Media debates about the underperformance of environmental, social, and governance (ESG) strategies miss the point entirely and reflect the confusion that still abounds in the space, according to Sonja Laud, chief investment officer at Legal & General Investment Management.

Investors who turn to ESG funds hoping to do good with their money also misunderstand what the label is actually all about. As Laud put it: “To be very blunt, we're not here to save the world. Asset managers are here to deliver credible investment solutions.”

ESG strategies have come under fire from several sides – politicians have pulled investments over perceived ideological bias, major asset managers (such as BlackRock and Vanguard) have scaled back their ESG efforts and some investors have felt misled by funds that marketed themselves as ESG while holding assets that seemed in contrast with their premise.

It’s no surprise that many of these portfolios disappointed recently, due to both a lack of market momentum and the underperformance of the growth investing style that many tend to follow.

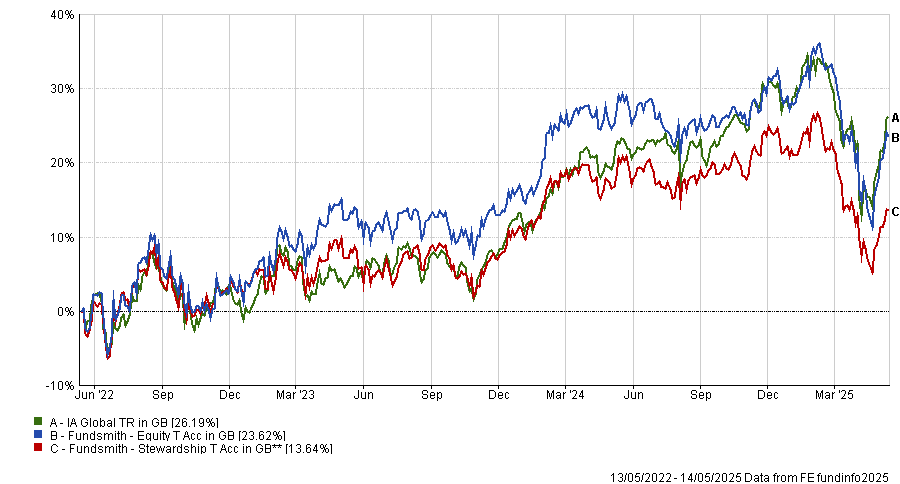

For example, Fundsmith Stewardship – the “sustainable” counterpart to the flagship Fundsmith Equity fund – has trailed its sibling by 10 percentage points over the past three years, despite following the same strategy with a few additional exclusions, as the chart below shows.

Performance of funds against sector over 3yrs

Source: FE Analytics

However, speaking of ESG underperformance in this context, and over this timeframe, may be misguided.

“There is not enough understanding of the fundamental risks that we are trying to integrate in our investment processes,” Laud said.

“The reason why we get very unfortunate headlines about the underperformance of ESG funds is because there is a genuine misunderstanding of the time horizon mismatch for when those risks will come to fruition, versus the short-termism of performance reports.”

According to her, we may now be moving past the initial wave of disillusionment, entering a new phase of debate around what ESG can and cannot achieve. In particular, Laud called for a “far healthier debate” centred on value creation.

“The integration of sustainability factors, particularly those that carry clear financial materiality, is a must-have for us to deliver against our fiduciary duty,” she said. “By bringing the debate back to the value creation aspect, you can very easily see why this is an integral part of your overall investment process.”

This is the reason why, at Legal & General, the stewardship team now sits within the investment team, Laud explained.

Regulation has been more of an obstacle than helpful. Instead of offering clarity, it has “added to the confusion” with fund classifications not always making it clear which strategies fall into which categories.

“Hopefully, we have an opportunity here too, to make sure that the end consumer of those funds can understand what we're doing.”

Finally, on the politics of ESG, Laud said US president Donald Trump and others who share his views that the investment process is untenable will struggle to dismiss ESG if it’s presented within a framework that centres on value creation. She stated: “If we show ESG factors as a value-enhancing opportunity, no one in the US will push back.

“To get there, we need clarity of thought around what we’re doing. The time horizon mismatch will never align unless we can clearly demonstrate our reasoning and the ESG assumptions underpinning the companies in our portfolios.”

That company-level relevance is crucial, she added, because systemic risks eventually become idiosyncratic. Fundamentally, ESG is long-term risk management.

“Climate change, for example, is a risk that will manifest in highly specific ways depending on where a company operates or locates its production facilities. That’s the level of understanding we need to show – how we’ve constructively assessed that these risks, if managed well, could ultimately lead to better financial outcomes.”