For investors who want exposure to equities but are concerned about the potential for an economic downturn, equity income funds could be a sensible choice for 2024. They tend to be defensive, given their bias towards stable companies with strong balance sheets that can grow their dividends.

Furthermore, for investors who do not need to draw down the income, reinvesting dividends can have a powerful compounding effect.

Trustnet asked fund selectors to recommend equity income funds that investors should consider next year in each regional market, as well as some global strategies.

The UK

Starting with the home market, Scott Avent, senior investment manager at JM Finn, highlighted the £3.1bn Evenlode Income fund, which is run by FE fundinfo Alpha Managers Hugh Yarrow and Ben Peters together with Chris Moore.

Evenlode Investment Management’s philosophy is based on “compounding free cash flow for sustainable long-term growth and attractive total returns,” Avent said. He believes that this “steady approach” and “focus on long-term fundamentals and risk management” should serve investors well.

The fund invests “predominantly in UK-listed companies that have better gross and operating margins than the benchmark, low economic sensitivity and importantly, whilst UK interest rates are the highest they have been since 2008, low levels of debt,” Avent explained. Its current dividend yield is 2.8%.

Kamal Warraich, head of equity fund research at Canaccord Genuity Wealth Management, recommended looking at funds that achieve a balance between growth and income.

“Dividend growth is the key indicator of future income potential,” he said. “Assets which pay a high yield, but with very little dividend growth, could lag inflation over time, and worse, could be prone to dividend cuts.”

Three funds that embody this approach are Artemis Income, Columbia Threadneedle’s CT UK Equity Income and the aforementioned Evenlode Income. All three funds have beaten their sector and benchmark over 10 years, as the chart below shows.

Performance of funds vs sector over 10yrs

Source: FE Analytics

Artemis Income is run by Alpha Manager Adrian Frost, Andy Marsh and Nick Shenton. They have built a portfolio of diversified cashflows with a focus on valuations. The £4.4bn fund targets an above average dividend yield with dividend growth and its yield is 3.8%.

Jeremy Smith’s £3.2bn CT UK Equity Income fund is a contrarian, value-oriented strategy, which focuses on large- and mid-caps. “The contrarian approach has often led to significant sector biases, at present including a zero weight to energy and banks, with a large overweight to industrials,” Warraich observed.

Smith aims for above-market yields with dividend and capital growth. The fund’s current yield is 3.6%.

Sheridan Admans, head of fund selection at TILLIT, recommended the £225m Trojan Ethical Income fund. It invests in dividend-paying, blue-chip companies across developed markets with at least 60% of its portfolio in the UK. Hugo Ure, who leads Troy Asset Management’s responsible investment process, runs the fund.

Admans said: “The fund is relatively concentrated with a clear focus on defensive quality growth, topped with ethical screening criteria. The manager looks for high-quality companies, defined by a strong balance sheet, high returns on capital and shareholder-friendly governance structures and policies. The team has a strong track record of this style of investing, combining quality growth with income.”

The fund has a 2.6% yield. It has beaten its benchmark over the past 12 months but lagged the FTSE All Share over five and 10 years.

Europe

Gary Moglione, a portfolio manager at Momentum Global Investment Management, highlighted Downing European Unconstrained Income for those turning to the Continent. It focuses on small and mid-caps so should provide some diversification against large-cap funds within investors’ portfolios.

The fund is managed by Mike Clements and Pras Jeyanandhan who “scrutinise industries or themes poised for enduring structural growth,” Moglione said.

“Their method involves a meticulous examination along the value chain to unearth companies that the market may have overlooked in relation to these themes. For example, the burgeoning field of artificial intelligence demands substantial processing power and infrastructure, leading to a surge in global data centre construction to accommodate the servers,” he explained.

Performance of fund vs sector since inception

Source: FE Analytics

The fund has faced headwinds recently due to a significant sell-off in small-caps triggered by inflation spikes and rising interest rates.

“However, the current landscape, with small-cap valuations in Europe recently hitting a two-decade low, presents an opportune moment for this fund,” Moglione argued. “What has been a challenging period for the fund might transform into a favourable tailwind in 2024 providing investors with an attractive yield and capital growth.”

The US

Square Mile Investment Consulting and Research’s Academy of Funds contains two US equity income strategies: Schroder US Equity Income Maximiser and JPMorgan US Equity Income.

Research director John Monaghan said: “The Schroder fund is a slightly different play versus the JPM US Equity Income fund in that the underlying portfolio is constructed to track the S&P 500, which is then overlaid by selling call options to generate additional income.”

As a result, the £332m fund has a relatively high 5% yield, which consists of 2% from the underlying portfolio and the remainder from the options overlay.

The trade-off is that the fund aims to capture 85% of the equity market’s upside because as share prices rise, the options are called, thus losing out on further capital gains.

Performance of funds vs sector and benchmark over 5yrs

Source: FE Analytics

JPMorgan US Equity Income is another harbour that investors might turn to if they expect markets to be choppy. The £3.7bn fund has a 2.4% yield and “should provide some protection from market volatility” on account of its “conservative” investment strategy, Monaghan said.

“It is worth noting that its return profile versus the S&P 500 is slightly lacklustre but that this is on account of the approach, which focuses on companies that are yielding at least 2% at the time of purchase,” he explained.

