US equities have been a shoot-the-lights-out growth market for the past 18 months or so, but for investors seeking diversification away from passive trackers’ heavy weightings to mega-cap technology names, value funds that focus on cheaper stocks in different sectors are a viable alternative.

Rosanna Burcheri, manager of the £633m Fidelity American Special Situations fund, has built a portfolio with a high active share that looks markedly different to the S&P 500. Her largest holdings are Alphabet, Wells Fargo, FedEx, Elevance Health and Salesforce, and her highest conviction position is Disney.

She believes that the US equity market offers a huge pool of opportunities, with many stocks delivering a return on invested cash flow above 25% (including Aon, Lowe’s and McKesson) and earnings per share growth for 2024-25 above 25% (such as Intel and Baker Hughes).

“The message is that there is life beyond the Magnificent Seven and there is an amazing amount of companies you can invest in,” she said.

Burcheri won the 2023 FE fundinfo Alpha Manager of the Year award for US equities, which was based on performance in 2022 – a year of rapidly rising interest rates that penalised growth stocks and played more to her fund’s strengths. She was nominated for the award again this year, having delivered strong risk-adjusted returns throughout her career.

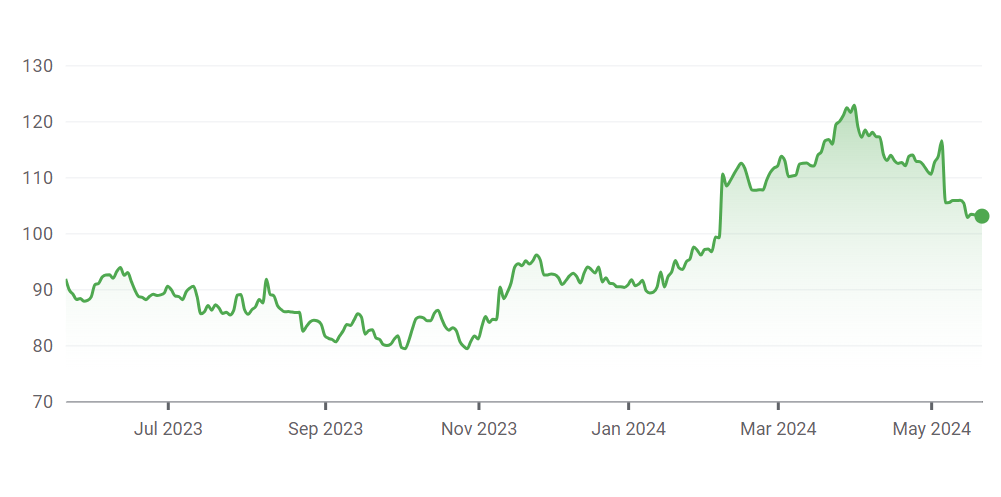

Performance of fund vs sector over 3yrs

Source: FE Analytics

Below, Burcheri tells Trustnet about her investment process, her best and worst-performing holdings and why she has such high conviction in Disney.

What is your investment process?

The Fidelity American Special Situations fund is an unconstrained, concentrated US value strategy with a high active share, where the fund’s sector exposures are purely a result of a bottom-up investment process.

As co-portfolio managers, Ashish Bhardwaj and I invest in great companies that are mispriced, either because they are out of favour or their intrinsic asset value is misunderstood. Bottom-up stock picking is the core of our approach and is the main driver of risk and return, alongside our value-biased investment style.

We aim to identify quality businesses supported by long-term tailwinds that will make them stronger and more successful in the future.

We place a strong emphasis on asset-backed valuations and margin of safety and look for businesses trading below their intrinsic value or close to it. We also mitigate downside risk by avoiding dying industries.

Why should investors pick your fund?

It is a core value strategy providing exposure to the US market. American exceptionalism, supported by a strong industrial policy, deep capital markets and an innovative economy, creates an attractive stock picking pool.

As a core value strategy with a mid-cap bias and high active share, the fund is differentiated from today’s more growth-biased US equity indices. An allocation to the Fidelity American Special Situations fund alongside an exchange-traded fund should enable investors to gain optimal exposure to the US market.

What’s your highest conviction stock pick?

