Commodities surged and momentum stocks outpaced the rest of the market by a significant margin during the first quarter of 2024, analysis by Trustnet shows.

Kristina Hooper, chief global market strategist at Invesco, said: “In short, this was overall a ‘risk on’ quarter as markets largely overlooked disappointing data and hawkish talk from central bankers, despite some initial negative reactions.

“Markets are discounting what they anticipate will happen this year – that disinflation in Western developed economies will continue and that their central banks will start cutting rates. Markets are also discounting a soft and brief slowdown for the global economy, followed by a re-acceleration.”

Below, we look at how the past three months have played out from multiple points of view, finding that the momentum trade remains in full swing, the stock rally is showing signs of broadening out and the price of commodities is on the rise again.

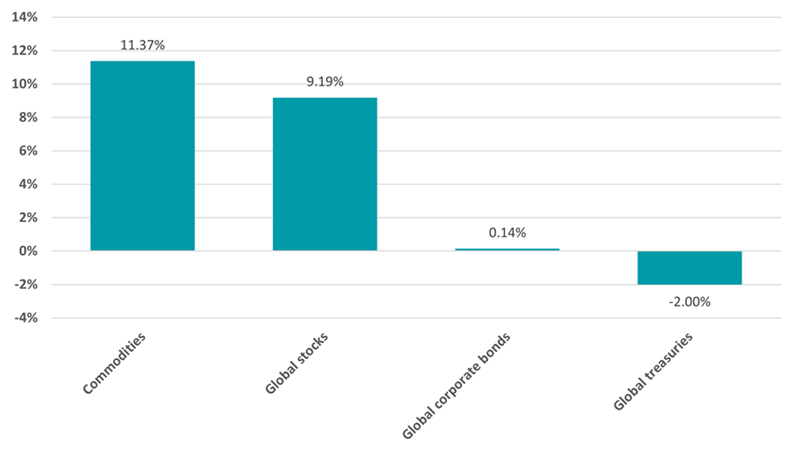

Performance of asset classes in Q1 2024

Source: FinXL. Total return in sterling between 1 Jan and 31 Mar 2024.

Commodities have been the strongest performing area of the market over the past three months, reflecting worries that inflation might be stickier than hoped. As we will see later, there was a broad rise in commodity prices over the quarter but the standout performer was cocoa with a rise of almost 150%.

John Plassard, senior investment specialist at Mirabaud Group, explained: “Adverse weather and tree disease in West Africa, which produces about two-thirds of the world's cocoa, has decimated output in Ivory Coast and Ghana, the world's two largest cocoa bean producers. El Niño brought heavy rains in December, leading to crop damage and the spread of black pod disease. Subsequent extreme heat, aging cocoa trees, and illegal mining further reduced production.”

Strong gains were also made in equity markets in 2024’s opening quarter as investors continued to bet that the global economy will avoid a ‘hard landing’, inflation will remain under control and central banks will soon have room to start cutting interest rates.

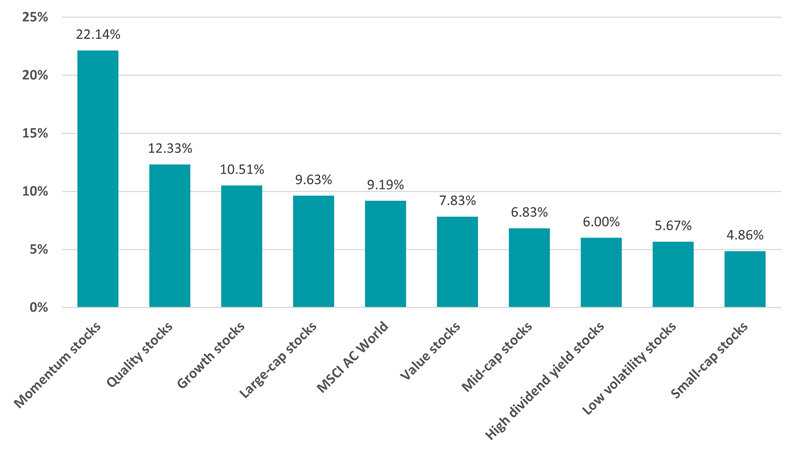

Performance of investment factors in Q1 2024

Source: FinXL. Total return in sterling between 1 Jan and 31 Mar 2024.

