The oldest investment trust on the market, F&C Investment Trust still packs a punch. In its latest half-year results, released last week, it reported a net asset value (NAV) total return of 13.2% to 30 June 2024, above the 12% from its benchmark, the FTSE All-World Index.

But perhaps more impressive is the longer-term track record, with the strategy not falling below the first quartile of performance against the IT Global sector over 10, three and one year; and defending a second-quartile position over five.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Yet, manager Paul Niven wishes he could have done more. Below, he admits he underestimated the market and says that in hindsight, he could have added more debt to enhance returns. He also defends the fee structure of the trust and shares his views on US valuations, which led him to change the style exposure to the region.

How do you invest?

Our objective is to deliver growth in both capital and income over the longer term. We seek to add value from both top-down and bottom-up decisions by making investments in a range of actively managed, focused strategies.

We select complementary investment strategies within Columbia Threadneedle investments as well as sourcing the best managers in the market, with the aim of adding returns and reducing risk both within listed equities and private equity.

How do all these components blend into one strategy?

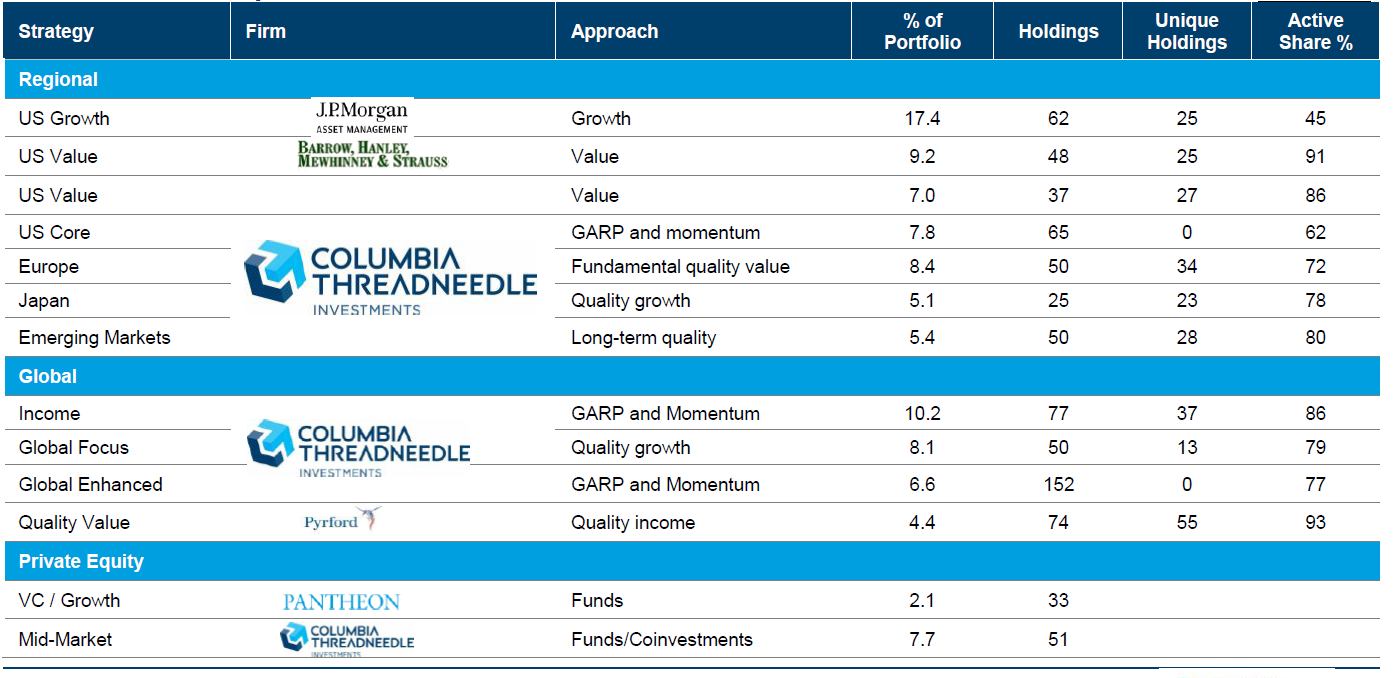

I make decisions about the overall asset composition of the trust and gearing.

Within that, we have managers such as JP Morgan, who run a US growth strategy for us investing in large-caps, and Barrow Hanley, a Dallas-based manager who runs a large-cap value strategy, and so on.

The idea is that by blending more components, we get diversified exposure to investment approaches or styles when we think that there is a positive tailwind in the long run.

F&C’s exposure to investment styles

Source: Columbia Threadneedle Investments, as of 30 June 2024

What is the fund more exposed to today and how does that change over time?

