Evenlode Global Income, Templeton Emerging Markets, TwentyFour Dynamic Bond and Odyssean Investment Trust were all put forward by fund selectors as potential building blocks for junior ISA (JISA) portfolios.

Fund selection is something many parents will be grappling with. Having looked at asset allocation yesterday, here experts tackle which funds to buy once you know the asset classes in which you want to invest. All of these picks have been selected for a child around nine years’ old with about a decade before they will receive the ISA.

What’s the ideal number of funds for a JISA?

There is no perfect number of funds, even for relatively small JISA portfolios – a lot will depend on how much research and monitoring parents are willing to do.

Edward Allen, private client investment manager at Tyndall Investment Management, said it’s crucial to understand all the JISA’s investments “because when one or more of these investments performs poorly it will be tempting to sell and rotate into something else that is doing well. A good starting knowledge of the strategy will help you to hold through tougher times.”

Laith Khalaf, head of investment analysis at AJ Bell, said if parents chose to invest passively, “you could happily have one globally diversified fund” but with active managers “it’s better to have at least two or three managers, just in case one goes off the boil.” Four or five funds would be “reasonable”, he added.

Darius McDermott, managing director of Chelsea Financial Services, prefers more diversified portfolios to “limit the risk of one fund going out of favour and doing badly”.

“I would recommend a portfolio of at least 10 funds, which will allow exposure to different geographies, styles and market caps,” he said.

Start with diversification

My son’s JISA is currently invested in just one fund, Lindsell Train Global Equity – a popular developed markets portfolio that invests with a quality-growth bias.

Emma Wall, head of investment analysis and research at Hargreaves Lansdown, suggested anyone with a developed market equity fund could diversify by adding a bond fund such as Artemis Corporate Bond and an emerging markets fund such as iShares Emerging Markets Index.

“Those three components would give you broad asset class and geography exposure, and also keeps the JISA simple to manage on an ongoing basis,” she said.

Which global funds should parents pick?

Jason Hollands, managing director at Bestinvest, highlighted GuardCap Global Equity and Evenlode Global Income as two options for parents to consider if they want an active global equity fund.

The $3.4bn GuardCap Global Equity fund has a concentrated portfolio of just 20-25 holdings and a quality-growth style. Its largest positions include the derivatives marketplace CME Group, healthcare giant Novo Nordisk, eyecare company EssilorLuxottica and Google parent Alphabet. The fund is managed by Michael Boyd, Giles Warren, Bojana Bidovec and Orlaith O’Connor.

Evenlode Global Income invests in 39 companies that provide value-adding goods and services, generate high returns on invested capital and have strong free cash flow. Top holdings include Microsoft, Unilever and professional services firm Wolters Kluwer. The £1.8bn fund is managed by FE fundinfo Alpha Managers Ben Peters and Chris Elliott.

Given the long-term horizon, for the environmentally conscious Wall suggested adding an impact fund such as WHEB Sustainability. The £698m fund is managed by Ted Franks, Seb Beloe, Ty Lee and Victoria MacLean. They focus on nine themes, including clean energy, environmental services, resource efficiency, education and health.

Performance of funds vs benchmark over 5yrs

Source: FE Analytics

For parents who want to take advantage of the wide discounts on offer in the investment trust space, McDermott said Scottish Mortgage is one of the “bombed-out Baillie Gifford growth trusts trading on big discounts” that he likes. It was trading at a 12 month average discount of 16.3% as at 31 October 2023.

Formerly the UK’s largest investment trust, the £10bn company is managed by Alpha Manager Tom Slater and Lawrence Burns. They have grouped their investments into three themes – technology meets healthcare, decarbonisation and a digitalised world – and then a fourth bucket for other companies, from SpaceX to French luxury group Kering. The fund’s top holdings are ASML, whose technology is used to create microchips, NVIDIA and Amazon.

How should investors tap into attractive valuations in the UK?

Some parents may prefer instead to invest in the UK, which has lagged other developed markets for the best part of a decade and could now be considered cheap.