Turning to investment factors, the momentum style – or buying stocks with high recent returns and selling those with poor performance to capitalise on continuing market trends – was the clear winner. The MSCI ACWI Momentum index rose 22.1% over the three-month period, compared with 9.2% from the broad MSCI AC World index.

However, history suggests that markets where momentum outperforms strongly are often followed by a pullback. Last month, JP Morgan strategist Marko Kolanovic warned: “Extreme crowding into momentum has steadily risen along with equity investor positioning.

“Momentum is a dynamic stock factor that changes its exposure depending on macroeconomic and fundamental conditions. As such, it often becomes crowded, followed by an inevitable and often sharp correction (i.e. momentum crash).”

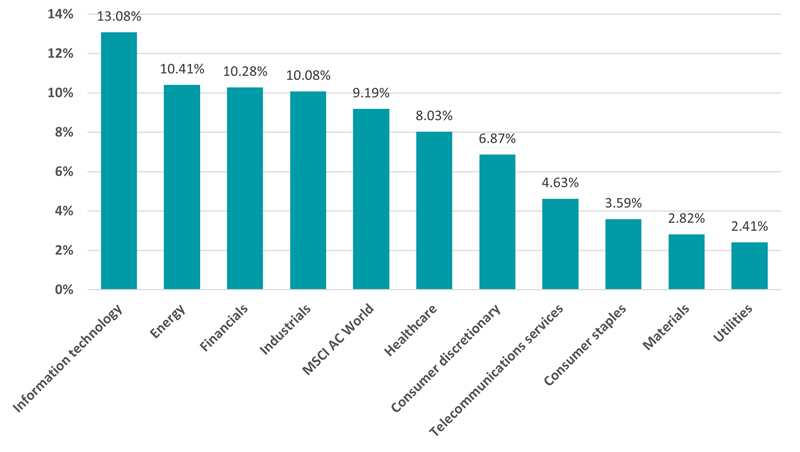

Performance of global sectors in Q1 2024

Source: FinXL. Total return in sterling between 1 Jan and 31 Mar 2024.

This momentum trade meant information technology was the best performing global stock sector as enthusiasm around generative artificial intelligence (AI) continues to grow and investors pile into the so-called 'Magnificent Seven' stocks, many of which are linked to AI.

These stocks have become some of the largest constituents of the MSCI ACWI Momentum index; indeed, Nvidia, Meta and Amazon are its three biggest weightings while Microsoft and Alphabet are in the top 10.

But the latest edition of the Bank of America Global Fund Manager Survey showed that being long the Magnificent Seven is seen as the most crowded trade in the market at present, while investors are split on whether or not AI stocks are in a bubble.

One interesting point is tech’s lead was not as secure as it once was with energy, financials and industrials stocks close behind with first-quarter gains in excess of 10%.

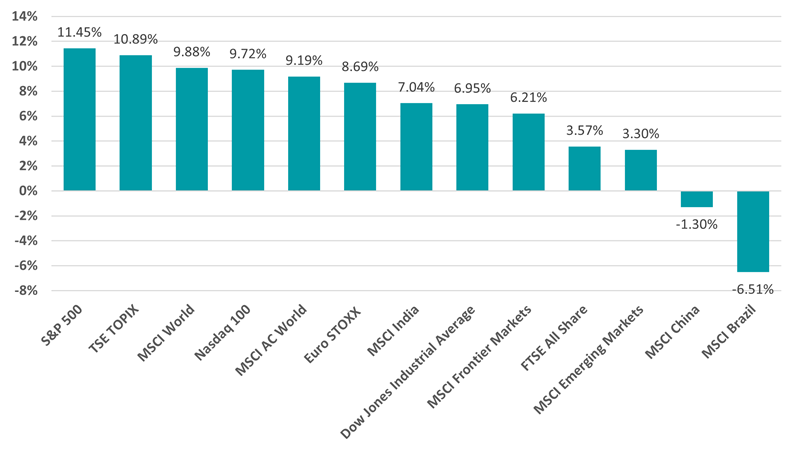

Performance of geographies in Q1 2024

Source: FinXL. Total return in sterling between 1 Jan and 31 Mar 2024.

