UK equity investment trust managers are enjoying a moment in the sun, as the domestic stock market raced ahead of US and global equities this year.

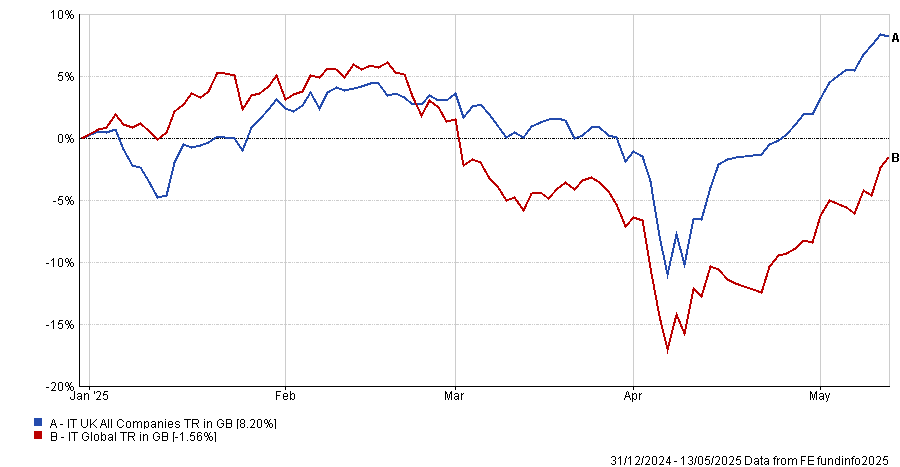

The IT UK All Companies sector pulled ahead of the IT Global sector average in late February and now leads by a solid nine percentage points, as the chart below shows. The gap is also clear over 12 months, with UK-focused investment trusts posting a 12.8% return compared to 4.8% for the global peer group.

Performance of sectors over 6 months

Source: FE Analytics

While it’s still too early to call a structural recovery or the reversal of a decade of UK underperformance, some managers are feeling upbeat.

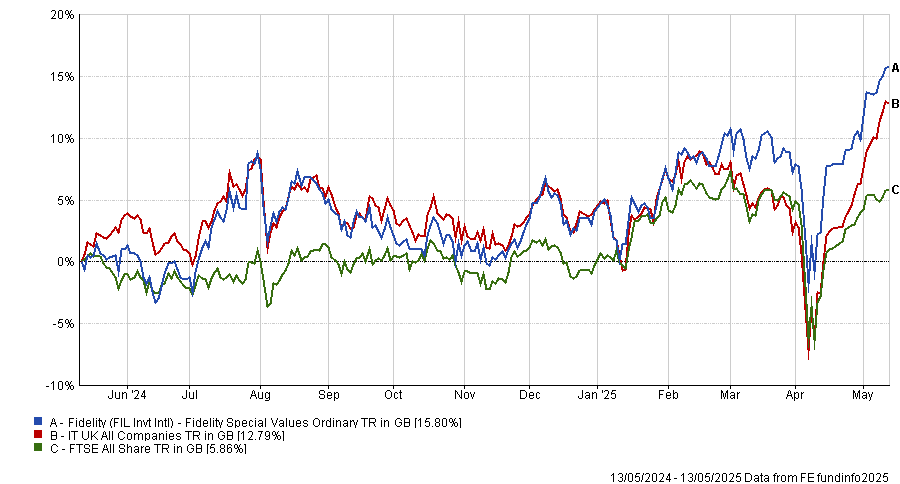

The UK market fell sharply after Brexit compared to global peers, but since then, it has been performing in line with international markets – yet few investors seem to have noticed. One who certainly did was Alex Wright, manager of Fidelity Special Values.

“This shift has made the UK an attractive hunting ground for contrarian value investors and was driven by strong earnings growth from UK companies in the portfolio,” he said.

