Investors may be questioning their holding in the JOHCM UK Dynamic fund after it was removed from AJ Bell’s Favourite Funds list in October.

The firm said its departure from the shortlist was to “consolidate the list of UK equity funds” – something Charles Stanley’s chief investment analyst Rob Morgan can understand.

With 363 portfolios to choose from in the Investment Association’s (IA) three UK equity-dedicated sectors, Morgan said “investors are probably oversupplied with choices for UK funds”.

After dropping JOHCM UK Dynamic from the Favourite Funds list, AJ Bell have narrowed their UK recommendations down to 17 names.

Though selectivity is needed in the vast UK fund market, Morgan said the JO Hambro fund should still be on investor’s radars.

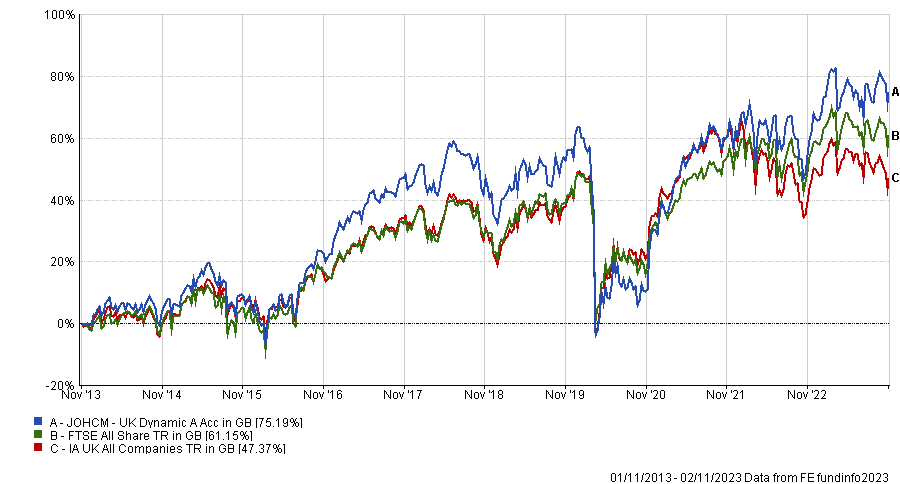

Over the past decade, its total return of 75.2% beat the average IA UK All Companies fund by 27.8 percentage points despite FE fundinfo Alpha Manager Alex Savvides’ value-oriented investment style being out of favour.

Total return of fund vs benchmark and sector over 10yrs

Source: FE Analytics

Morgan said Savvides’ expert selection of 41 names has delivered strong returns for the portfolio that outshone many of its peers over the past decade.

“The high level of concentration means the manager’s stock picking has a significant impact on returns versus the benchmark, and Savvides has a strong record in this regard,” he added.

“The fund continues to make a good one-stop-shop for UK equities given its multi-cap approach that encompasses small and medium-sized companies.”

-

Likewise, IBOSS senior investment analyst Michael Heapy said Savvides ability to construct a portfolio that outperforms in all market conditions is rare to come by.

As the UK is rattled by rising interest rates, inflation, and overall negative sentiment towards the region, Heapy said “there are few funds as attractive right now”.

He added: “You get a fund manager who has navigated numerous market conditions and the latest performance figures reflect this experience”.

This was echoed by Gavin Haynes, investment consultant at Fairview Investing, who said it was unusual for AJ Bell to drop JOHCM UK Dynamic as its value approach was coming back into vogue.

Over the past three years – a period characterised by financial volatility – the fund’s return of 64.4% was more than doubled that of its peer group.

Total return of fund vs benchmark and sector over 3yrs

Source: FE Analytics

Savvides targets unloved companies trading on low valuations, so current market conditions are the prime environment to thrive, according to Haynes.

He said: “It seems a strange decision by AJ Bell to remove this fund from their favourite list at the current time as it has come into its own since value investing returned to favour and this has resulted in the fund showing an impressive performance record both in the short and long term.

“Given how unloved the UK stock market is currently, this makes it a fertile hunting ground for value investors going forward.”

JOHCM UK Dynamic remains a solid buy for Haynes, as it does for FundCalibre. The firm’s managing director Darius McDermott highlighted that while it is not an income strategy, Savvides invests heavily in dividend-paying companies.

As such, the fund has a 3.7% yield that may appeal to investors who want an extra source of income as well as capital growth on their savings. These regular payments from the fund are notably higher than the 2% average yield offered by the average IA UK All Companies fund.