US stocks led the market in the first quarter, aided in part by the momentum trade and the fact that the outperforming Magnificent Seven are all based in the country.

But the S&P 500 beat the tech-focused Nasdaq over the period as the rally broadened out from a narrow group of stocks, including more cyclical areas. This makes sense as investors become more confident that the Federal Reserve has pulled off a soft, or even no, landing in its battle to curb inflation.

Elsewhere, Japan continues to perform on the back of solid corporate earnings and as investors warm to its shareholder-friendly reforms. But the UK continues to lag its developed market peers while emerging markets like China and Brazil struggle.

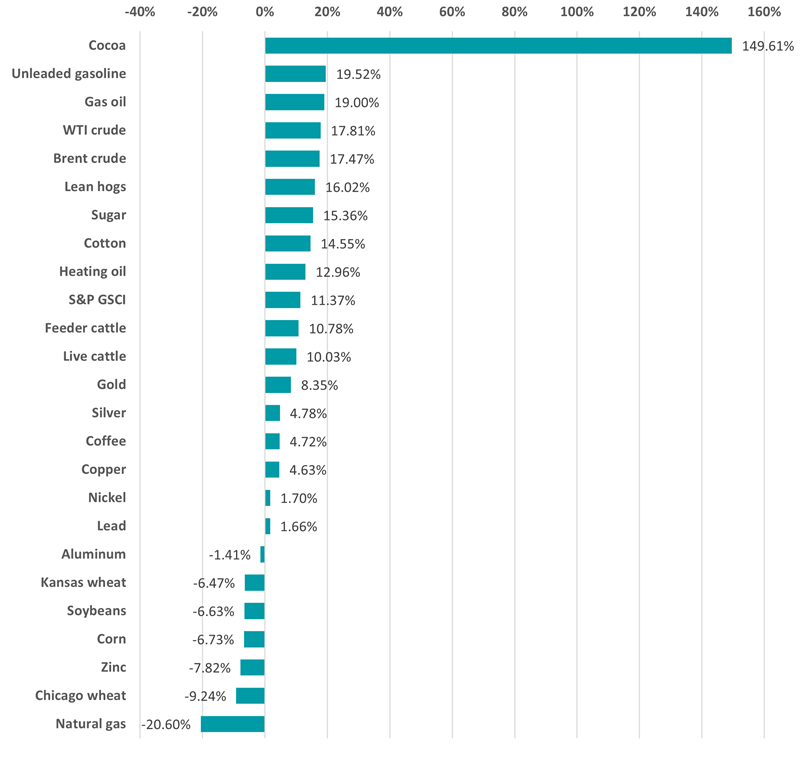

Performance of commodities in Q1 2024

Source: FinXL. Total return in sterling between 1 Jan and 31 Mar 2024.

As noted above, commodities had a strong quarter with the clear winner being cocoa. However, energy and food commodities also rose over period.

Warren Patterson, head of commodities strategy at ING, said: “The oil market appears to have finally broken out of the fairly narrow range we have seen it trading in since the beginning of the year. Brent has spent much of the year trading within a $75-85/barrel range. However, recently the market managed to break above $85/barrel.

“The rollover of voluntary supply cuts from OPEC+ into the second quarter of 2024, Ukrainian attacks on Russian refining capacity more recently and lingering disruptions to oil flows through the Red Sea have provided a boost to the market.”

Gold also had a strong quarter, reaching a record high. The yellow metal tends to rally when interest rates are being cut and was supported by comments from Federal Reserve chair Jerome Powell, who said inflation data was “along the lines of what [the Fed] would like to see” for interest rates to come down.