Growth started stalling last year after a decade of outperformance as central banks began their hiking cycle.

This has led growth funds, such as Baillie Gifford Managed, the largest active fund in the IA Mixed Investment 40-85% Shares sector, to suffer. Yet, Steven Hay, one of the fund’s co-managers, does not believe that this is the end for growth. In fact, he does not see a higher inflation environment as an obstacle on the long-term.

But as the macro environment has changed, Hay believes that growth in the future is likely to be different from that of the past, which had been supported by a low interest rate environment.

Therefore, Hay identified four specific themes that could dominate the growth investing landscape going forward.

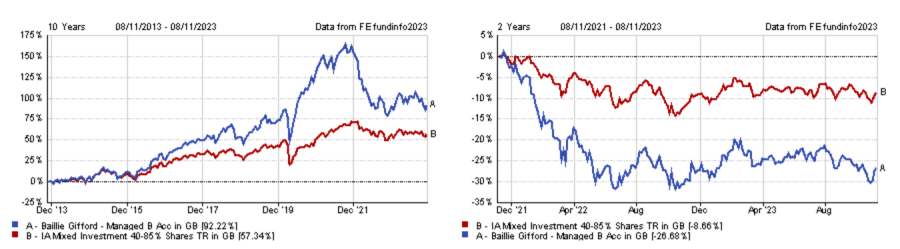

Performance of fund over 10yrs and 2yrs

Source: FE Analytics

One of those themes is the energy transition and more precisely the companies that can benefit from this trend.

Electric vehicle (EV) manufacturers fall in those categories, with Hay naming Tesla as an example, but also BYD, a Chinese competitor.

He said: “It overtook Tesla last year and is in fact the largest EV manufacturer in terms of volume in the world. Its scale and its R&D spending for batteries make it hard for others to compete.

“It has a very good place in the Chinese market. That alone can ensure a good growth run. But it is also trying to enter the European car market and could undercut many European car manufacturers."

Another winner of the energy transition for Hay is Nexans, a French company in the cable and optical fibre industry.

“The reason we're interested in it is because of the growing need to bring back renewable power from offshore. It requires heavy cables that can go undersea and only a few companies can do it. Nexans is one of them,” he said.

The second growth theme for the future is artificial intelligence (AI). Hay stressed, however, that it is difficult to identify how AI will feed through different industries.

Instead, he is focusing on the “nuts and bolts” of AI, with companies such as Nvidia, which has done particularly well this year, but also semiconductor companies ASML and TSMC. Both have a quasi-monopoly in their respective sectors: ASML in machinery and TSMC in high-end manufacturing.

A third growth theme for the future is industrials, with Hay emphasising that growth is not only about technology. Individual names he mentioned include Ashtead, a British industrial equipment rental company, and Watsco, an American distributor of air conditioning equipment

Hay said: “Ashtead has been great at aggregating local businesses and making things more efficient. It is very well run with most of its business in the USA.

“As for Watsco, it is also well run and it is taking advantage of the need for more air conditioning due to global warming.”

The last growth theme for the future identified by Hay is “enduring brands”, which are companies benefiting from customer loyalty and with a differentiated offering.

One of his holdings to play this theme is Greggs, the British bakery chain, due to its capacity for innovation.

Hay said: “Greggs has been very quick to do the likes of vegan sausage rolls to pick up the vegan market. It has extended its opening hours to capture the early dinner market. It also has good drive-throughs.

“It's maybe not one you would think of as a growth company, but it has been a great growth story. That's what we like.”