Not all fund managers move straight into the investment industry. Some pursue other careers before becoming the custodians of investors’ cash, which can give them a unique perspective.

Richard Scrope, who manages the VT Tyndall Global Select Fund, began his professional life in the army. Yet he always wanted to become a fund manager, ever since reading Mathematics at the University of Edinburgh. “I was probably the only person in the army in Iraq with my CFA textbooks,” he recalls.

For the past 15 years, Scrope has used a three point screen that was devised by the army in his best ideas global equity portfolio: factor; deduction; what if/so what?

Before any engagement, the army uses these screens to reach a combat estimate that helps officers to decide "what troops-to-task ratio you need to fulfil a mission”, Scrope said.

A military scenario might play out as follows. The factor is: “a rebel force is going to attack your encampment,” Scrope explained. The deduction is “you have two land rovers and a certain number of men. The nearest aid station is 40 miles away and you only have one radio. How do you get reinforcements?”

The what if/so what questions you need to ask are: “what happens if one of your land rovers breaks down? Can you get to the aid station with one land rover? What if your radio doesn’t work?”

Scrope applies this military-style stress testing to his holdings including Nike, which he has owned for more than 10 years.

One of Nike’s factors is where it produces footwear. The deduction is that about 18% of Nike’s footwear is produced in China.

The what if/so what scenario is: what happens if the US bans Nike from importing trainers made in China? Can Nike flex its production lines in Vietnam and Indonesia to meet increased demand? Can it produce footwear in the US for the American market?

Today, 15% of Nike’s revenues come from China so most of the footwear produced there can be sold into the domestic market and the extra 3% could be sold elsewhere in Asia if a trade war commences. Back in 1999, 45% of Nike’s production took place in China but only 10% of its revenues came from China so this scenario would have been more problematic.

The three screens might also be used to ask: “do you trust management?” Scrope continued. In this case, the deduction involves ascertaining who is on the management team. Mark Parker was president and chief executive officer of Nike until January 2020 when John Donahoe took over.

Back when Parker was still the incumbent CEO, this exercise might have looked at succession planning: who were the most likely internal and external candidates to succeed him and what was their track record of capital allocation? What might happen if management changed?

Now, the what if/so what scenario involves drilling into the current executives' track records for creating shareholder value.

The three screens are not a checklist as such; rather, Scrope uses them to devise an extra level of questions, to figure out what additional information he needs to know and to build as full a picture as possible of a company. He also rewrites companies’ reports and accounts the way he believes they should be stated.

This year he introduced Heineken Holding to the portfolio, initially buying shares in April then adding to his position when the share price dropped in July. Heineken has a leading position in south America and exposure to growing demand in Africa. It also has a dominant market share in zero alcohol beer, which is growing at three times the rate of the traditional beer market.

Heineken’s what if/so what questions include: “with the increased cost of living, will the growth trend in low and non-alcoholic beer continue? What is Heineken’s current non-alcoholic market share and what percentage could it grow to? How does it differ by regions? What are the launch plans for local champion/international beers within the portfolio to launch zero versions?”

Scrope has been running his fund for 15 years with low turnover – owning two thirds of his 39 holdings for more than five years, one third for more than a decade and 20% for the full 15 years.

He recently sold out of Estee Lauder, having bought the prestige make-up brand in April 2020 after the market sell off.

Estee Lauder has a heavy focus on the Chinese travel market, duty free shopping and Hainan (an island province in China with duty free.) It does not have a production centre in Asia so Chinese customers have to order supplies eight months ahead. “That’s fine when markets are open,” Scrope observed, but became problematic when China went into full lockdown.

By the time China reopened at the start of this year, massive inventories of Estee Lauder’s products had built up, which were hard for retailers to sell because consumers were not using Hainan or travelling internationally.

“Hainan customers are coming back but the average ticket size is smaller, so the backlog of inventory will take longer to work through,” Scrope explained.

Estee Lauder’s second biggest market after China is the US. “The US beauty market is growing by 2% so it doesn’t offset what is happening in Asia,” Scrope continued. Furthermore, “cash flows will be eaten up as [Estee Lauder] invests in putting a production site in Japan.”

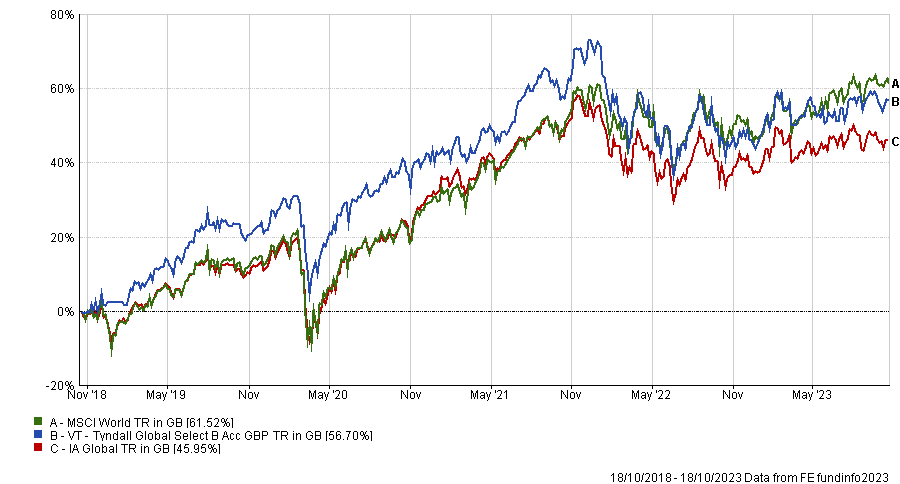

Tyndall Global Select has outperformed the IA Global sector but lagged the MSCI World Index over five years, as the below chart shows. Scrope said his aim is to achieve strong long-term performance with more consistency and lower risk than his peers. To that end, the fund is among the top quartile of its peers for volatility (a common measure of risk) and Sharpe ratio (which tracks risk-adjusted returns) over five years.

Five year performance for Tyndall Global Select versus its sector

Source: FE Analytics, data to 18 Oct 2023