“A number of the stocks that have been leading the market of late do not meet this criterion. For instance, Nvidia is currently yielding 0.03% and Apple 0.49%, so these stocks (and many others) are currently un-investable.”

Global

For those wanting global exposure, Admans chose Heriot Global, which he described as a “growth fund backed by dividend-paying heavyweights”. Although it isn’t an explicit income fund, its manager, Dundas Global Investors, pursues an investment philosophy based on dividend growth.

“The managers look for companies with solid cashflows that have the ability and willingness to pay dividends, even if they don’t pay one currently,” Admans said. “There is a clear preference for developed markets, with the US making up a significant proportion of the fund. Decisions are based on bottom-up analysis.”

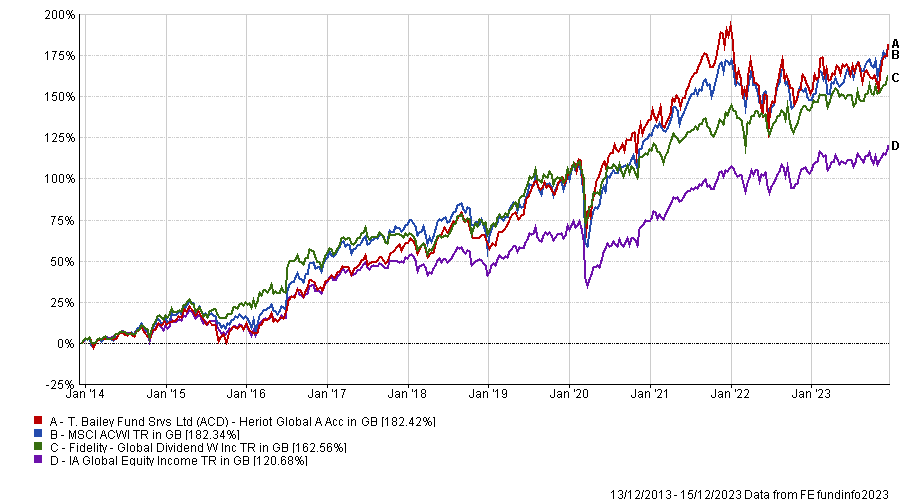

Performance of funds vs sector and benchmark over 10yrs

Source: FE Analytics

Emma Wall, head of investment analysis and research at Hargreaves Lansdown, recommended Fidelity Global Dividend, which has been managed by Daniel Roberts for more than 10 years.

“Roberts invests in companies that he believes have predictable revenue streams that can continue to grow and provide reliable dividends to investors. He has a preference for companies with simple balance sheets, little debt and experienced management teams,” Wall explained.

“The focus on valuations and income has led Roberts to have a high degree of exposure to Europe and the UK. Although we are wary of the fund’s Europe overweight, given the macroeconomic backdrop, from a valuation point of view the market looks cheap compared to its long-term history.

“Roberts also has a strong track record of picking winning stocks in Europe, and the income discipline of the fund helps avoid value traps.”

Japan

Karen Lau, an investment director at JM Finn, invests in the Coupland Cardiff’s CC Japan Income & Growth Trust. It pays a dividend so “we’re getting something while we wait,” she explained. “Japan is a difficult market to invest in, so we’ll take the income.”

Performance of trust vs sector and benchmark since inception

Source: FE Analytics

The trust is managed by Richard Aston and has a five FE fundinfo Crown Rating. Its performance is top quartile over one, three and five years and the current yield is 2.8%.

Emerging markets

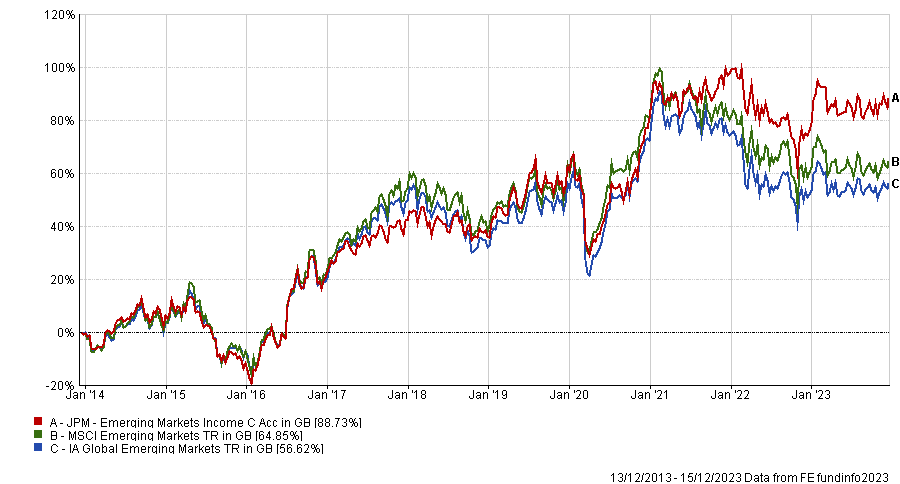

It is fairly unusual to find emerging market equity funds focused on income, Admans said, but JPM Emerging Markets Income focuses on quality income and pays a 3.8% yield. It is managed by FE fundinfo Alpha Manager Isaac Thong, Jeffrey Roskell and Omar Negyal.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The five-crown fund is top quartile within the IA Global Emerging Markets sector over one, three and five years.