Hawksmoor Investment Management has placed a bold bet on the UK stock market, with its cautious Vanbrugh multi-asset fund having 20% in UK equities and the allocation rising to nearer 30% for the higher risk Global Opportunities portfolio.

Chief investment officer Ben Conway said UK equities are so cheap that they have a high probability of returning 10% or more per annum for the next decade, with even greater gains from mid and small-caps.

Valuations are Hawksmoor’s “north star” because, over five years and longer, they are a reliable indicator of returns, he explained. UK equities are “tremendously attractive from a valuation standpoint”.

The broad UK equity market is currently valued at 10x price to earnings. Historical data from Liberum dating back to 1927 shows that when valuations are below 10x, returns in the subsequent three to 10 years average about 14% per annum. From starting valuations of 10-15x, returns tend to be about 9-10% over the subsequent three to 10 years, Conway said.

Under-valuations are even more pronounced in UK small and mid-caps and therefore the return potential is commensurately greater.

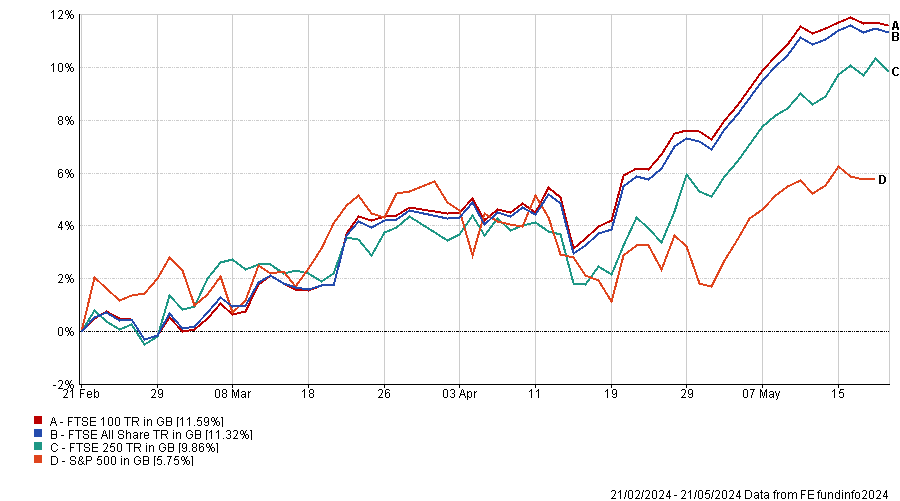

UK equities have begun to rally, outperforming the S&P 500 over three months. Conway thinks the UK stock market is just getting started and said recent gains were driven by takeover activity, with cheap companies attracting attention from private equity and international trade buyers.

UK equities vs S&P 500 over 3 months

Source: FE Analytics

The UK stock market has been cheap for years but it recently entered the national conversation and is featuring in headlines and in politicians’ speeches, such as chancellor Jeremy Hunt’s Mansion House compact.

The chancellor’s request that pension funds disclose their UK equity allocations is the first step towards putting pressure on them to invest more in their home market, Conway said, “but there’s a fabulous investment reason to do so because it’s so cheap”.

Labour’s Financing Growth document, which sets out the party’s plans for the financial services industry, is “a UK equity fund manager’s dream”, he continued. It cites the undervaluation of the UK stock market and low levels of investment by pension funds in their home market as problems. It also states that vibrant capital markets are a necessary precondition for economic growth.

“UK equities are at the centre of policy to the extent that I don’t think they’ve ever been before,” he concluded, which is part of a “magic formula” driving the current rally.

Hawksmoor’s fund picks

For private investors who want to increase their exposure to the UK, Conway’s first suggestion would be a FTSE 250 tracker to capture a broad spectrum of opportunities in the mid-cap space.

Choosing active managers increases the odds of both outperforming and underperforming the market and requires an immense amount of research and monitoring, he said, hence passive investing may be more appropriate for retail investors if they do not possess the time or resources to research active managers.

For those who prefer active managers, Conway thinks investment companies are well-suited to retail investors because they have an independent board of directors looking out for shareholders’ interests who can hold the investment managers to account and replace them if a key person leaves.

He has high conviction in Aberforth Smaller Companies and Odyssean.

The Aberforth trust is managed by a long-established team of value investors based in Edinburgh and has a track record of accessing the cheapest parts of the small-cap universe, he said. Its largest holdings are publisher Wilmington and derivatives dealer CMC Markets.

Conway described Odyssean Capital’s Stuart Widdowson as a “wonderful investor” with an impressive five-year track record. He invests in high-quality, undervalued businesses, several of whom have received takeover bids. For instance, he holds XP Power, which has just rejected a bid from Advanced Energy Industries.

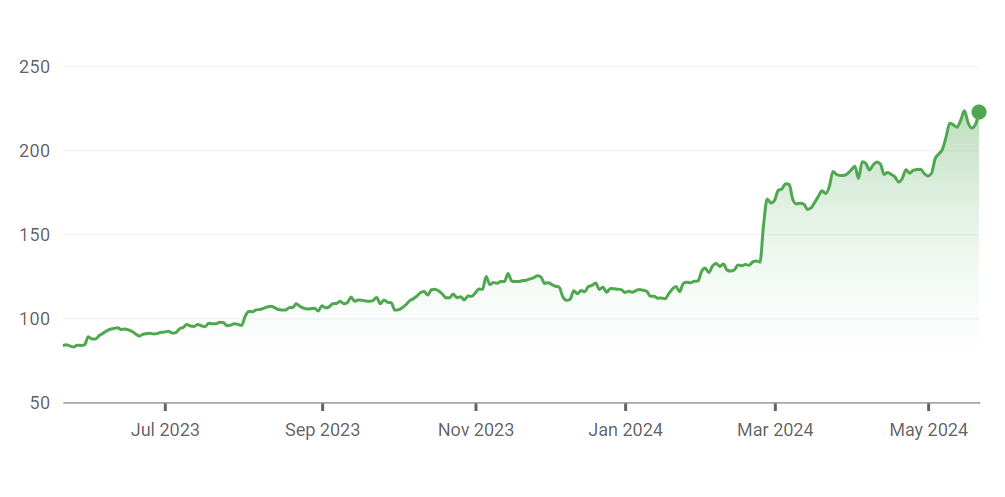

Performance of trusts vs sector over 5yrs

Source: FE Analytics

For large-cap exposure, FE fundinfo Alpha Manager Ed Legget, who runs Artemis UK Select, is “very talented”. The £2.2bn flagship fund has delivered top-quartile performance over one, three and five years and its largest holdings are Barclays, NatWest, 3i Group, Rolls-Royce and Shell.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics