Tech funds continue to top the 2023 performance rankings despite being hit by a sell-off over recent weeks, FE Analytics data shows, while renewable energy strategies are sitting on even deeper losses.

The opening half of 2023 was dominated by tech stocks, especially the so-called Magnificent Seven of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla, as investors overlooked rate hikes to bet on the rise of artificial intelligence and a strong US consumer.

However, they have come under pressure more recently after some disappointing earnings and heightened worries about the impact of ‘higher for longer’ interest rates on high-growth companies.

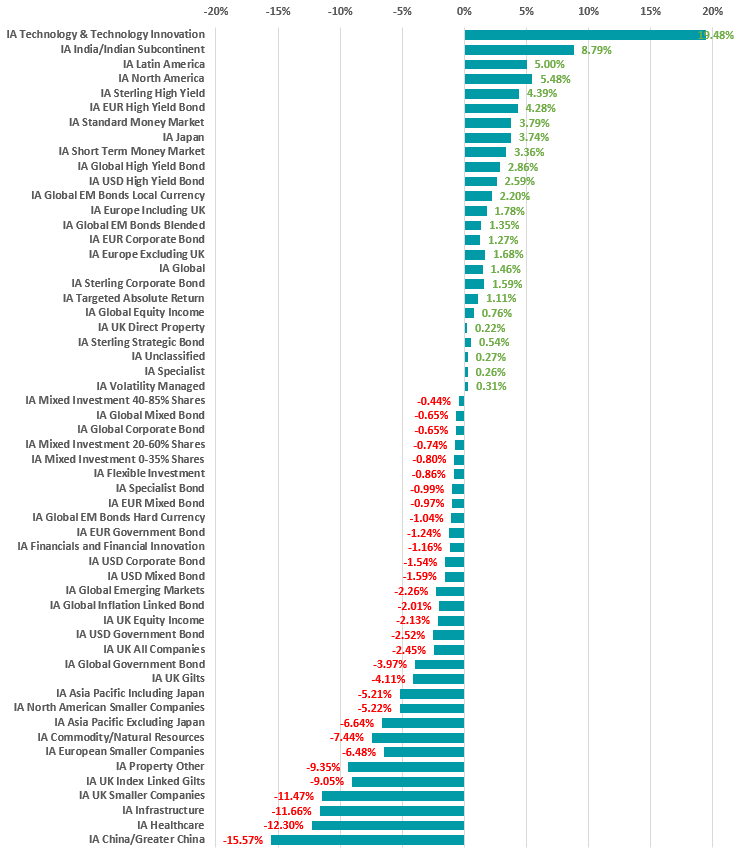

When it comes to the 57 sectors in the Investment Association universe, this is reflected the performance of the IA Technology & Technology Innovation sector. It is down 6.9% since mid-July (making it one of the worst performing peer groups over this period) but, as the chart below shows, it is still 2023’s highest returning sector over 2023 to date by a significant margin.

Performance of Investment Association sectors over 2023

Source: FinXL

Other strong sectors in 2023 include IA India/Indian Subcontinent (benefitting from robust economic growth), IA Latin America (strong economy and beneficiary of the US ‘nearshoring’ trend), IA North America (home of the Magnificent Seven) and IA Japan (economic recovery and interest from foreign investors).

The two money market sectors are also towards the top of the performance tables this year, after rising interest rates boosted their yields and made cash an attractive opportunity for investors for the first time in years.

However, there have been some hefty losses this year with IA China/Greater China funds being worst hit. Chinese stocks have sold off this year on the back of a slowing economy, its embattled property sector and Beijing’s geopolitical tit-for-tat with the US.

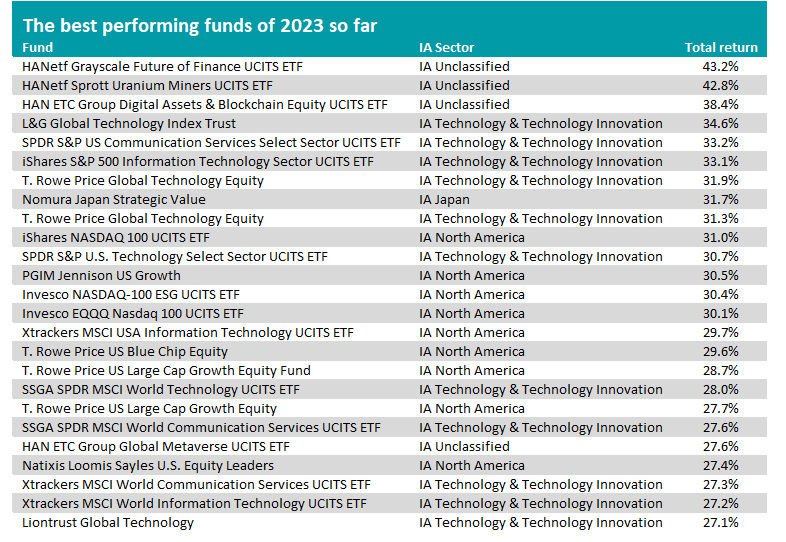

Turning to the returns of individual funds in 2023, it should come as little surprise to see that the top of the performance tables is full of tech funds.

Source: FinXL

Of the 25 funds with the highest returns over the year to date, 18 have a direct focus on investing in tech stocks.

The highest returns have come from niche pockets of the tech market such as HANetf Grayscale Future of Finance UCITS ETF and HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF.

However, there are plenty of funds offering broad exposure to tech stocks, including L&G Global Technology Index Trust, iShares S&P 500 Information Technology Sector UCITS ETF, T. Rowe Price Global Technology Equity and Liontrust Global Technology.

Another five are funds that invest heavily into large-cap US growth stocks, which means they have significant exposure to the tech stocks that powered 2023’s opening half.

The only two funds that don’t fit into these categories are HANetf Sprott Uranium Miners UCITS ETF, which has been driven by the multi-year high in the price of uranium (a key commodity in the transition towards clean energy) and Nomura Japan Strategic Value (benefiting from renewed interest in Japanese equities, with a focus on undervalued stocks and corporate restructuring).

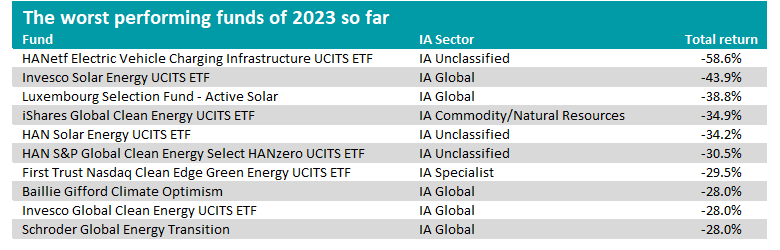

Source: FinXL

The very bottom of the performance table is dominated by clean energy funds, with the worst performance coming from HANetf Electric Vehicle Charging Infrastructure UCITS ETF. This fund is down close to 60% over 2023 so far.

The renewable energy sector has been especially vulnerable to rising rates because many companies fix the price at which they will sell energy in long-term contracts before developing their projects.

They have also been hit by a jump in costs amid the global inflation spike, which was compounded by growing demand for renewable projects, while elevated rates made it more expensive to service the high levels of borrowing necessary to fund their projects.