Square Mile began to include investment companies in its Academy of Funds – a recommended list previously made up solely of open-ended portfolios – last week, with 18 trusts making the cut.

Of those, there were eight trusts investing in European, Asian and emerging market equities. Here, Trustnet looks at the portfolios that made the list.

Europe

Only one trust dedicated to European equities appeared on the list, but it came in at one of the highest ratings of ‘AA’.

The Fidelity European Trust is run by FE fundinfo Alpha Manager Samuel Morse alongside Marcel Stotzel, who target dividend-paying companies as they believe this indicates steady structural growth.

Both managers also run an open-ended version – Fidelity European – but the investment trust has performed better. While both beat their respective benchmarks and sectors, the closed-ended version performed 24.1 percentage points better over the past decade, climbing 24.1%.

Total return of trust vs fund over 10 yrs

Source: FE Analytics

Researchers at Square Mile credited this improved performance to the trust’s ability to use gearing – a process unique to investment companies that allows them to borrow money.

“Higher gearing can of course boost returns when markets are going the managers way, but it can also work against them, thus amplifying the downside,” they said.

Asia

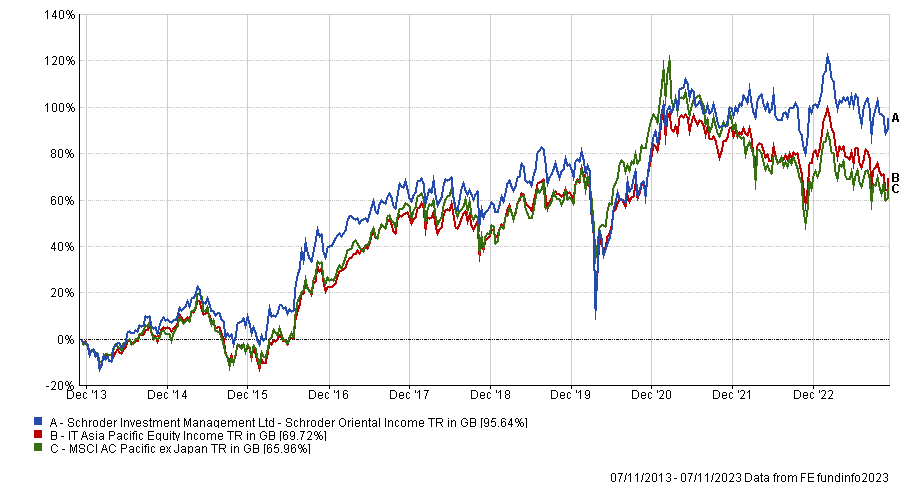

To the east, the Schroder Oriental Income fund also received an AA rating. The portfolio is made up of 62 dividend-paying companies offering an overall yield of 4.8%. It generated a total return of 95.6% over the past decade, beating the MSCI AC Pacific ex Japan benchmark by 29.7 percentage points.

Total return of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Researchers at Square Mile said: “Each stock in the portfolio must have a sound income story and must either already offer an attractive yield or have the potential to grow its dividend over time.

“The managers do not chase high yielding stocks for the sake of yield, rather they prefer firms that have robust cash flows and balance sheets, which allows them to continue paying dividends as they grow.”

Volatility in Asian markets may put some investors off the region, but analysts at the firm said manager Richard Sennitt is a safe pair of hands. He has ran the trust since 2020, but managed the Schroder Asian Income fund since its inception in 2006.

“Sennitt has followed the Asian markets for a considerable amount of time and has a fine appreciation of the nuances and complexities of investing in these markets and is aware of the opportunities that can emerge when investors throw the baby out with the bath water during volatile periods,” researchers at Square Mile said.

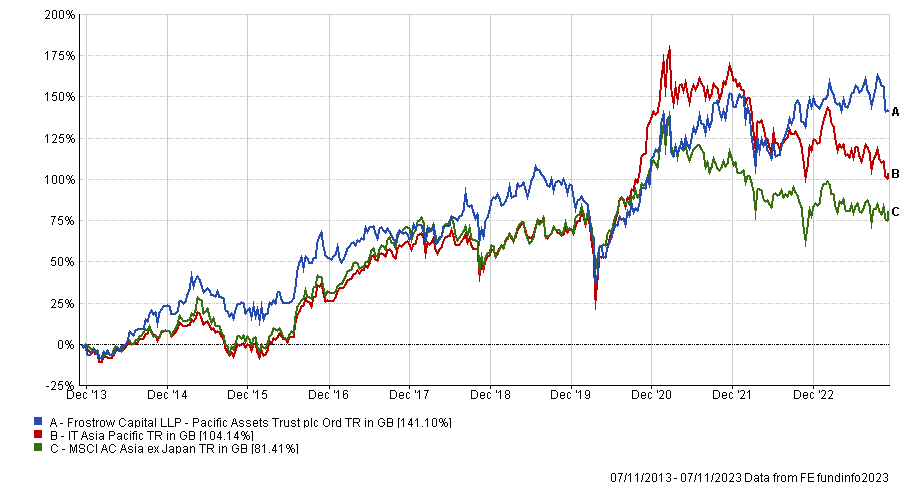

Alternatively, investors who want an ethically-focused Asia trust could look to the Pacific Assets Trust, which has a ‘Responsible AA’ rating. It made a total return of 141.1% over the past decade by investing in stock that were in line with the UN PRI guidelines.

