Although the UK is a rich hunting ground for dividend-paying stocks, wealth managers have also found a wide range of international equity strategies for clients who want to receive regular income payouts.

From dividend-rich areas such as Europe, to tougher tasks like emerging markets and the US, Kamal Warraich, head of fund selection at Canaccord Wealth, and Edward Allen, private client investment director at Tyndall Investment Management, explain below how they are gaining exposure to dividend income in every market.

Europe: Attractive valuations and higher dividends

Valuations are relatively modest in Europe at present, which means that yields are higher than their historical average, Warraich said.

He holds BlackRock Continental European Income, which he said has a compelling long-term track record of strong risk-adjusted returns and dividend growth, as well as an attractive yield (currently 3.4%). The managers, Stuart Brown and Brian Hall, have a total return mindset.

Meanwhile, Polar Capital European (ex UK) Income is Allen’s go-to fund on the continent. The manager, Nick Davis, has an absolute return approach and aims to deliver returns of about 10% with just under half coming from dividends. The fund has yielded 4% over the past 12 months.

Davis has a good investment discipline, Allen continued. “He is looking for relatively dull European companies that are growing in single digits.”

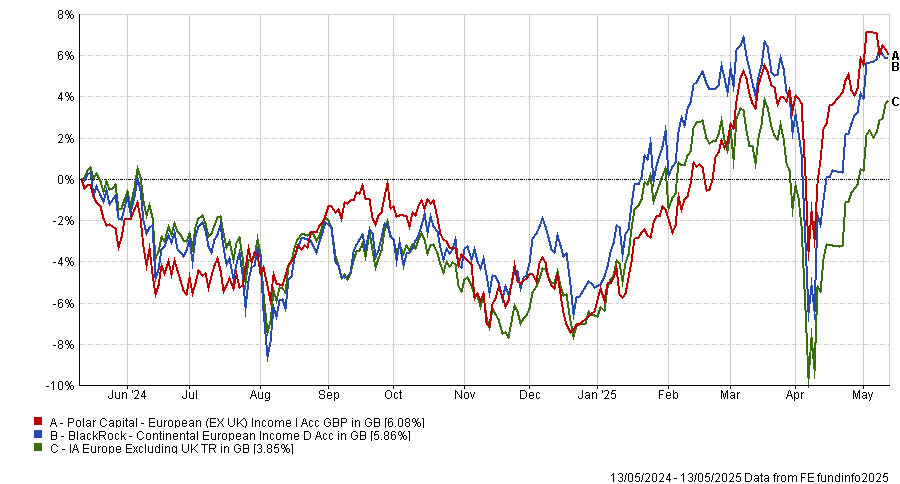

Both funds have had a strong 12 months, pulling ahead of their benchmarks and sector, although their total returns are below the sector average over three and five years.

Performance of funds vs sector over 1yr

Source: FE Analytics

Japan: Land of the rising payout

Japanese corporate governance reform has led to large amounts of cash being released to shareholders, Allen said, making the country an increasingly attractive space for income-seeking investors.

Many companies within the Morant Wright Nippon Yield fund still have about 50% net cash so the process of returning cash to shareholders still has a fair runway ahead, he added.

The fund’s dividend yield is 3.3% but Morant Wright expects to achieve returns of around 10% from a combination of share buybacks, regular dividends and special dividends – even without the need for any earnings growth on top, Allen explained. He has held the fund for two and a half years.

Canaccord Wealth uses the Baillie Gifford Japanese Income Growth fund, which has a core total return approach and is managed by Matt Brett and Karen See.

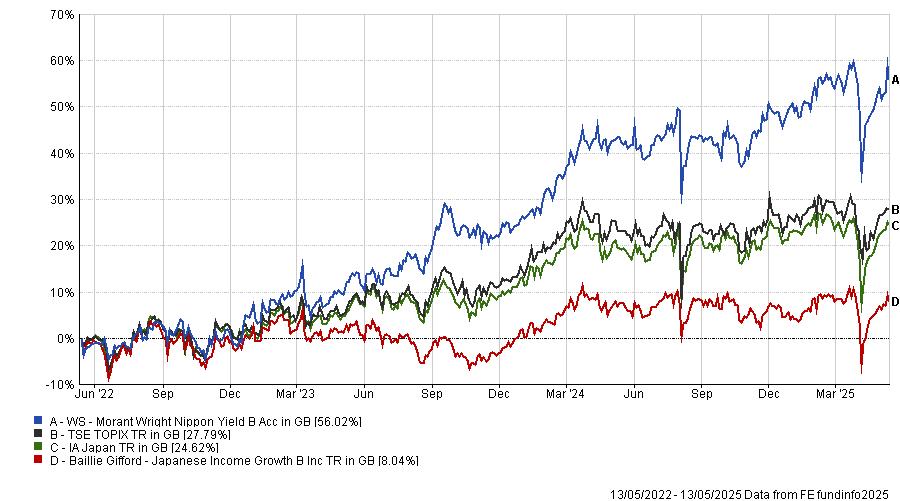

Performance of funds vs sector over 3yrs

Source: FE Analytics

Asia Pacific, emerging and frontier markets

Tyndall and Canaccord both invest in the JPMorgan Global Emerging Markets Income trust, which pays a 4% yield and has a quality bias.