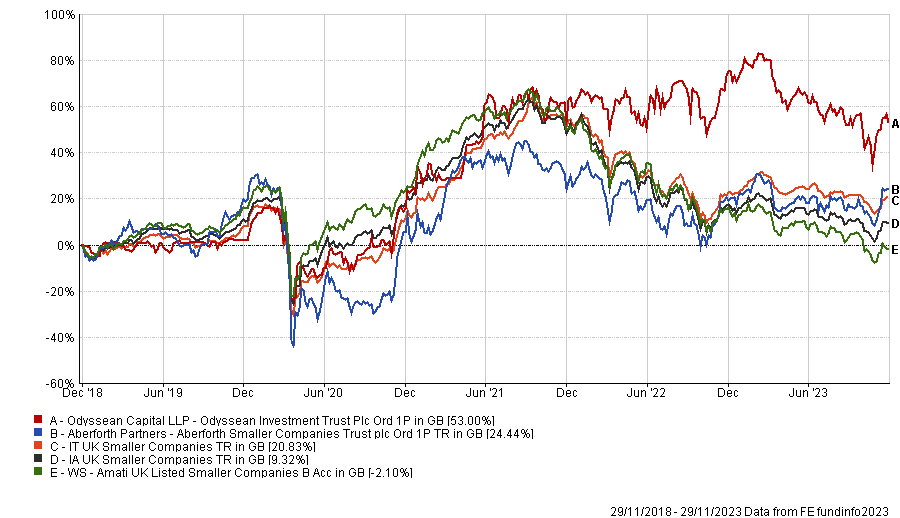

UK small and mid-cap stocks are heavily discounted relative to their history, even more so than their large-cap rivals, so Wall tipped Amati UK Listed Smaller Companies, while Allen mentioned Odyssean Investment Trust and Aberforth Smaller Companies.

“Odyssean takes a private equity approach to public market investing, buying meaningful stakes in growth businesses, often when out of favour with the market, targeting a 15% annualised return. It actually trades at a small premium, but I wouldn’t be put off by that given the nine-year time horizon,” Allen said.

“Aberforth Smaller Companies can be bought on a price-to-earnings ratio (P/E) of 6, taking the 10% (ish) discount into account… which suggests a good starting point for investment and perhaps even a margin of safety.”

Fund and trusts vs sectors over 5yrs

Source: FE Analytics

For broader UK equity exposure, Wall suggested the £1.9bn City of London investment trust, which is managed by Job Curtis and David Smith from Janus Henderson Investors. Whilst many investment trusts are trading at substantial discounts, City of London had a discount of just 0.8% at 31 October.

One of the UK’s oldest investment trusts, City of London focuses on large companies with international revenue streams that are sufficiently robust to increase their dividends. It has a yield of 5% and a long track record of increasing its dividend. It was one of five UK equity trusts added to Square Mile’s Academy of Funds when it admitted investment companies for the first time.

What about emerging markets strategies?

Alongside any developed market exposure, Hollands recommended a 10% allocation to emerging markets for diversification.

“A little exposure to high growth regions such as Asia ex-Japan provides access to a wider set of opportunities,” he explained. “It’s also true that emerging market valuations are more compelling currently as riskier assets have come under pressure and China has been deeply out of favour for a couple of years.”

Hollands put forward the Templeton Emerging Markets investment trust, which is trading on a 14% discount to its net asset value, while Allen highlighted JP Morgan Emerging Markets because its co-manager Austin Forey “talks persuasively about his companies’ ability to generate meaningful returns on capital in markets that are evolving and growing.”

Total return of trusts vs sector over 5yrs

Source: FE Analytics

Dampening down risk with some bond funds

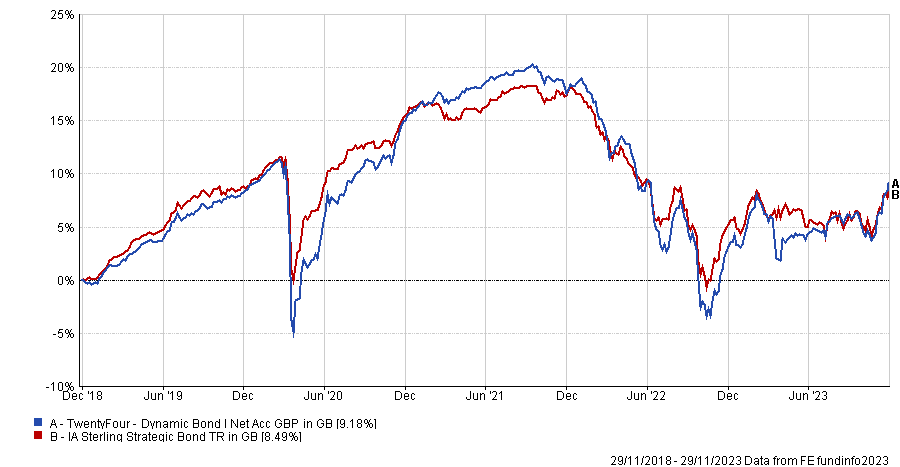

Finally, despite the long time horizon, Hollands suggested a 20% bond exposure split between government bonds using the iShares Core UK Gilts UCITS ETF and a strategic bond fund such as the £1.5bn TwentyFour Dynamic Bond.

Allen owns TwentyFour Dynamic Bond, which has a yield to maturity of circa 8% (before fees) and a bit of duration as well. “It’s a little complex but worth looking into,” he said.

TwentyFour Dynamic Bond is top quartile in the IA Sterling Strategic Bond sector over one year and second quartile over three years.

Performance of fund vs sector over 5yrs

Source: FE Analytics