Investment companies are notoriously cheap, with more than 30% currently trading at double-digit discounts, as a recent study showed.

Yet there is no single headwind that has caused this phenomenon, and no silver bullet that will get discounts back to more normal levels, according to QuotedData analyst David Johnson.

A combination of factors are weighing down on the industry as a whole, including changes in investor behaviour, higher interest rates and cost disclosure rules.

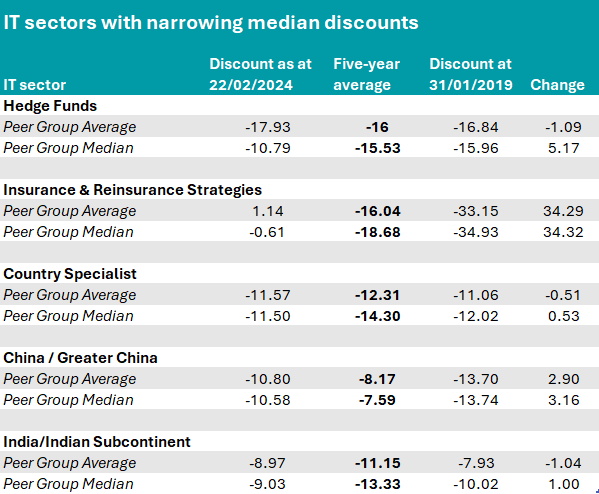

Discounts over the past five years have been widening “virtually across the board”, he said, with only a few sectors bucking the trend – namely India, China, country specialists, hedge funds and insurance. The latter has had the greatest re-appreciation over the past five years, as shown in the table below.

Source: QuotedData

Source: QuotedData

Below, Johnson identified five trends that are responsible for the discount epidemic.

Investors’ behaviour and risk attitudes

Rising global interest rates have led to a huge shake-up in investor behaviour and this can also be seen in the trust world. For example, higher yields on bonds and interest rates on cash deposits have diverted money that might otherwise have been invested in trusts, explained the analyst.

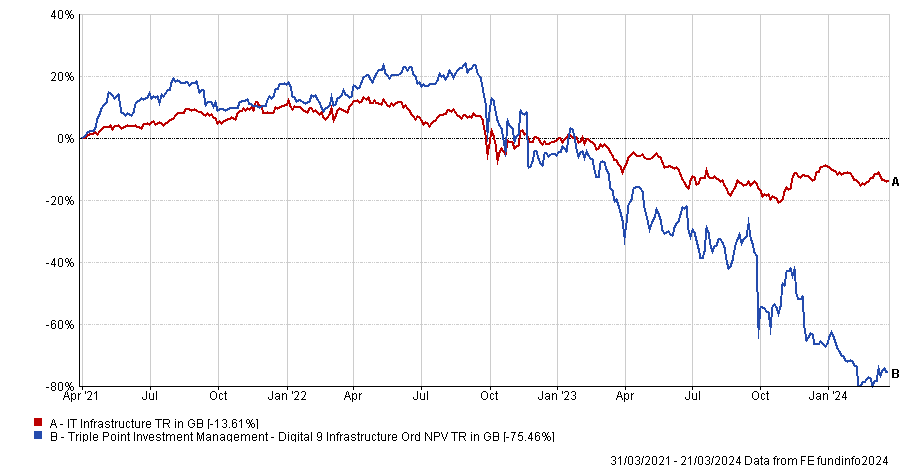

“The biggest impact that the sell-off in risk assets has had is the greater scrutiny around unlisted assets, with rising rates leading to increased uncertainty around the sector, and thus wider rates,” he said. “It has also placed pressure on indebted trusts, with Digital 9 Infrastructure being one such example.”

The trust is in managed wind down after facing a period of heightened uncertainty and share price volatility.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Consolidation in the wealth management industry

There has been a wave of consolidation in the UK wealth management industry, historically a major buyer of investment trusts, and the surviving players preside over much larger pools of assets than before.

The most notable example was Rathbones, the largest single holder of trusts with £6.5bn invested, according to the Association of Investment Companies. It acquired Investec last year, ballooning its books to £100bn. Another more recent case is Waverton’s merger with London & Capital.

“This can be problematic for their investment trust exposure,” Johnson explained. “At these sizes, mammoth asset managers encounter more difficulties in utilising investment trusts because these vehicles have smaller market caps and sometimes liquidity issues.”

Passive investing

The rise of passive investing has shaken the traditional asset management industry, but the quakes have hit investment trusts particularly hard.

Retail investors looking for a more user-friendly investing experience have flocked to exchange-traded funds (ETFs), which are also cheaper. ETFs don’t have the complexities of discounts, which adds to their appeal.

“Passive investments added competition in the retail space, with investors being given ever-increasing choice, as well as a greater number of simpler investments to buy,” Johnson said.

Concentration

Global performance has been highly concentrated in recent years, with US mega-cap technology leading the way and a newly emerged group of stocks, the so-called Magnificent Seven, spurring the US market almost single-handedly.

“This unfortunately means that regions such as the UK and Europe have not produced competitive returns when compared to other investment products available, reducing their demand,” said the analyst.

This has not been a headwind for all trusts, however. Some have been able to take advantage of it, one example being JPMorgan Global Growth and Income – a £2.6bn portfolio which has been able to issue shares and currently trades on a 0.82% premium.

With a FE fundinfo Crown rating of five, the strategy is managed by FE Alpha Managers Timothy Woodhouse and Helge Skibeli, flanked by Rajesh Tanna.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Fee disclosure rules

Current regulations on cost disclosure treat trusts the same way as open-ended funds, which, has been argued, results in trusts looking more expensive than they actually are.

In fact, because they are traded instruments, their share price already reflects the market’s assessment of their financials, including fees – but the regulation requires them to disclose their fees “on top”, with the result that a significant portion of the UK’s investor base no longer invests in the sector or is divesting.

“The issue around fee disclosures has hindered the competitiveness of investment trusts, especially as asset management consolidation and the rise of ETFs has increased the volume of low-cost investment opportunities,” Johnson concluded.