Allen has followed portfolio manager Austin Forey for years and said he is adept at leveraging JPMorgan Asset Management’s pool of analysts. “They’ve got a very systematic way of looking at those relatively few quality companies in each market that are going to be good stewards of capital,” he added.

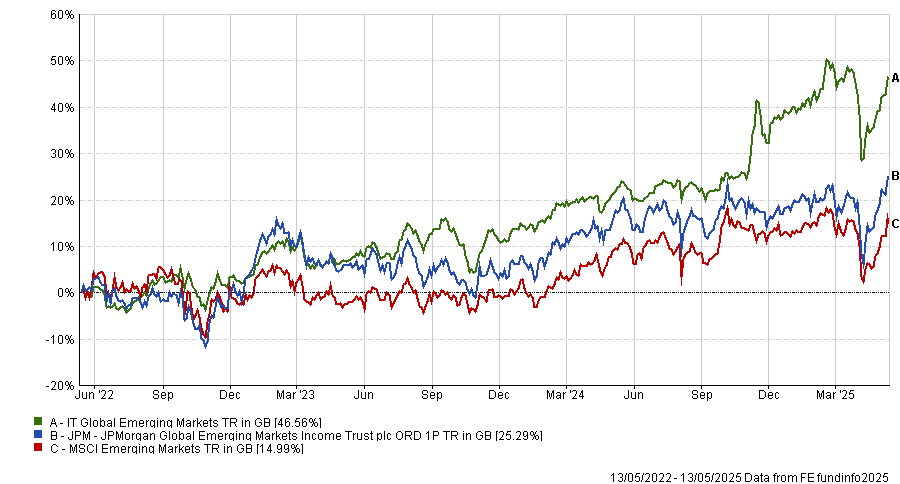

Performance of trust vs sector and benchmark over 3yrs

Source: FE Analytics

Tyndall also uses the BlackRock Frontiers trust for total returns, income and diversification. It isn’t explicitly an income strategy but local investors in several of its markets are dividend-driven, meaning there are some pockets of the portfolio where income is more important than others.

As such, the trust tends to deliver a decent income stream, Allen said – although that waxes and wanes depending on how much the trust allocates to higher income markets. The fund has paid a 4% yield over the past 12 months.

In Asia, Canaccord Wealth holds the Prusik Asian Equity Income fund, which has a contrarian value style and is managed by Tom Naughton. The $721m fund aims to outperform the MSCI AC Asia Pacific Ex Japan Gross Return index (USD) by 5-10% annually whilst growing its dividend.

Prusik’s investment process combines qualitative and quantitative elements, such as screening for companies that pay a high dividend and are best positioned to sustain and grow their payouts.

Naughton looks for companies that are attractively valued but which also boast exceptional franchises, annuity-like cashflows and pricing power.

US equity income

In the US, Tyndall uses the SPDR S&P US Dividend Aristocrats UCITS ETF for equity income, which pays a 2.3% yield.

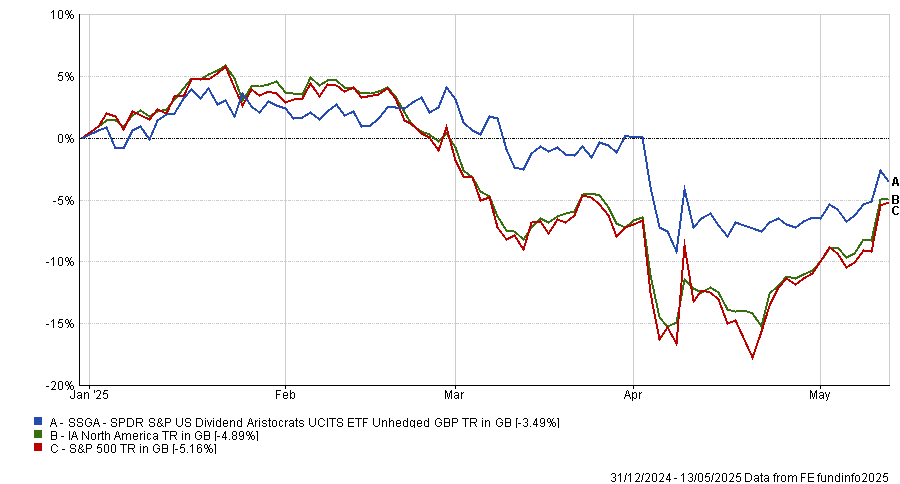

“It does track a relatively high-quality set of stocks and that – excuse the pun – pays dividends when the markets are in trouble. So this year, the fund was a real outperformer around ‘Liberation Day’,” Allen said.

“We’ve got a US underweight anyway but I don’t really look to the US when it comes to yield. Dividends are not much to write home about.”

Performance of ETF vs S&P 500 and sector YTD

Source: FE Analytics

Warraich said the US equity market is a hard one in which to outperform, where “the odds are stacked against you” for active managers. He uses the Fidelity US Quality Income UCITS ETF, which is a cheap way to access the stock market and achieve a robust dividend stream with a focus on quality.