Sometimes the pace of change in emerging markets can be hard to quantify. While the MSCI Emerging Markets index has barely changed for 30 years, some countries have now overtaken their developed cousins in certain areas.

One that caught the eye of Nilang Mehta, co-manager of the HSBC GIF Indian Equity fund, was the quality of airports. Upon entering Italy’s Milan Linate, he said it was akin to travelling to his hometown – from almost 30 years ago.

“I was in Linate the other day with my colleague and I was telling him that the airport looked like Mumbai’s airport from the 1990s to me,” he said. “I didn't expect we would be travelling from the plane to the terminal using buses, I thought that only happened in India.”

It opened his eyes to the scale of growth in infrastructure that has been undertaken in the country in recent years and highlighted the pace of development in the supposed ‘emerging’ economy.

“At Indian airports, the physical infrastructure has improved dramatically. Today Mumbai, Delhi and Bangalore airports are now operating at another scale,” he said.

However, it is not just upon arrival that this change has been noticed. “It’s everywhere, not just in infrastructure and in the digital infrastructure (where it’s most impressive).”

Performance of fund vs sector and index over 1yr

Source: FE Analytics

India is becoming too relevant for investors to ignore. Mehta argued that it should be considered as its own individual country, not just as part of a wider allocation to emerging markets.

“India is the fifth largest economy in the world today and is set to become the third-largest over the next five to six years,” he said. “How is that to be considered a niche market to allocate to?”

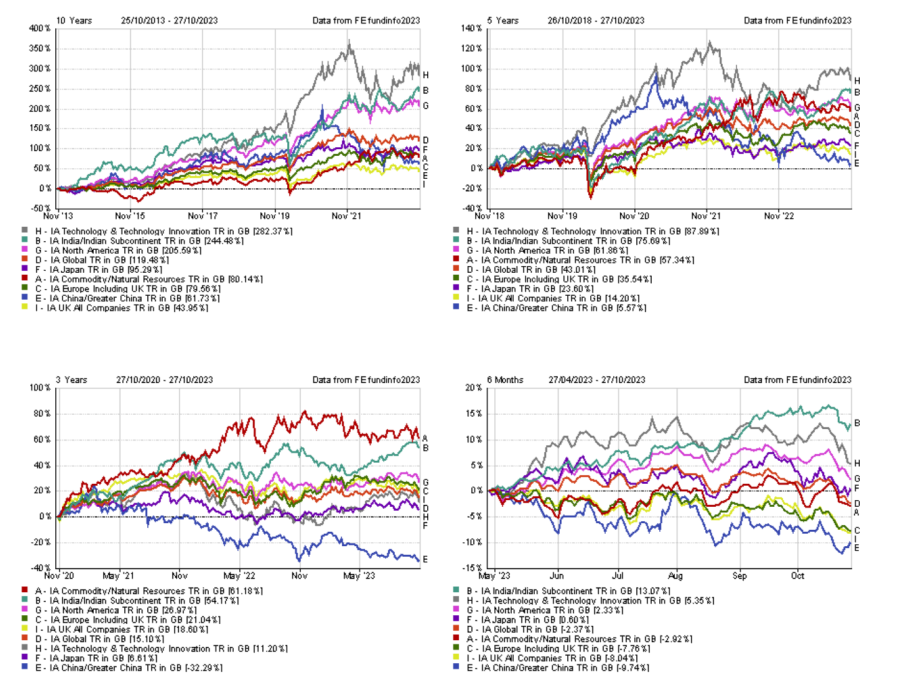

The numbers seem to make a compelling case too. The IA India/Indian Subcontinent sector was the second-best performer over 10 years with a return of 244.5% – just a handful of points below the 282.5% of the IA Technology & Technology Innovation sector.

The same is true over five years and three years, when it came second after the IA Commodity/Natural Resources sector. India then topped the list over the past six months, as the charts below show.

Performance of IA sectors over 10, five and three years and six months

Source: FE Analytics

Yet last year foreign investors withdrew $17bn out of Indian mutual funds, highlighting how little love the country received from abroad.

One of the widest-spread concerns is high valuations, for which Mehta provided multiple reasons why they could be justified.

These include India’s higher expected growth rate compared with other markets, high returns on investment and growth for certain sectors, and the 70% to 80% earnings growth expected over the next two to three years.

But India’s premium can sway from 20% to 30% and sometimes reach as high as 60%, which can be too high even for managers who like the market, as is the case for Gabriel Sacks, co-manager of the abrdn Asia Focus trust.

At 17%, the country is the trust’s largest allocation, with Sacks convinced that the market is in “a sweet spot”, despite “pretty high” valuations.

“Some of those high valuations are justifiable, but at the moment, we're not adding to India. We are actually taking a little bit off it because of the valuations – but over time, we'd like to have more,” he said.

“India has always been more expensive than most of the other Asian markets given the growth opportunity. There are many decades of growth ahead to account for.”

Ian Hargreaves, who allocates 11.3% of the Invesco Asia trust’s portfolio to India, also took issue with valuations, despite liking the fundamentals of the market.

“This is the first time that I've been below the index over 10 years, and it's primarily to do with valuations,” he said.

“When you try to value companies, if you were to really use an appropriate discount rate for the cost of capital, you would struggle to justify these valuations.”

Among the risks that investors aren’t pricing in, the manager counted the Indian elections coming up, the country’s large fiscal deficits, and the risk that interest rates won't fall in the way people hope they will do once the US rate cycle rolls over, as others to watch out for.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

Carlos Hardenberg of the Mobius Investment Trust (18.2% of which is invested in India) was more positive, highlighting the “talented” workforce that is returning to India after having spent time abroad, as well as the “very impressive” businesses that are there to invest in.

“We like India, but we don't like big India, we like small India,” he said. “There are 6,000 listed companies in India and it's just lazy to focus on the five or six largest names, the Tatas of this world, etc. If you really dig into this space, you'll find a jewellery box of hidden gems, which are incredibly competitive.”