Hargreaves Lansdown has called on investors to check the US tech exposure in their portfolios and consider diversifying into other parts of the market.

The growth investing style – especially US large-cap tech stocks – has dominated the market for most of the past decade thanks to ultra-low interest rates after the 2008 financial crisis and, more recently, the rise of artificial intelligence.

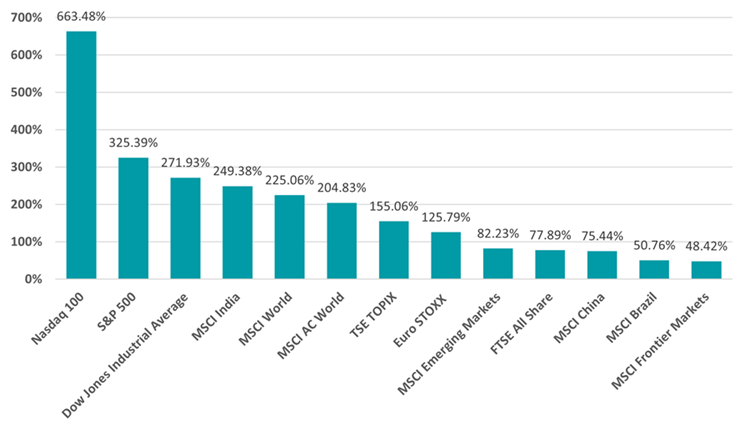

This is made clear in the chart below, which shows that the Nasdaq – the US index with a high concentration of technology companies – has made a total return more than three times greater than the broader MSCI AC World index over the past 10 years.

Performance of indices over 10yrs

Source: FinXL

Over the same period, the MSCI AC World Growth index has gained 282.6% while its value counterpart is up just 134.3%.

However, Hargreaves Lansdown has cautioned investors against blindly pouring more money into these stocks despite their strong returns in 2024 as well.

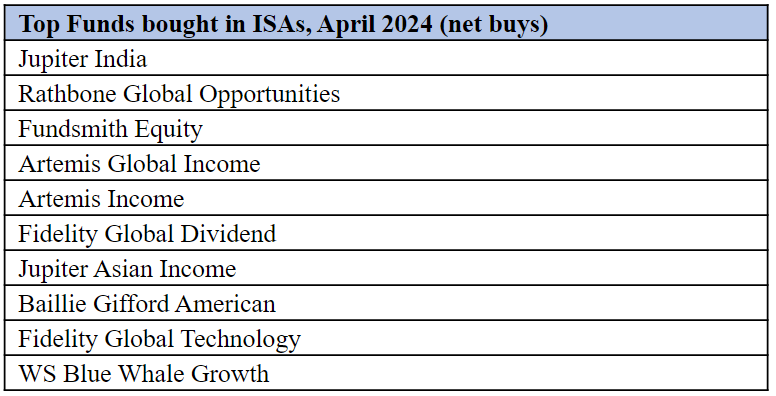

The platform’s fund sales figures for April show tech funds remain popular with its investors, as Fidelity Global Technology appears in the most-bought funds among ISA, Junior ISA and Lifetime ISA clients.

In addition, growth funds such as Rathbone Global Opportunities, Fundsmith Equity, Baillie Gifford American and WS Blue Whale Growth – which have US tech giants among their top holdings – are found in the most-bought funds.

Source: Hargreaves Lansdown

Emma Wall, head of investment analysis and research at Hargreaves Lansdown, said: “While it is good to see some diversification in these selections, there is still a definite growth-bias and tech funds feature across all the different ISA wrappers.

“This is an area of the market that has driven returns in the past 18 months. Momentum is often a key determiner of retail fund flows, but we would encourage investors to be mindful not to double down on portfolio biases.

“Check your existing exposure to the US and tech; it has likely grown as those markets and sectors have outperformed and rather than adding new money to these allocations, look to diversify by geography, sector or asset class depending on your investment goals, horizon and attitude to risk.”

A similar trend can be seen among Fidelity International’s Personal Investing clients, as Fidelity Global Technology and L&G Global Technology Index are among the platform’s most-bought funds in April.

Ed Monk, associate director at Fidelity International, also struck a cautious note about investors backing large-cap US tech stocks in the expectation that all of them will continue to outperform.

“The top seven companies, known as the Magnificent Seven, have been driving much of the gains for the year – but returns from the group are not evenly spread between them, with losses being registered by Tesla and Apple so far in 2024,” he said.