Total return of trust vs sector and benchmark over 10yrs

Source: FE Analytics

It is the closed-ended version of a fund run by the same team – Alpha Manager David Gait and deputy Douglas Ledingham – which performed slightly better over the period, up 161.6%.

However, researchers at Square Mile said the trust’s commitment to deliver shareholders with a total return that is 6% higher than inflation is a worthwhile differentiator.

“We have a high regard for this trust's managers and the team,” they added. “They seek to be long-term investors and companies are assessed on their own merits and not in comparison with other stocks listed on a stock market.

“We think this is a sensible approach to have when investing in this region, but it can lead to significant positioning and performance deviations versus a broader index at times, for good or for ill.”

Other fund investing in the region to gain a rating by the firm were the Invesco Asia Trust and Schroder Asia Pacific, which both beat their shared MSCI AC Asia ex Japan benchmark over the past decade with total returns of 151.8% and 130.3%.

Japan

Investors who want exposure to Japan specifically may be interested in Baillie Gifford Japan, which garnered an AA rating from Square Mile.

Although its total return of 95.4% over the past decade slipped 30.1 percentage points below the average IT Japan trust, analysts at the firm said its high-growth principles led to greater performance prior to the 2021 downturn.

“The clear upside to such an approach is that the longer-term time horizon used by Baillie Gifford is different to that of many other Japanese equity investors, and so differentiates this trust from its peers,” they added.

“We would highlight that this style of management can lead to highly variable returns relative to the benchmark index and that the trust will likely underperform when this investment style is out of favour with the broader market.”

Another Japan trust run by one of the same manager – Praveen Kumar – gained a slightly lower rating of A.

The £381m Shin Nippon portfolio made a 94% return over the past decade by investing in Japanese smaller companies, but has more than halved from its 323.1% peak over the period.

Total return of trusts vs theirs sectors and benchmarks over 10yrs

Source: FE Analytics

Square Mile researchers again highlighted the sharp pitfalls that come with the steep highs of this investment style, especially when it comes to small-caps.

“We believe this strategy has the ability to deliver outperformance of its benchmark over the longer term, however we acknowledge that it has struggled to meet its performance objective in recent years, therefore investors need to be long-term owners,” they said.

Emerging Markets

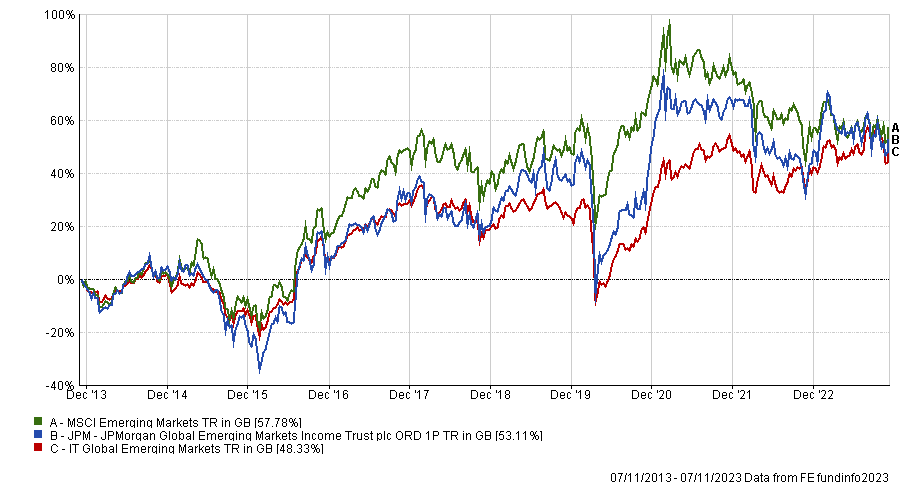

Investors who would rather have exposure to developing nations around the globe may be interested in the JPMorgan Global Emerging Markets Income Trust.

It is up 53.1% over the past decade having invested in growing companies that offer a high and sustainable dividend payments.

Researchers at Square Mile gave the £363m trust an A rating, praising Omar Negyal, Jeffrey Roskell and Alpha Manager Isaac Thong for their strong stock picking in a challenging market.

Total return of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“The trust has many of the qualities we like to see in a strategy, including an experienced lead manager at the helm, backed up by two talented portfolio managers, and a large team of analysts supporting him as well as the wider resources at the firm,” they added.

“Emerging markets is a complex region with thousands of listed companies, and there can be complicated ownership structures, poor disclosures and inadequate standards of corporate governance, therefore a well-resourced team of professionals is viewed as a positive.”