Environmental, social, and governance (ESG) investing has gained significant traction in recent years, driven by a growing desire among investors to align their financial decisions with ethical concerns.

But a common knock on the strategy is that the by excluding parts of the market, some funds may significantly underperform the market.

In 2022 soaring oil prices created a stumbling block for renewable energy stocks and ESG strategies as a whole, which typically do not invest in the sector. Sustainable funds had their second year of underperformance in a row in 2022.

Yet after the disappointment of 2022, last year was a strong one for ESG investing as the types of stocks commonly found in these portfolios – namely technology and healthcare – did well.

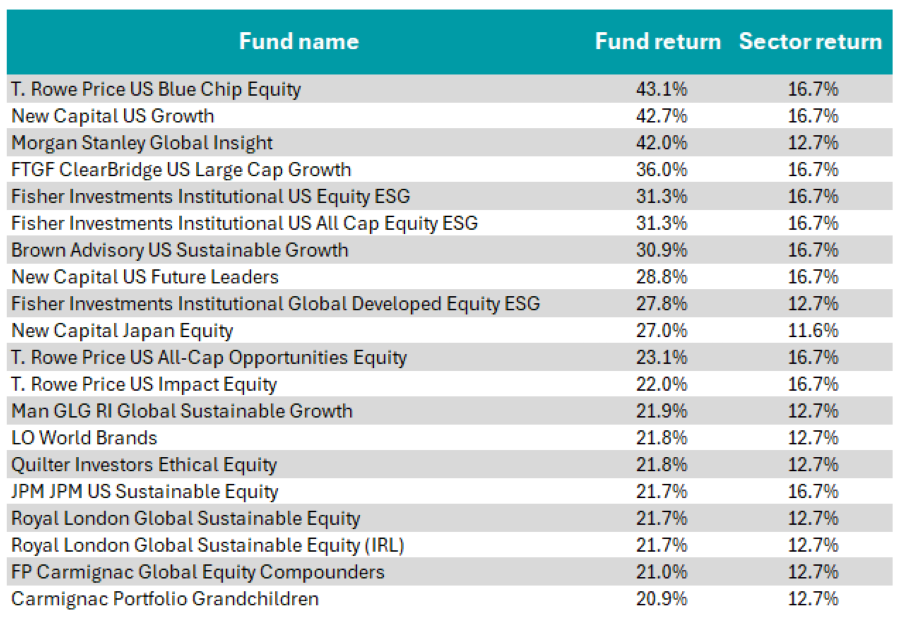

Investors that wanted to pick an ethical fund able to outperform their peers would have done well to focus on the IA North America sector in 2023, with the below table dominated by US names.

The top 20 ethical funds of 2023

Source: FE Analytics

Throughout 2023, many active funds performed well with T. Rowe Price US Blue Chip Equity, managed by Paul Greene, coming out on top.

The $649m fund is not a classic ESG fund but does aim to invest 10% of the portfolio in sustainable companies and is therefore eligible for this study.

The T. Rowe Price US Blue Chip Equity Fund returned 43.1% in 2023 and outperformed its sector by 17.4 percentage points, consistently outperforming its benchmark index over the past decade, delivering an average annual return of 13.9%.

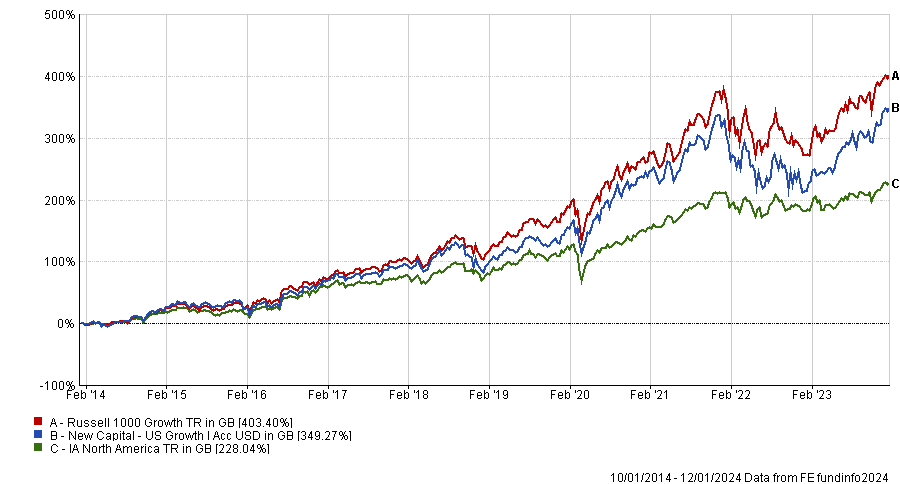

Total return of trust vs sector over 10yrs

Source: FE Analytics

The next best ethical fund during 2023 was New Capital US Growth, which is managed by Joel Rubenstein. The $182.4m fund targets high-quality US mid- and large-cap growth stocks and outperformed its sector by 26 percentage points, returning 42.7%. The fund has outperformed its sector comfortably over the past 10 years.

