Savers can be put off investing for many reasons, whether it be a lack of knowledge, a fear of losing money, being overwhelmed by the choices available or the thought that they have plenty of time before needing to make a decision.

Regardless of situation, the crucial first step for any investor is to consider why they are putting money aside in the first place. The reason for investing – whether it be to purchase a house, save for your children or build up a nest egg for retirement – will determine what route an investors should take, according to Sam North, personal finance expert at eToro, a trading and investing platform.

“It is essential to decide why you want to invest before starting,” North explained. “The why dictates all subsequent decisions – what you invest in, how long you invest for and how much you put in.

“Motivations can vary, and can start with you simply wanting to put savings to better use each month, but typically it's a good idea to invest for long-term future wealth.”

This segues onto North’s next point – think long term. Any saver, regardless of their end goal, should aim to invest for multiple years.

Doing so allows investors to make the most of their assets and maximise their total return. Holding something for a year can deliver incremental gains, but investors with a long time horizon tend to do much better, according to North.

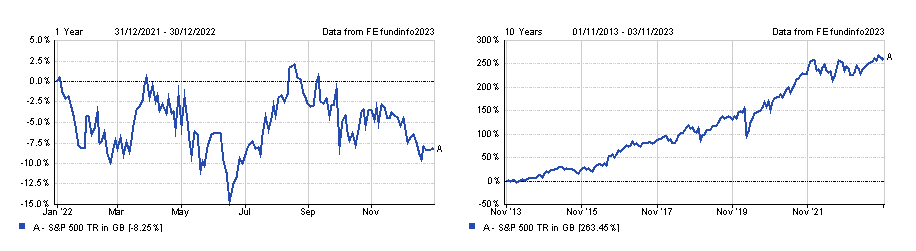

Long-term investing also smooths out bumps in the road. Taking the S&P 500 as an example, this bellwether for the US stock market lost 8.3% last year but is up 263.5% over the past decade. This means that investors in the ever-popular US stock market would have more than tripled their money.

Total return of index in 2022 and over 10yrs

Source: FE Analytics

North noted that the benefits of a long-term approach appear even more powerful when you consider the impact of compounding – the process of reinvesting the gains you make on your assets.

“Time is a superpower for any investor if you learn how to harness it, and if you’re saving for your retirement and still have at least a couple of decades left in full-time work, there is a phenomenal opportunity for wealth growth,” North added.

Once you have established your investment goals and adopted a long-term mindset, it is vital to make manageable, regular contributions.

If you are in a financial position to put money aside, North suggested that investing 10-15% of your salary is a good target.

“No matter your age, it’s important to start, even if you start small,” he said. “Regular, consistent contributions can add up over time and staying engaged with the process can make you more likely to stick to your investing habits.”

Drip feeding small amounts gradually not only forms good habits and creates consistency, but protects your savings in volatile markets.

Investing small sums regularly can minimise your losses in downward markets, whereas if you invest a large amount of money at one time, your savings could diminish quickly if you mistime the market.

The other important consideration in portfolio construction is diversification – spreading your investments across a vast range of assets to offset risk, according to North.

However, the set of assets you invest in may vary depending on your situation. Generally speaking, young people can afford to take more risk as they can withstand more volatility because they have a longer time horizon. This enables them to shoot for higher returns.

North said: “If you’ve got a long horizon, riskier assets such as technology stocks and faster growing markets are the place to be.

“Although in times of market falls, the value of your assets will drop more steeply, your portfolio should also grow more over a longer timeframe.”

Contrastingly, older investors may have a shorter timeframe before they need access to their savings and may be less willing to put their money on the line.

North suggested that investors approaching retirement age look to value stocks that can generate a regular income via dividend payments.

Diversification doesn’t just relate to asset class – investors should spread their assets across multiple regions too.

It may be tempting to invest in your home market because you know it well, but that can cloud your judgement and ultimately limit your portfolio’s potential, according to North.

However, investing solely in fast-growing markets may not offer any protection on the downside, so it is important not have all your eggs in one basket.

“UK indices such as the FTSE 100 are great if you’re looking to derive an income, but in your thirties this might be less relevant,” North added.

“Likewise the US is seen as a leader for growth stocks. But with sky-high valuations in recent years, you might want to look in places where there is more potential for value growth in the future.”

Ultimately, the most important thing is to be invested – your cash will be losing purchasing power if you keep it in savings accounts, especially now that inflation is so high. “Make sure to do your research and don’t put all your eggs in one basket, but don’t miss out entirely either,” North concluded.

For further tips as you embark on your investment journey, Trustnet has published a series of articles for first-time investors.