Investors who always favour growth over value strategies are failing to understand that any bounce in value stocks can be just as profitable as the gains made by the growth companies the market seems to love.

That is according to Richard De Lisle, manager of VT De Lisle America, who is convinced that US technology and growth stocks were never “the only place to be”, not even when interest rates were close to zero and the environment was perfect for them.

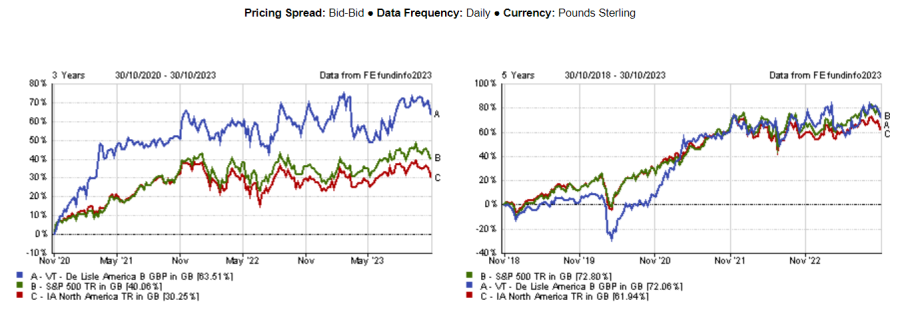

Value stocks can be just as profitable, he argued, and that seems to translate in the performance of his fund, which outperformed its average peer over five years and was in the top decile of the IA North America sector over three years, as shown in the chart below.

Performance of fund vs sector and index over 3yr and 5yr

Source: FE Analytics

He remained convinced of this even when it meant missing out on Starbucks’ rampant returns.

“In 1996, I went over to San Francisco for the sole purpose of sitting in a Starbucks coffee shop and ‘feel it’. Everyone considered it this incredible new growth stock that was trading on more than 50x price-to-earnings ratio. So I went, I sat, and I thought it was a load of rubbish,” he said.

“I thought anyone could do that, so paying 50x earnings for that was stupid. I didn't buy it and I completely missed Starbucks. But I got something else out of it.”

This experience allowed De Lisle to pick up on the theme and play it a different way.

“We bought Green Mountain, a company that made coffee pods that became 10% of the portfolio because it rushed up tenfold. That was until it got taken over by a private German company, because it was effectively competing with Nestle, that came late to the market,” he said.

“These sorts of moves are as good as any of those technologies stocks we don't have. Our weighting in technology stocks all through this period has been a big fat zero, and of course they were ‘the only place to be’. But fortunately, the moves in these stocks are as good as those rockets.”

Another example was pet food, which also helped to keep the fund up between 2010 and 2020.

“Pets are one of the most difficult things to play in the stock market because everyone knows that they are a good category, so everything to do with them is too expensive. There were crazy stocks trading on more than 30 times earnings for something that's hardly growing,” said the manager.

“We eventually found a company that distributed pet food to vets, and that was a winner because it was cheap and we made 10 times more money on that. It also became 10% of the portfolio before being taken over. It's all about themes and being able to lean into them when you find something that works.”

De Lisle also doesn’t feel he’s missing anything from not allocating to any of the Magnificent Seven stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla – which have been driving the US market recently).

In fact, he compared them to the ‘Nifty Fifty’, the fifty US large-cap companies that fuelled the market boom in 1960s and are often referred to show how risky it can be to invest based on popular opinion rather than fundamental analysis.

Investors considered them reliable buy-and-hold-forever companies until they went into a saucer-shaped growth trajectory before then crashing in the 1980s.

“When the ratings got too high and when inflation came in in the 1970s, the earnings kept on coming in, but the stocks went into a saucer-shaped pattern for 10 years and never regained their old ratings again. The earnings kept coming in forever, but the stock prices didn't go up,” he explained.

“I would think we're right on the lip of the saucer for the Magnificent Seven, so for the next 10 years they'll go sideways. I know that that moment is now because we already know that the euphoria around AI is the greatest it has ever been and can’t be pushed further.”

This is particularly evident with Apple, he argued where more than 90% of sales are from phones and related services.

“It's clear that it’s really just a phone company. So again, that would suit the idea that it goes sideways as the [price-to-earnings ratio] P/E steadily comes down,” said De Lisle.

To these stocks, he prefers small manufacturing companies, community banks and industries benefiting from infrastructure spending and onshoring trends in the US.

“These stocks can run for years and sometimes you even get a value stock getting re-classified as a growth stock. While that's very rare in the market, if you can catch one, you make a lot of money,” he said.

“Quite a few stocks in our portfolio have gone up more than 10 times, and that might have taken 15 years or three or four years, but if they're doing well and they keep on doing what they said they were going to do in the first place, then that's worked for us.”