Total return of trust vs sector over 10yrs

Source: FE Analytics

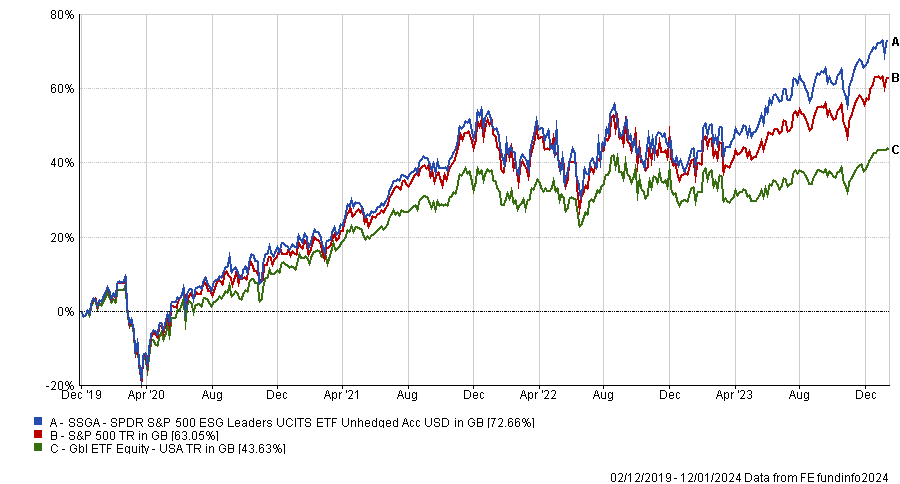

While active funds with an ethical mindset did well over 2023, passive ESG funds also delivered strong returns Investors seeking broader exposure at lower costs may favour passive ESG options, which have grown in popularity. Indeed, passive ESG exchange-traded funds (ETFs) saw significant inflows throughout 2023 despite market volatility.

Three ESG ETFs stood out during 2023; firstly, the iShares ESG Aware MSCI USA ETF, which aims to obtain exposure to higher-rated ESG companies while accessing large- and mid-cap US stocks.

The $1.2bn fund returned 23.3% in 2023, outpacing its benchmark, the MSCI US Investable Market ESG Focus Index, by 2.2 percentage points. It has also outperformed the global ETF equity sector consistently since launch.

Total return of trust vs sector over since launch

Source: FE Analytics

The next ESG ETF fund that stood out during 2023 was the SPDR S&P 500 ESG ETF, with top holdings including Microsoft, Apple, Amazon, Nvidia and Tesla. The $1.8bn fund returned 21.1% in 2023.

Total return of trust vs sector vs index since launch

Source: FE Analytics

Its low expense ratio of 0.07% further enhances its attractiveness for investors seeking to balance ESG principles with cost efficiency.

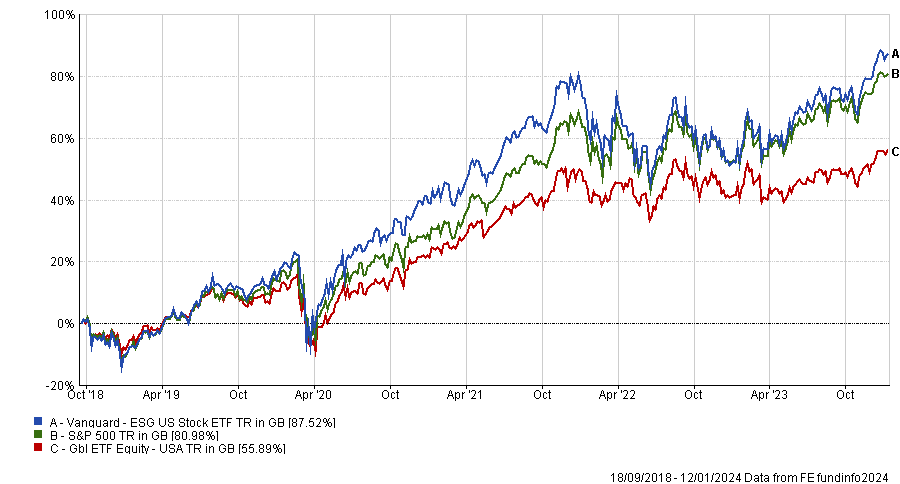

The final ESG fund to highlight during 2023 is the Vanguard ESG US Stock ETF. This $6.4bn fund made 23.9% in 2023.

It aims to give diversified exposure to US equities while holding to its stringent ESG criteria. Tracking the FTSE U.S. All Cap Choice Index it beat S&P 500 by more than 3.5 percentage points.

This Vanguard ETF has returned an average of 9.6% annually since its launch (as of December 31, 2023). This slightly outperforms the S&P 500's average annual return of 9.2% during the same period.

Total return of trust vs sector vs index since launch

Source: FE Analytics