Money market funds are having a moment. In October, they enjoyed their third best month of inflows ever as investors fled the uncertainty of equity markets against a backdrop of rising inflation and high rates, according to data from Calastone. Savers gravitated towards money market funds’ high yields of 5% and above, for relatively little risk.

August was an even better month, when money market funds netted £673m; October’s net inflows amounted to £586m.

Royal London Short Term Money Market was the most popular fund on interactive investor’s platform in October (knocking the prestigious Fundsmith Equity from its perch at the top) and was the second most popular fund every month from June to September. It has been in the top 10 since April.

UK-based savers’ sudden enthusiasm for money market funds is notable because they have historically been neglected. During the long period of relatively subdued inflation and quantitative easing since the financial crisis, the yields on offer were less attractive than today.

American savers allocate 17% of their investment portfolios to money market funds, but UK savers only have around 1% in the asset class, according to data from ICI Global (as of 31 March 2023).

British consumers have tended to favour cash ISAs and savings accounts with banks and building societies, perhaps because they are easier to understand and to access.

Alastair Sewell, liquidity investment strategist at Aviva Investors, pointed out that “the average saver in the UK is earning miles less than the central bank rate in their savings accounts and deposit accounts. UK investors are missing out because they do not use money market funds.”

Craig Inches, head of rates and cash at Royal London Asset Management (RLAM), described money market funds as “a bit of a no brainer” in light of their high yields and low risk.

Below, Trustnet offers a guide below to money market funds, outlining the investment case and discussing how to choose a fund.

What are money market funds?

Money market funds are highly liquid, diversified, open-ended funds that invest in short-term instruments. They can buy government and sovereign bonds, very short-term debt and corporate bonds, as well as more complex instruments.

These include floating rate notes, which are debt instruments with a variable interest rate, covered bonds (which are backed by a pool of loans) and in some cases, derivatives.

They have to meet certain criteria regarding risk, duration and liquidity. European and UK money market funds must have a minimum 30% allocation to assets that mature within seven days (weekly liquidity) and they cannot have more than 5% exposure to a single issuer (with the exception of governments and overnight deposits.)

What are the different types of money market funds?

There are two main types of money market fund. Stable funds and variable funds.

Stable funds function like savings accounts as investors can redeem shares at the same price paid. There are two types, one that invests solely in government debt (public debt constant net asset value (NAV) funds) and one that has the full range of instruments available (low volatility NAV funds).

Variable money market funds mean investors will get back the value of their units at the time of sale. The underlying value of their assets can go up or down, just like any other investment fund.

There are two types of variable fund: short term and standard. The latter can invest in securities with a maximum duration of two years, whereas for other types of money market fund, the maximum duration is 397 days.

Short term variable funds have seen the most inflows in recent years compared to the other types of money market fund, Inches said.

What yields are on offer?

As Inches explained: “Money market funds are yielding almost 5.5% and government bond funds are yielding almost 5% with very little credit risk attached. In the past to get these yields you had to go very far down the credit spectrum or into equities.”

However, the purpose of a money market fund is not necessarily to maximise yield but to be used as relatively safe places to store cash, with the option to move money in and out the same day or the next day.

“For us it’s security, liquidity and yield, in that order,” Inches said. “It shouldn’t be yield first.”

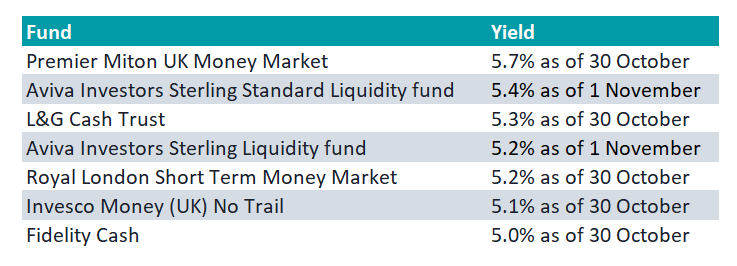

Yields from money market funds

Source: interactive investor, Aviva Investors

How to choose a money market fund

First, investors need to decide between the types of money market fund highlighted above. Next comes the choice of fund and fund manager. Factors to consider include: how interest rate risk and credit risk are managed; how experienced and stable the investment management team is; the performance track record; and the manager’s attitude to environmental, social and governance factors if that is important to the investor.

When it comes to picking a provider, scale matters because larger money market funds have better access to intermediaries in the market, Sewell said.

Diversity amongst the investor base is also important, so if one type of investor (for instance liability-driven pension funds) all redeem their assets, it doesn’t sink the whole fund. Money market funds tend to have a broad base of investors from local authorities to pension funds, insurers, corporations, other institutions, private banks and individual savers.

Another consideration is what percentage of the portfolio has weekly liquidity and how conservatively the fund is managed.