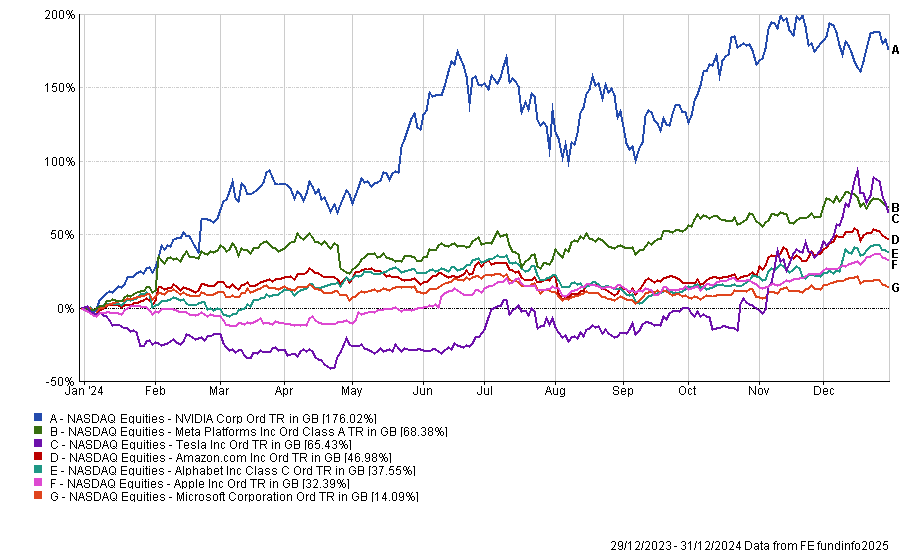

Having no allocation to Tesla was also a major headwind last year. In 2024, Tesla was up 65.4% in sterling terms, the third-best performance of the ‘Magnificent Seven’ tech stocks, as demonstrated by the chart below.

Performance of the Magnificent Seven in 2024

Source: FE Analytics. Total return in sterling.

If the team had owned Tesla last year, “we would have made a lot more money” but partially because it did not, portfolio performance was “basically flat” in 2024.

“We didn’t want the entire portfolio’s performance to be dictated by owning or not owning Tesla, and so we decided to take a small weight in it. It was one of those things that we do from a risk management point of view,” Provan said.

However, to demonstrate that the stock still did not match their ideal characteristics, Provan’s team has gone underweight Tesla (currently 1.1% of the MSCI World benchmark).

This underweight towards Tesla has worked out for the better so far this year, Provan noted.

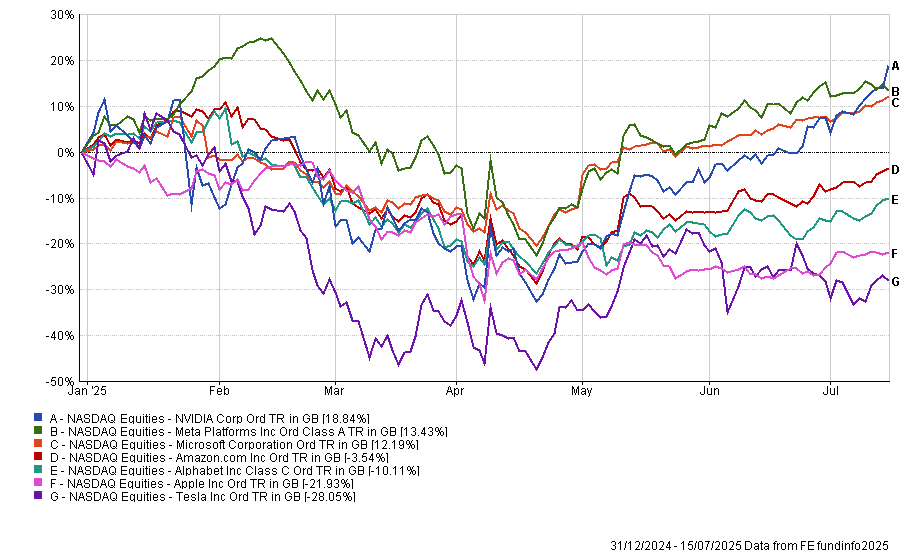

In sharp contrast to their strong performance last year, the Magnificent Seven have posted volatile results so far in 2025. Tesla has been battered particularly hard, due to chief executive officer Elon Musk’s tumultuous relationship with US president Donald Trump. As a result, Tesla is the worst-performing member of the Magnificent Seven this year, down 28.1% in sterling terms, as demonstrated by the chart below.

Performance of the Magnificent Seven year to date

Source: FE Analytics. Total return in sterling.

“Having Tesla as an underweight has certainly not been disadvantageous over the past month or two,” Provan explained.

This is not the only stock the fund purchased to maintain index level risks; it added to Broadcom last year for similar reasons.

While Provan explained that the team thought Broadcom is a “fantastic business”, valuations were more stretched than it usually looks for at the time it was purchased. However, the business had strong enough fundamentals and enough quality characteristics that the managers were willing to take on a bit of extra risk to own it, concluding it would soon pay off, she added.

“The valuation was historically quite difficult. So we think, well, we want to be somewhat exposed to it, because it’s too much of a risk not to be. Then, when the valuation opportunity comes, we’re in the position to take it up.”

For example, late last year following strong returns from Broadcom, the team raised the allocation to around 1.5% of the total portfolio, bringing it in line with the MSCI World’s 1.46% allocation to the stock.

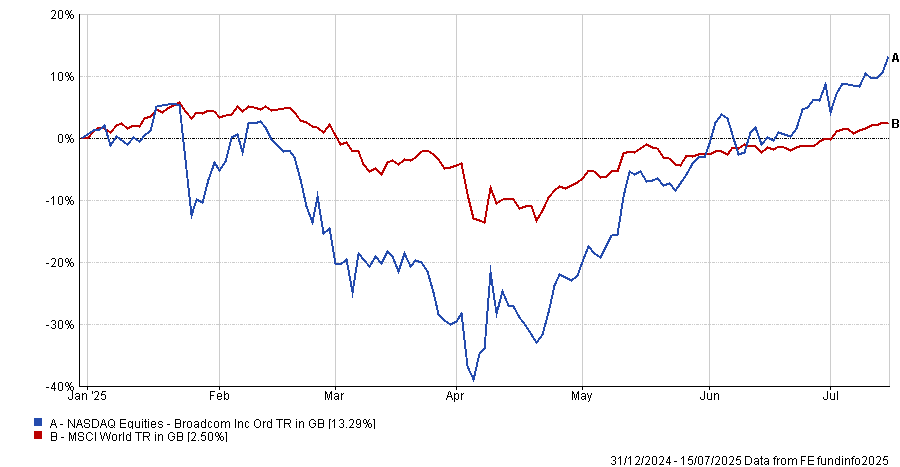

This allocation is starting to pay off for the team in recent months, with Broadcom up 13.3% so far this year. By contrast, the MSCI World is up just 2.5% as demonstrated by the chart below.

Performance of Broadcom and the MSCI World year to date

Source: FE Analytics. Total return in sterling.