Odyssean Investment Trust regularly appears in investment trust recommendations from brokers, such as Winterflood or Numis, due to its distinctive approach to UK smaller companies.

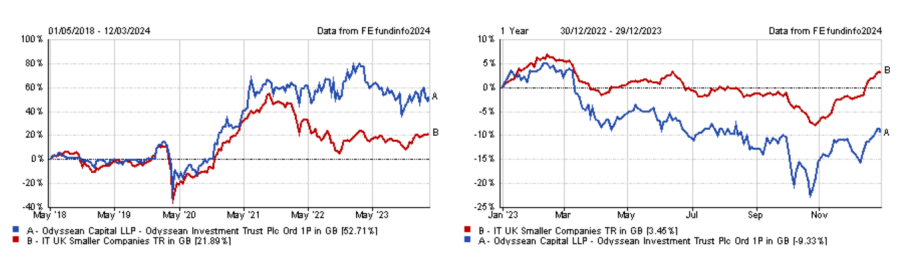

However, the trust had a challenging time in 2023, its worst calendar year since inception in 2018.

Nonetheless, Odyssean remains the fourth best performer in the IT UK Smaller Companies sector over five years. Stuart Widdowson, managing partner at Odyssean Capital, is optimistic that there is more to come as he expects UK small- and mid-caps to eventually re-rate after years of underperformance.

Performance of trust since launch and in 2023 vs sector

Source: FE Analytics

Below, Widdowson explains Odyssean’s approach to investment, why the strategy struggled in 2023 and why UK small-caps remain a compelling offer.

Could you explain your investment philosophy?

Our starting point is what we want to achieve for our clients. We think the right yardstick is to try to double our net asset value (NAV) per share every five years. So we focus on making money rather than beating an index.

We do that by investing in a small number of companies that have particular attributes that we think are going to give us the best chance of making a positive return over a three- to five-year period and where there is a very low chance of losing money. Our strategy is neither growth nor value, it's more a collection of special situations.

We want above-average-quality businesses trading significantly below today's intrinsic value, while thinking about how value is going to be created over the next five years. Self-help is important as well. There has to be something that the company can do that is in its own control to generate value.

The portfolio is quite concentrated (87.6% in the top 10). How do you manage risk?

We avoid speculative stocks or companies on very high ratings. When market shocks happen, it's quite often the over-expensive stocks that correct the most, because they were puffed up. So, the buying stops and fundamentals reassert themselves.

The quality bias helps as well. The only certainty in investing is that not everything will work, but in our experience, your prospect of recovering value when things go wrong is much higher if you have a decent business.

Historically, the trust has tended to perform better than the market in times of short-term stress. In March 2021 when Covid happened or in March 2022 when the war in Ukraine broke out, the NAV tended to be much more resilient than the broader peer group.

Performance has been good since launch, but 2023 has been a challenging year for Odyssean. Why?

We didn't have as many positive catalysts coming through. We had one investment that generated very strong returns, but that wasn’t enough to compensate for things that didn't work.

I think it was a mixture of a couple of factors. We had many stocks that experienced trading difficulties. They typically were more cyclical companies and they suffered from supply chain disruptions. We believe that was just a temporary issue.

Also, historically we've benefited quite a lot from mergers and acquisitions (M&A), but most of those that happened in the small-cap space towards the end of 2023 were not in sectors we tend to invest in.

Is M&A part of your strategy or a byproduct of your strategy?

It's a byproduct of the way we invest. We always want to have a potential M&A exit as an underpin for valuation, because if the stock market fails to re-rate a company over a long period, there's the optionality of somebody else buying that company. That allows you to close the gap from share price to fair value.

But we don't go into a stock thinking it's an obvious takeout candidate. Quite often, when these companies transform, they become growth stocks again and can trade at significant premiums to take-out valuations.

What has been your best performer over the past 12 months?

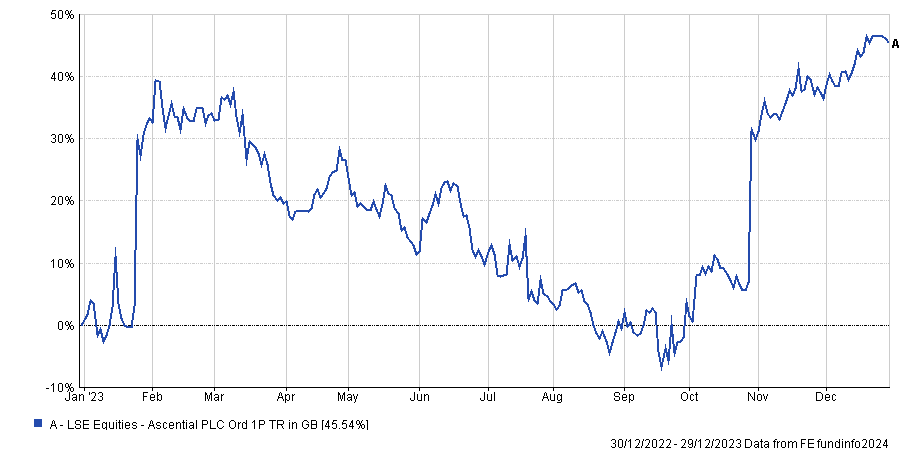

Ascential was our best performing stock. It is as a B2B media company that we invested in at the end of 2022.

