Some UK investors have been tempted to hold their savings in cash as bank accounts offer historically high interest rates, yet they would have been better off investing in equities this year, according to Dan Howe, head of investment trusts at Janus Henderson.

A total of £1.95trn was held in savings accounts in July – down by £5bn since the start of the year – on which UK investors earned £32bn in interest.

By the end of 2023, savers would have accumulated £45bn in interest, which is three times more than last year and more than the six years from 2017 to 2022 combined, so the appeal for investors is clear.

Despite these record highs, Howe pointed out that UK savers actually lost money over the period, with the £69bn loss in purchasing power in the first nine months of the year offsetting the £32bn made in interest.

Indeed, investors who thought they were taking advantage of high rates would have been better off in global equity markets, which generated a return that outpaced inflation this year.

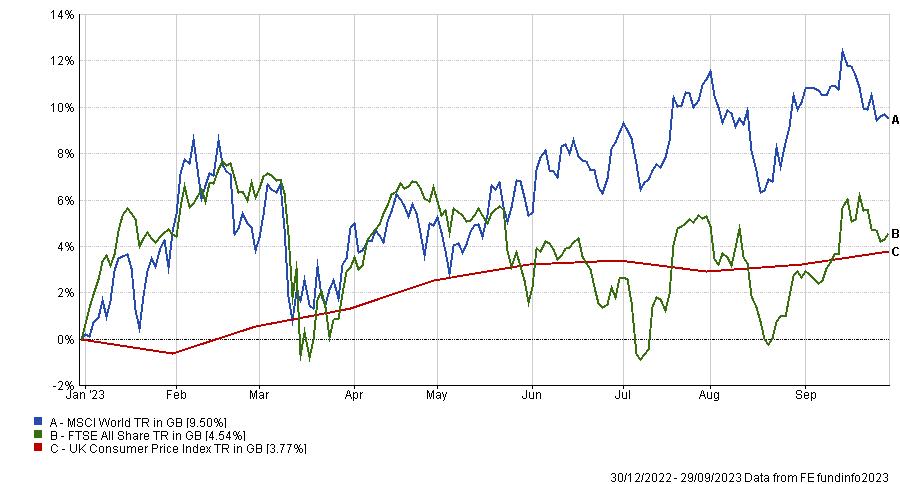

The MSCI World index was up 9.5% in the first nine months of the year, giving investors a return that significantly outperformed UK inflation over the period.

Even those who had invested in UK equities that delivered a lower return of 4.5% would have beaten inflation, which cash savings accounts failed to do.

Total return of indices vs inflation from January to September

Source: FE Analytics

Global equities greatly outperforming savings accounts is not just a 2023 story – those who had invested in them over the past 25 years would have been more than three and a half times better off then holding their savings in cash.

Howe explained that £1,000 invested in global stocks 25 years ago would be worth £5,936 today, compared to £1,631 if it had remained in a cash account.

Although this paints a clear investment case for equities, a recent survey by Janus Henderson revealed that almost one quarter (22%) of UK investors thought cash was the most defensive asset class against inflation. A third of respondents (33%) did not know investments were protective against long-term inflation at all.

Howe said: “Interest rates, despite being at their highest level in 15 years, are still not enough to fight the corrosive effects of inflation. It’s no wonder that many UK savers are struggling to decide how to best protect the value of their hard-earned savings.

“In 25 of the past 34 years, equity investments have delivered superior returns compared to holding cash. They can also provide investors with a much-needed boost to income in terms of capital gains and dividend payments, particularly when those dividends are reinvested.”

Investing in equities may have generated a return greater than inflation this year, but investor confidence continues to fall, according to Emma Wall, head of investment analysis and research at Hargreaves Lansdown.

The firm’s Investor Confidence Index dropped 7% to 71 after the Hamas attack at the start of the month, with investors toning down their risk exposure among geopolitical volatility.

Wall said the fall in sentiment was “not surprising” given the already “uncertain global economic outlook,” yet there is a place for cash in investors’ portfolios.

She said savers are often advised to have at least three month’s salary in cash as a safety net to fall back on in case investors are met with unforeseen expenditures and high rates could offer an attractive option on that front.

“It can be a great tactical play in a portfolio – in a rising rate environment, with market volatility you are rewarded for keeping your powder dry,” Wall added.

“But it has limited long-term strategic asset allocation benefits. Investors should be looking longer term – markets will be choppy over the next six months, but rates have peaked so holding cash in your investment portfolio no longer pays.”