Findlay Park Partners started out in 1998 as a US small- and mid-cap specialist but shifted to an all-cap approach in 2011, predicting correctly that large-caps, which were looking comparatively cheap, would outperform. Now the London-based firm is moving back down the capitalisation spectrum, back to its roots and, essentially, back in time.

Once again, the firm is finding more compelling opportunities in US mid-caps, which is why chief investment officer Anthony Kingsley, a fan of the 1985 ‘Back to the Future’ movie, put a DeLorean time machine car on every member of the investment team’s desk in January.

The car symbolises “Findlay Park 3.0” and a return to the firm’s roots as a mid-cap specialist. “Back to the future is where we’re going,” he declared.

“We believe that the market environment has changed dramatically as interest rates have normalised and as America is re-industrialising,” Kingsley continued. The era of “free money”, low rates, quantitative easing and a “huge amount of stimulus” causing markets to compound at a higher rate is over and we are in a “different world”.

These changes should create opportunities for companies with market capitalisations between $3bn and $50bn as the US equity market broadens out from underneath the leadership of the ‘Magnificent Seven’.

Rose Beale, responsible investment lead, said the mid-cap space is where Findlay Park is finding “fairly undiscovered” companies with “great compounding potential”.

The $11bn Findlay Park American fund returned 27% last year in US dollar terms, pipping the mighty S&P 500 index to the post, as the chart below shows. In a year when the ‘Magnificent Seven’ led the way, most of Findlay Park’s outperformance was generated away from mega-cap tech stocks.

Performance of fund vs S&P 500 and sector in 2023 in US dollar terms

Source: FE Analytics

Furthermore, during the past five years, 75% of the fund’s performance came from outside of the Magnificent Seven, Kingsley said. The fund does own three of the seven – Microsoft and Nvidia are top 10 holdings and Alphabet is also in the fund.

Strong performers last year included TopBuild, a mid-cap insulation company; Intuit, which provides software to help Americans complete their taxes; and Martin Marietta, which supplies building materials for infrastructure and property.

Intuit is benefitting from the growth in online tax returns. Its premium-priced service, TurboTax Live, connects customers with a tax adviser 24/7. Meanwhile, its QuickBooks accounting software is the dominant product in a small market. Intuit has recurring, predictable revenues that can compound in the high teens.

For TopBuild, insulation is “such a quick win” on environmental grounds, Beale said. “It’s about making the most of the energy we have and keeping it in buildings.” TopBuild is the largest player in a fragmented market.

Companies that provide a vital service or product that is a small part of the overall cost tend to have pricing power, Kingsley said. Insulation and tax returns are a small part of the building cost or a person’s household budget but they are critically important.

Findlay Park looks for high quality, durable businesses delivering a good compound rate of return. It focuses on downside risk and environmental, social and governance (ESG) analysis is a key part of that. “Our starting point is how much are we going to lose if we get it wrong,” said Kingsley.

Rigorous ESG analysis led Findlay Park to walk away from a royalty and streaming company in the mining sector. The most important mine for the company’s revenues was in an area in Panama that was contested on environmental and legal grounds, near a region where threatened species were living. Findlay Park spoke to the management team about these concerns, who were “very complacent and quite dismissive”, Beale said.

Based on the management team’s tone, approach, and their failure to see this mine as a significant risk, “we decided to park a huge body of work that had been done and look for other opportunities,” she explained. A year later, the issues Findlay Park had identified materialised and operations at the mine in question were stopped.

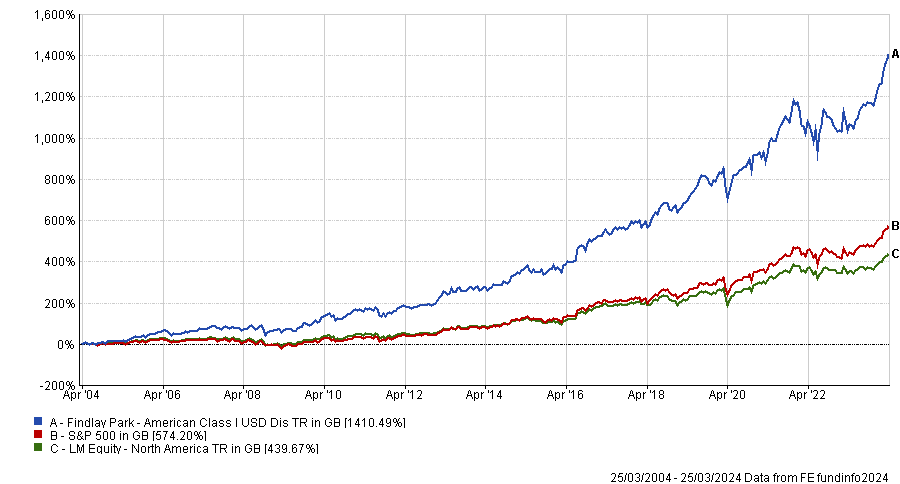

Performance of fund vs S&P 500 and sector over 20yrs in sterling

Source: FE Analytics