Our investment thesis was that it was a high quality collection of media assets and events businesses. The company was hitting its forecast, but the shares de-rated by more than 50% over the previous 18 months for a number of reasons. We felt the company was trading on a very substantial discount to the valuation of each of its three divisions. In early 2023, the company announced it was going to sell one of its divisions and float another one on Nasdaq. The shares started to perform very well from that point.

Performance of stock in 2023

Source: FE Analytics

We think there's more to go with that stock. The remaining business unit is an event business and we feel the shares are trading below intrinsic value.

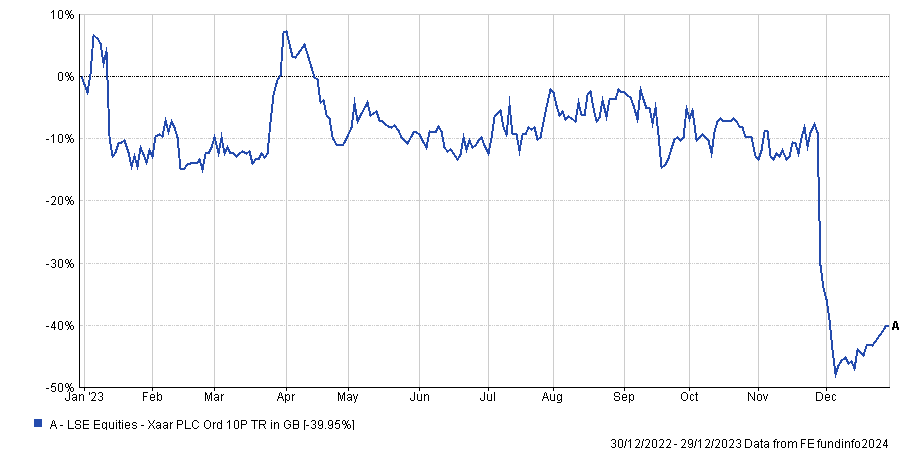

And the worst performer?

It’s a company called Xaar, which is a niche print technology business. It has been a recovery situation in the portfolio for the past four years.

The company had a profit warning at the end of November because of delays in its end customer product launch schedules.

Actually, the company exceeded expectations for 2023, but highlighted that 2024 would likely be a flat year because of the difficulties its customers are seeing. The shares de-rated significantly off the back of that.

Performance of stock in 2023

Source: FE Analytics

UK equities, especially small- and mid-caps, have been cheap and unloved for many years. What is your view on this situation?

The US stock market has done so well, especially the ‘Magnificent Seven’, and a lot of money is crowded into global equities, so that people have almost forgotten about the benefits of diversification.

If I look back over my career, I can remember the time when Vodafone used to be 11% of the FTSE 100 and when Nokia was one of the biggest companies in the world. The fact that both companies have been really poor investments over the past 20 years shows the benefits of diversification. I think there is a reallocation of capital coming, but it's very difficult to tell when.

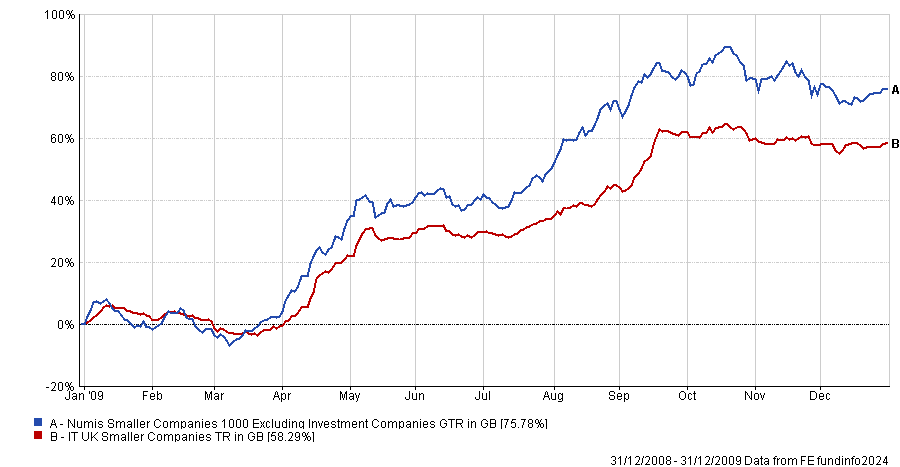

The excitement I have about small-caps is due to liquidity. It is quite poor in small-caps and that’s not helpful when the market doesn't want them. But when the market does want small-caps, you tend to see quite sharp re-ratings in a very short amount of time. Back in 2009, UK small-caps delivered 32% in the second quarter and 35% in the third quarter. So, when it moves, I suspect it will move quickly.

Performance of sector and index in 2009

Source: FE Analytics

We always get asked what the catalysts are and when the recovery is going to happen. It's human nature because they’ve been waiting for such a long time. People almost want to see the first 10% of the market go up before they start allocating.

We are seeing a lot of interest and everybody can see the opportunity, but we're not at the tipping point yet where people are prepared to commit.

What do you do outside of fund management?

I spend time with my family: lodger, taxi driver, head cook and bottle washer.