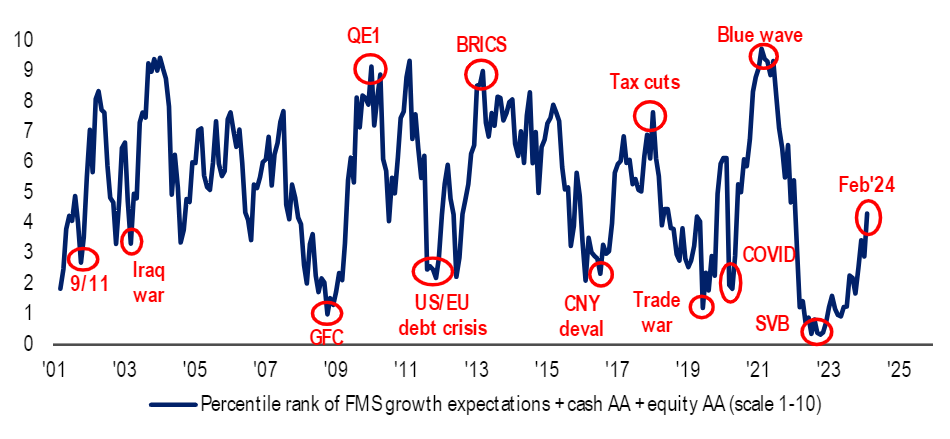

Sentiment among fund managers has rocketed in recent weeks, according to a closely watched portfolio positioning survey, as investors become more convinced that a recession has been avoided.

The latest edition of the Bank of America Global Fund Manager Survey found sentiment among asset allocators has climbed to its highest in more than two years, based on bullish readings for portfolio cash holdings, equity allocations and economic growth expectations.

Global fund manager sentiment

Source: Bank of America Global Fund Manager Survey - Feb 2024

For the first time since April 2022, most investors are not expecting the global economy to fall into recession; previously, investors were worried that higher interest rates would send the economy into reverse.

When asked about the path of the economy this year, only 11% of fund managers said they expect a recession, or ‘hard landing’. Two-thirds are tipping a ‘soft landing’ (a slowdown that does not result in recession) and one-fifth see ‘no landing’.

Bank of America analysts added: “[An] improved macro outlook and reduced risk perception drove investors to take down their cash levels to 4.2% in February from 4.8% in January, a 55 basis point month-on-month drop.”

They also claimed that previous month-on-month declines in cash levels of more than 50 basis points tend to be followed by a rise of around 4% in stock markets over the next three months.

When it comes to equity allocations, survey participants are running a net overweight to stocks of 21%. This is up 12 percentage points over the past month and takes the allocation to its highest since February 2022.

“Fund Manager Survey investors have been overweight equities for four months now, after an 18-month period of underweight allocation that ran from May 2022 through October 2023,” the bank’s analysts said.

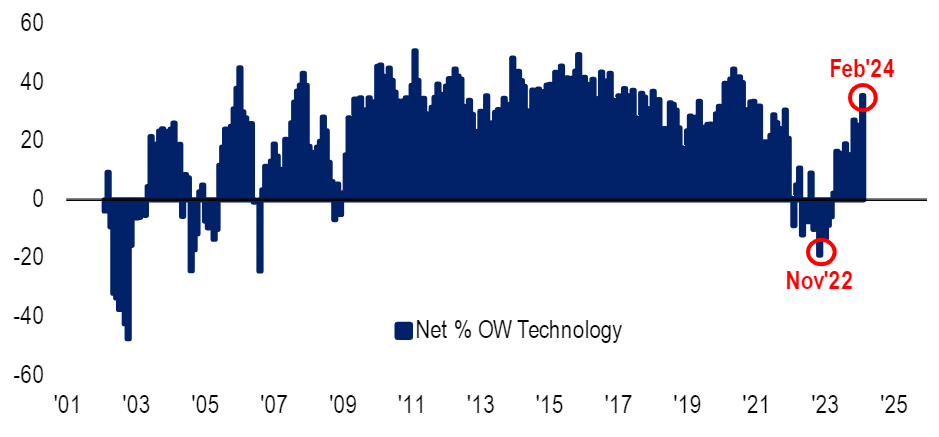

Net allocation to tech stocks

Source: Bank of America Global Fund Manager Survey - Feb 2024

This improvement in sentiment has sent fund managers rushing back to tech stocks. Investors have increased their allocation to tech by 10 percentage points over the past month, taking to a 36% net overweight.

Bank of America analysts said: “[The] allocation to tech is now the highest since August 2020 and is the number-one most overweight sector for the first time since July 2021 (replaces healthcare, which was the most overweight sector from March 2022 to January 2024).”

February's rotation has seen fund managers buy more stocks, especially US, telecoms, tech and consumer discretionary, while cutting emerging markets, consumer staples, real estate investment trusts and cash.

In keeping with this sector rotation, a net 13% of the survey’s participants think growth will outperform value over the coming year, which is a reversal from last month when a net 2% expected value to outperform. The expectations for growth to outperform are now the highest since May 2020.

And when asked about the leadership of a new US equity bull market, 41% of fund managers pointed to large-cap growth stocks. This was the clear favourite, ahead of small-cap growth (18%), small-cap value (12%) and large-cap value (11%).

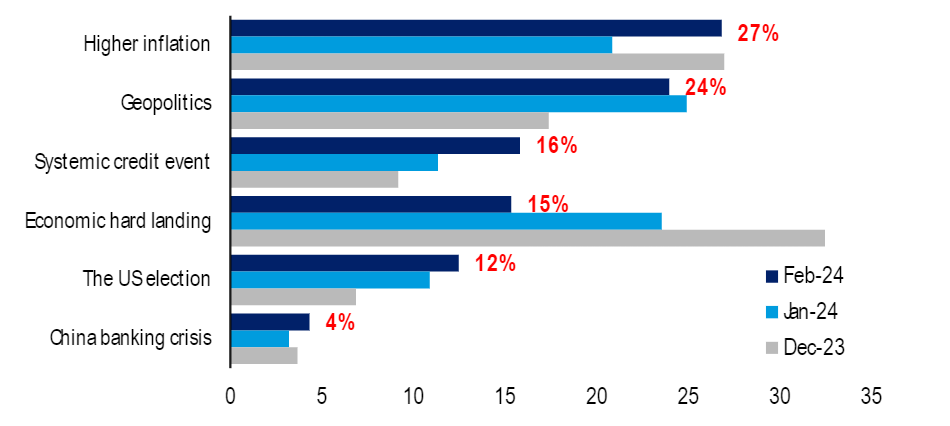

Fund managers' biggest tail risks

Source: Bank of America Global Fund Manager Survey - Feb 2024

However, there are some risks on fund managers’ radars – as shown in the chart above.

Higher inflation is the most-common concern, cited by 27% of the survey’s participants and representing an increase on last month's reading. Although central banks have made significant progress in bringing down inflation over the past couple of years, investors are still closely watching monthly inflation prints for clues to the next moves in monetary policy.

Geopolitics remains a big concern as well, given the ongoing conflicts in Ukraine and the Middle East, while managers have become more worried by the prospect of a systemic credit event and the US election than they were last month.