I’ll take the US as an example, where exposure is quite balanced between growth and value, but that wasn’t (and isn’t) always the case. Previously, we have had quite a significant deviation.

Optically, US large-cap growth stocks look relatively richly priced at present, but they are benefiting from a relatively positive, cyclical and perhaps structural backdrop as well.

I am not intending to make a significant stylistic shift in the coming months, as I am not buying into the view that there is going to be a very sustained performance of value relative to growth at this point.

Do all these managers increase costs?

We are paid in terms of the market capitalisation of the company with a graduated fee. The larger the company becomes, the lower the tiering becomes in terms of the fee rates. Our ability to use internal Columbia Threadneedle strategies as part of the solution makes the overall trust more cost-effective [with an ongoing charge figure of 0.49%] than if you select purely third-party funds.

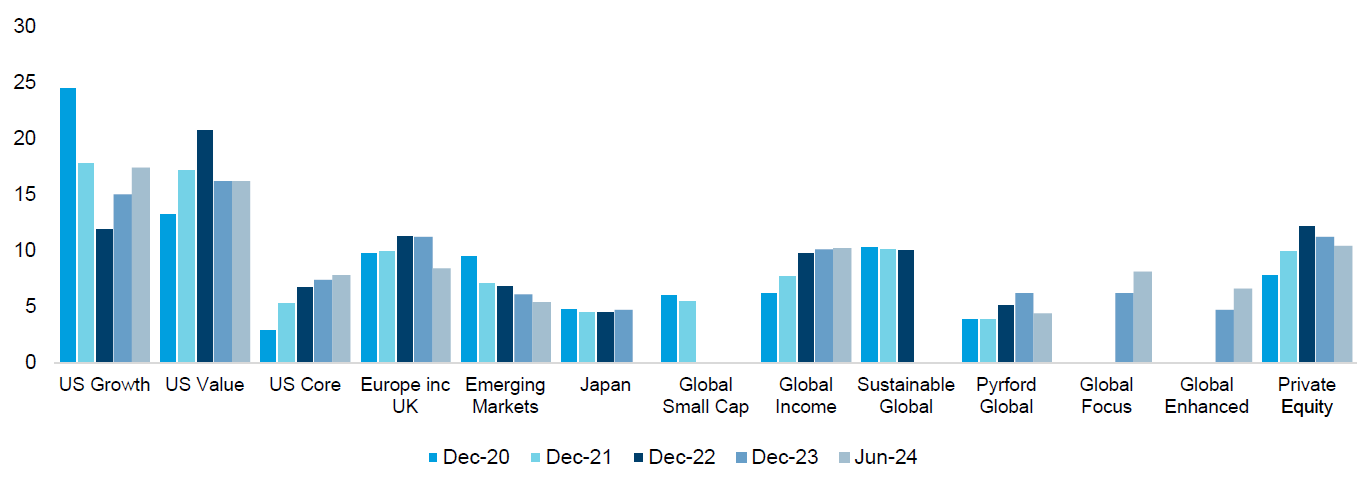

F&C’s strategic allocation

Source: Columbia Threadneedle Investments, as of 30 June 2024

What were your best calls of the past 18 months?

One of the best decisions for shareholders was to restructure our debt, which we’ve been doing in the past few years. We borrowed to the year 2061 at a fixed, blended rate of 2.4%. If we can earn a return on our portfolio above 2.4% over the next number of decades, that will prove additive to shareholder returns.

As for stocks, we’re underweight the Magnificent Seven, but other stocks adjacent to the tech theme have done well, including Broadcom, TSMC and Qualcomm. And in healthcare, Eli Lilly.

And the worst?

In 2023, our private equity exposure declined by 1.7% against a market return of 15.1%, so having a 10%-11% exposure to private equity has been a relatively material detractor from our returns. But we think about that in the context of the long-term opportunity, which tends to be accretive in the long run.

Also, markets have been considerably stronger than I would have assumed 18 months ago, partly because the downturn in macro and earnings terms did not transpire. Given the returns we’ve seen, we should have been more bullish and could have been more geared. So that was a bit of a missed opportunity.

What level of gearing do you have now and what did you wish it was?

At the end of the first half of the year, gearing was 8.2% – that's down a bit from the start-of-the-year level when it was 9.9%. I'm very comfortable with where gearing is now which is positively geared but within a sensible range.

If we had been more aggressive, we would have delivered a better return. With the benefit of hindsight, we would have had more Nvidia and we would have been higher geared.

What do you do outside of fund management?

I enjoy tennis, playing and watching.