Investors have been through a tumultuous couple of years, with almost every risk asset hit at different times. Now that we live in an environment with higher rates, we are seeing substantial flows into the more reliable return profile offered by cash and money market funds.

But if we are looking for another constant we can hang our hat on, it would be the growth in levels of government debt. UK Public Sector Net Debt as a percentage of GDP is more than triple today what it was 20 years ago, and US national debt is approaching $34trn.

There are many political conversations about controlling this growth but it is hard to envisage the headline numbers shrinking when the interest payment on US government debt alone this year totals $1trn. So what does this mean for investors?

New debt, new money

In simple terms, taking on new debt creates a new supply of money. If you think about when you take out a loan for instance, you now have more money in your hands than you did yesterday.

Another good example of this would be a new mortgage customer in the UK. When they take out a mortgage, the money they hand over to the seller is borrowed from a bank, but the bank themselves also borrow money from the Bank of England.

The central bank creates new money each time it lends to commercial banks. The more money a central bank creates by lending, the more the balance sheet of their assets increases.

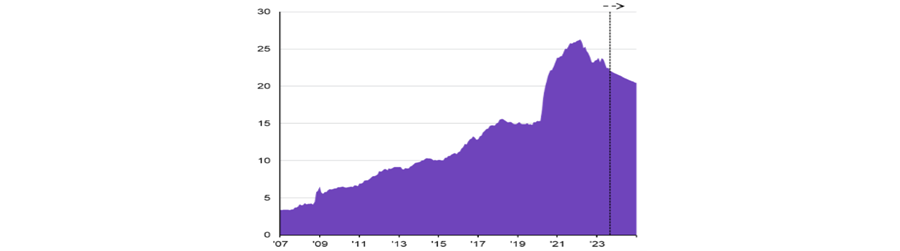

Central banks can also increase their balance sheet by creating money to buy government debt, known as Quantitative Easing (QE). This was one of the consequences of the global financial crisis, and that trend continued into the Covid pandemic, which saw one of the sharpest increases in the money supply as seen in the chart below.

Global central bank balance sheets

Source: BoE, BoJ, ECB, Fed, LSEG Datastream, J.P. Morgan Asset Management. Global central bank balance sheet is the sum of the balance sheets of the BoE, BoJ, ECB and Fed, in USD trillions

In turn, this led to a sharp rise in inflation, which central banks have been trying to address by raising interest rates and reducing their balance sheets. The higher rates have tempered the growth of debt, with individuals and companies now less inclined to borrow.

Governments on the other hand have continued to borrow to fund large fiscal deficits. However, despite this we have experienced one of the rare occasions where the money supply is contracting.

If inflation continues to fall, we may get the interest rate cuts that market participants are pricing in for 2024. This alone could bring about a resumption in the growth of the money supply, creating an environment where individuals and companies are happy to take on more debt.

It could also be boosted by a return of QE, which cannot be ruled out even if central banks are loathe to consider the possibility at this time. Longer-dated government bonds may still offer high yields even after a cut to the base rate, if the term premium is high (i.e. the extra yield investors get for taking on interest rate risk). In that scenario QE could help limit the interest expense on government debt and ease concerns about debt sustainability.

The Cantillon effect

In the 18th century the French banker and philosopher Richard Cantillon coined the term ‘Cantillon effect’ to describe a change in prices resulting from a change in money supply. This change is often uneven – take the impact of QE on the value of bonds for example.

The increase in the supply of money flowed directly into the bond market, which boosted their value, and consequently the value of riskier assets such as equities. The theory is that those who receive new money first profit most from the increase in the supply of money.

The case for investing in risk assets is more attractive in an environment where the money supply is growing, and is worth keeping an eye on as we head into 2024.

Colin Morris is an investment manager at Parmenion. The views expressed above should not be taken as investment advice.