Fixed income has been a tough place to invest over the past few years as rising interest rates have caused a sell-off in the bond market as investors are able to pick up higher yields from cash savings.

Everything has suffered in this environment, with more than two-thirds (68%) of all funds failing to beat UK inflation over the past five years, but those investing in bonds struggling the most.

Indeed, 17 of the 22 sectors dedicated to fixed income didn’t contain a single fund that outpaced the consumer price index (CPI) over the period.

However, there were five funds among the 702 bond portfolios with a five-year track record that bucked the trend and beat inflation.

The greatest outperformance came from AXA World Funds US Dynamic High Yield Bonds, which beat its peers in the IA USD High Yield Bond sector by 16.5 percentage points with a total return of 30.3%.

Total return of fund vs UK inflation and sector over the past five years

Source: FE Analytics

It could be argued that making a positive return at all from investing in bonds over the past five years is an achievement in itself, with almost half (44.4%) of all fixed income funds landing in the red over the period.

The $872m AXA fund was taken over by Mike Graham and deputy manager Robert Houle in 2021. It was formerly run by Carl 'Pepper' Whitbeck, who died in a car crash. Over the full five years, the fund generated an 8.2% return by investing in a set of 116 high-yield bonds, the vast majority of which (85.8%) come from UK issuers.

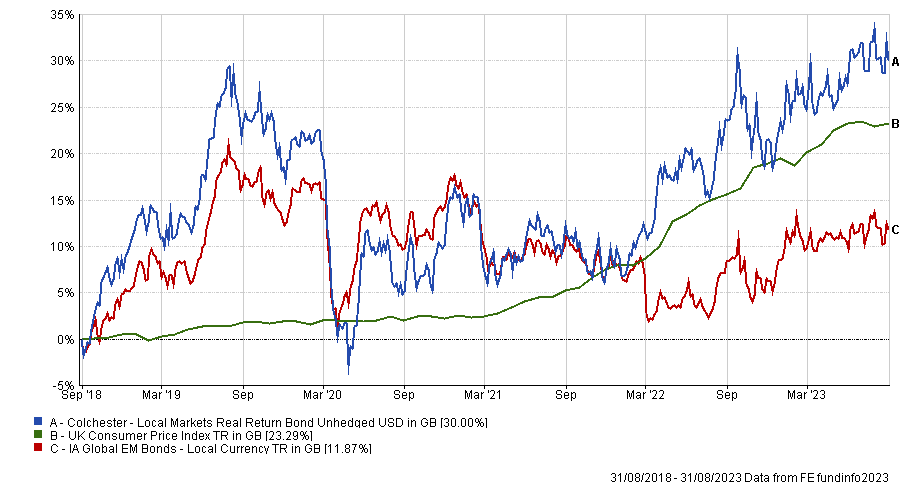

High-yield bonds in the US may have made investors a healthy return over the past five years but the Colchester Local Markets Real Return Bond fund came in shortly behind by investing in emerging markets.

It made a total return of 30% over the period, more than doubling the 11.9% average delivered by most IA Global EM Bonds – Local Currency funds.

Total return of fund vs UK inflation and sector over the past five years

Source: FE Analytics

Allocations are spread across a breadth countries with most of its exposure concentrated in South American nations such as Brazil (30.2%) and Mexico (25.7%).

Investors who don’t want to take on added risks in emerging markets may prefer a fixed income fund with a developed market focus, such as PGIM European High Yield Bond.

The €135m fund gives UK investors a 24.2% exposure to their home market, with the rest of its bonds spread throughout Europe.

Manager Jonathan Butler has been with the fund since launch in 2014 and was joined by Arvinder Chowdhary and Rob Fawn in 2019. Together, they generated a return that was seven times better than their peers in the IA EUR High Yield Bond sector over the past five years, climbing 26.1%.

Total return of fund vs UK inflation and sector over the past five years

Source: FE Analytics

Alternatively, investors who prefer the cheaper fees and broader exposure of passive funds would have beaten UK inflation with the iShares Fallen Angels High Yield Corporate Bond UCITS ETF.

It was up 24.6% over the past five years, beating the return of the average IA Global High Yield Bond by 11.7 percentage points.

The $932m fund invests in high-yielding corporate bonds across all sectors and regions that have been downgraded from investment grade.

Total return of fund vs UK inflation and sector over the past five years

Source: FE Analytics

Though it has a global reach, more than half the fund (58.2%) is concentrated in US bonds, with the following largest regions – the UK and Germany – accounting for 10.6% and 8.9% respectively.

The only other fund to keep up with roaring inflation over the past five years was Algebris Financial Credit. Whilst its 23.3% return was substantially better than the 1.2% average delivered by the IA Specialist Bond sector over the period, it was exactly in line with UK CPI.

That means the savings held in this fund, which is managed by Sebastiano Pirro, would have the same price pricing power it did five years ago.