The Walt Disney Company has an unrivalled catalogue of intellectual property (Disney characters, Pixar, Avatar, etc.) which drives the media business as well as parks, resorts and consumer products.

It is delivering on a media business model change to improve the long-term outcome for shareholders.

Disney’s experiences segment is a highly valuable tangible asset that has grown to more than $25bn of revenue annually and represents over 55% of the company’s enterprise value. The business is guiding towards a long runway to grow the size and scope of the parks business over time.

Disney also has intangible assets with franchise intellectual property in the form of Disney characters, Pixar characters and Marvel characters. In 2019 the company launched Disney+ to bring its storytelling around these characters directly to consumers for the first time.

The company’s direct to consumer business (DTC) has been in investment mode for the past five years and is a long-term area of growth in the entertainment industry. In its most recent quarterly results, Disney reported profitability in the DTC business for the first time, driven by cost controls and revenue growth.

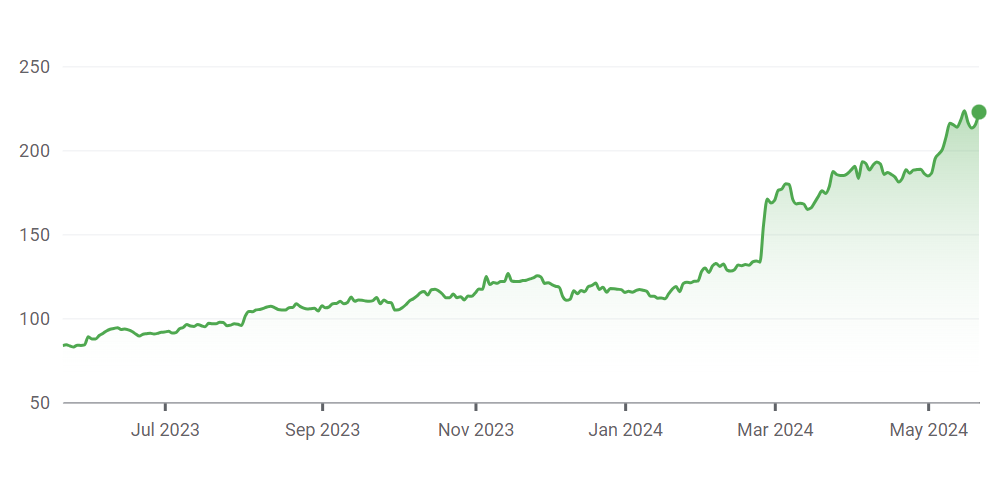

Performance of Disney shares over 1yr

Source: Google Finance

What was your best call over the past year?

The fund’s 1% position in Constellation Energy (0.9 percentage points overweight relative to the S&P 500 Index) was a strong contributor to relative performance. Over the year to 31 March 2024, Constellation Energy returned 136.5%.

The company produces carbon-free energy via nuclear, hydro, wind and solar energy solutions. Within its nuclear power generation business, the implementation of US Nuclear Production Tax Credits (PTC) via the Inflation Reduction Act (in place until 2032) provides a floor to power sales prices, supporting future revenue generation.

In addition to this, the business is well positioned to sign large contracts with hyper-scalers building artificial intelligence data centres, to provide low carbon energy.

Performance of Constellation Energy shares over 1yr

Source: Google Finance

Which stock has been your worst investment recently?

The fund’s 2.9% off-benchmark position in Cheniere Energy detracted from relative performance. In the 12 months to 31 March 2024, Cheniere returned 2.3%.

The company is a liquified natural gas (LNG) business, owning and operating LNG terminals and pipelines. Its revenue generation comes from fixed-term export contracts over 20 years, with 95% of the business covered by these contracts. As a result, the business has a high-quality, repeatable revenue stream today, and expansion projects at its LNG terminals will deliver revenue growth in the future.

The energy sector was weak during the year to 31 March, alongside energy commodity prices. Despite 95% of Cheniere’s revenue being covered by fixed-term contracts and not at risk of energy prices, performance returns were broadly aligned with the rest of the energy sector.

The value of Cheniere’s 20-year contracts ending 2028 are $203 per share. As at end March 2024 its share price was $112.3, providing a strong margin of safety.

What do you enjoy doing outside of fund management?

I enjoy spending time with my family and I head to the ski slopes when I can.