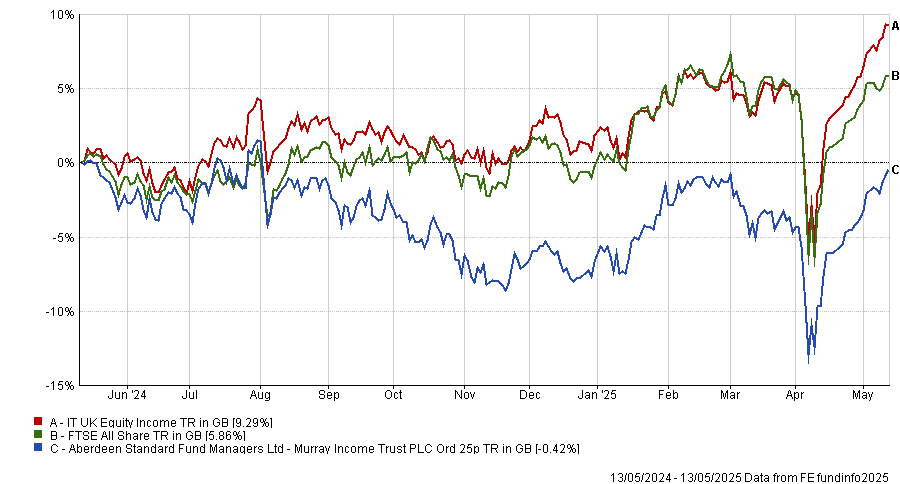

Performance of fund against index and sector over 1yr

Source: FE Analytics

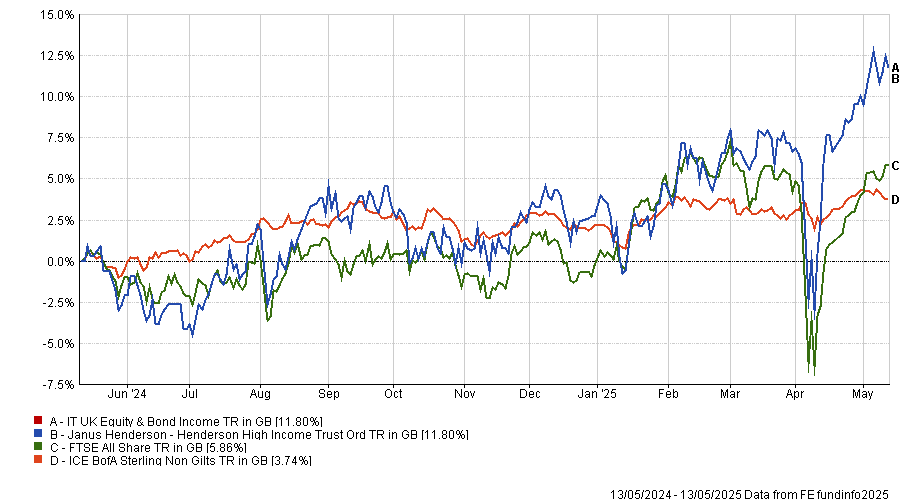

David Smith, manager of Henderson High Income Trust, said the catalyst for a UK recovery has already been triggered.

“It’s no secret that the UK equity market has significantly underperformed the global index over the past 10 years or so. However, looking at long-term analysis, UK underperformance hasn’t always been the case. The UK outperformed the global index in the ‘70s, ‘80s, ‘90s and noughties. During these decades, interest rates were higher versus the near-zero rates we have experienced since the global financial crisis,” he observed.

“Interestingly, since interest rates started to rise at the end of 2021, the FTSE 100 has outperformed the MSCI World ex UK Index. This would suggest that the catalyst may have already happened and a more normalised level of interest rates has led to better returns from the UK market.”

Performance of fund against index and sector over 1yr

Source: FE Analytics

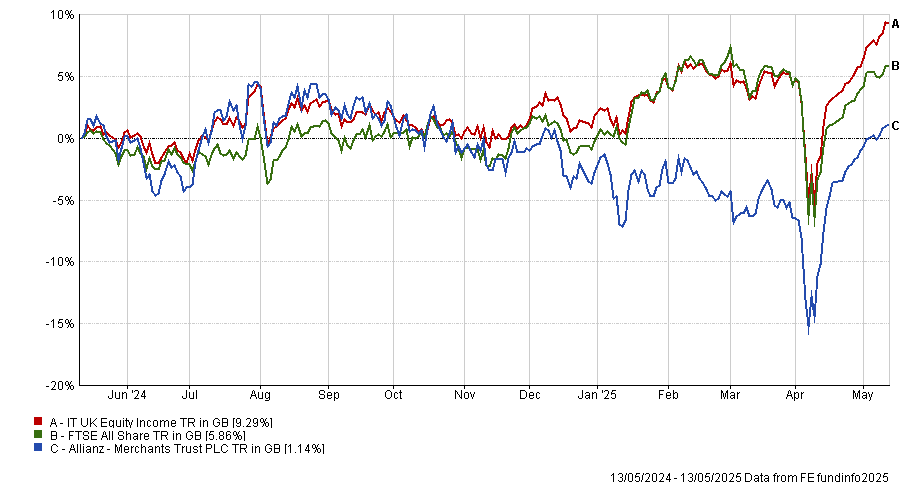

A cheap market and a stable political environment are also helpful at a time when many investors seem to be reassessing their exposure to the US, as Simon Gergel, manager of Merchants Trust, noted.

Given the recent increase in share buybacks and takeover bids from private equity and corporate buyers, a revaluation of the UK market looks overdue, he said.

Performance of fund against index and sector over 1yr

Source: FE Analytics

When it comes to the most compelling areas, Smith highlighted domestically focused businesses. UK consumers are supported by low borrowing levels, high savings, falling oil prices, a weaker dollar and continued wage growth, he said.

Valuations in consumer-exposed areas of the market are “particularly attractive”, with the manager highlighting companies such as Premier Inn owner Whitbread, housebuilder Taylor Wimpey and real estate company British Land.

Gergel agreed that companies associated with the housing market, either building homes themselves or supplying materials, look “well placed to benefit from recovering house building volumes and lower interest rates”.

He added: “Real estate companies should benefit from recovering asset valuations over time, and many are trading at historically low levels compared to those asset values.”

At Fidelity, Wright’s portfolio is orientated towards cyclical areas, in particular industrials, advertising and staffing. He has also been selectively adding exposure to real estate stocks and housing-related names.

“We recently increased exposure to retailers specialising in big-ticket items such as kitchens and sofas, where sales are 10% to 25% below historical volumes,” he said. “We anticipate an improving outlook as housing market volumes strengthen and interest rates decline, coinciding with a reduction in industry competition.”

In a similar vein, Charles Luke, manager of the Murray Income trust, highlighted long-overlooked opportunities in home furnisher Dunelm, which he believes can continue to grow its share of a fragmented market, and telecoms company Gamma Communications, which has just moved from the Alternative Investment Market (AIM) to the main market.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“Dunelm has a strong selection of own-label products across different price ranges and works closely with its suppliers under long-term partnerships. The shares trade on a mid-teens price-to-earnings (P/E) ratio with a dividend yield of around 4% and this has typically been supplemented by an additional annual special dividend, given the strength of the balance sheet,” he said.

“Finally, the increasing complexity of communications is a growth driver for Gamma Communications, which benefits from recurring revenues, strong margins, high cash conversion and a product that is critical to the businesses that use their services. We think a mid to low-teens P/E multiple belies the growth potential for the business.”