Donald Trump celebrated his 100th day in office by calling it one of the most successful starts of any administration in American history. The data does not agree.

The US president’s whipsawing approach to tariffs, his trade war with China and his continued feud with the Federal Reserve mean investors are reconsidering their asset allocations.

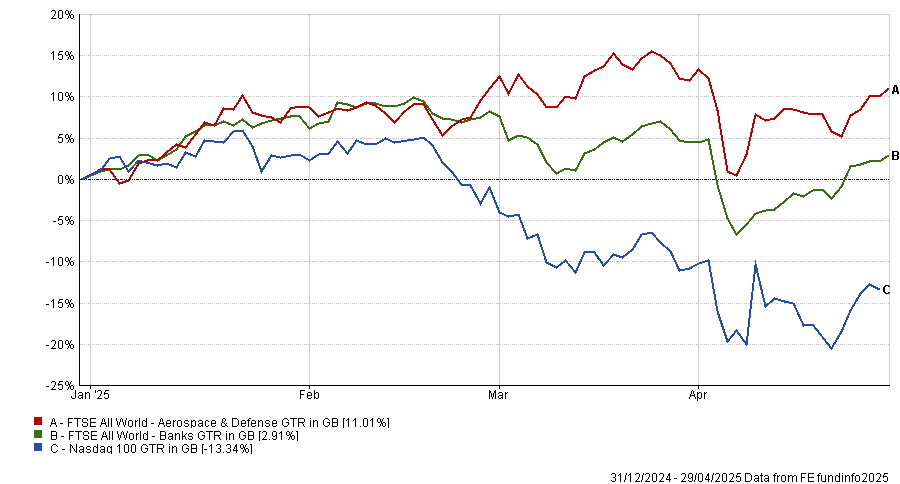

One of the biggest losers from the market rotation has been tech, with the Nasdaq down 13.3% year-to-date. However, sectors such as defence and financials are benefitting from recent volatility, surging 11.3% and 2.3%, respectively.

Performance of indices year-to-date

Source: FE Analytics

Steve Clayton, head of equity funds at Hargreaves Lansdown, said: “People are taking a classic recessionary approach. They are selling anything economically sensitive, buying what they think is most secure, putting their tinfoil hats on and crawling under the kitchen table.”

James Thomson, manager of the Rathbones Global Opportunities fund, added: “The reality is that it’s been a pretty dreadful start to stock markets and we are not out of the woods yet.”

Below, Thomson and Clayton explain why defence stocks might disappoint in the short term and why banks could struggle in a recession.

Banks are ‘like a cartoon character running off a cliff’

Financial stocks have delivered exceptional returns in recent years and are “entirely different beasts” compared to the global financial crisis, with better balance sheets and stronger financial buffers, Clayton said.

If a soft landing occurs in the US this year, banks may benefit as investors breathe a sigh of relief and spend their stored-up capital.

However, if a recession occurs then he believes investors should be wary of investing in banks. “Banks right now are like cartoon characters; they have run off the cliff but not looked down yet,” he said.

Financials are highly economically sensitive, with bank earnings supported by the steepening of the yield curve in the past few years, Clayton explained. In a recession, bank debts would rise and interest rates would start to come down, eating into profit margins.

History supports this, with banks' earnings often being hit most harshly in the event of an economic downturn, which could be dangerous in today's volatile market, he argued.

Thomson added that despite a “calamity in banks” being unlikely, they are still “off the menu” for him. “I do not like businesses where the main driver of their success is outside of their control, whether that is the price of oil or the rate cycle,” he explained.

Defence spending might go ‘down the drain’

The world has become a more dangerous place, Clayton said, as China and Russia are proving increasingly territorially assertive, defence spending is climbing and geopolitical tension is reaching a breaking point.

While governments are increasing their defence budgets and this has pushed the share prices of defence stocks such as Rheinmetall upwards, it will not be plain sailing moving forward, he said.

It takes years of development before companies can push new weapons down the production line, limiting how fast defence companies can put new investment into practice. “The market will be frustrated when all this political energy does not immediately manifest,” he concluded.

He also thinks some of the defence budgets could be wasted. “It’s not easy to raise your defence expenditure without pouring it down the drain,” he said.

Thomson agreed that defence commitments will take years to manifest. For example, new orders that come in during 2026 will not impact revenues until 2027, according to conversations he has had with defence businesses. “That’s quite a long gestation period for a very short-term market,” he said.

However, Thomson believes the defence story still has room to run. The rise in stock prices increases the visibility of these revenue streams, allowing investors to have a more genuinely long-term view of these companies.

“Before this year, we had confidence in defence companies for maybe five years. Now, I have confidence for more than 10 years,” he noted.

As a result, Thomson has added two new defence stocks to his portfolio in the past year, including European aerospace business Thales, his first defence holdings in 20 years.

Is tech still on the menu?

Finally, Thomson turned to technology. The Magnificent Seven (Amazon, Nvidia, Microsoft, Tesla, Alphabet, Meta and Apple) surged in value during the past couple of years because they “provided growth in a world where it was hard to find”, he explained.

That dynamic has been turned on its head this year. “When you get a major inflexion point in markets, investors will almost always do the same thing. Sell their winners,” Thomson said.

He argued that this is denting expectations in the Magnificent Seven and “evaporating” the perception they are the only place to find growth. The difference in growth between mega-cap tech and the rest of the market is becoming “wafer thin”.

As a result, Thomson is underweight tech, with 12% of his portfolio in the sector compared to 23.6% for the MSCI World index. “Tech is still on the menu and I think it’s a great story but it is not as clean as it used to be,” he concluded.