UK equities are a core component of many portfolios designed by wealth managers for clients who want a regular income and the home market’s total return prospects look promising in light of low valuations and a more lenient tariff regime compared to other regions.

Kamal Warraich, head of fund selection at Canaccord Wealth, said: “The UK still looks relatively cheap, so on a forward multiple it looks like a great place to pick up some income. And here’s the kicker: you’re reaching levels of near all-time highs in terms of dividend growth.

“Share buybacks as well are giving you an extra boost – share counts are coming down, which is accretive to your net asset value. And at the same time, you’re getting the higher yield with dividend growth.”

There is an element of cyclicality to the FTSE 100 because of its commodity exposure, so dividends can be prone to volatility, he pointed out. Yet “in aggregate, the index has been a really good fishing ground for income investors of late”.

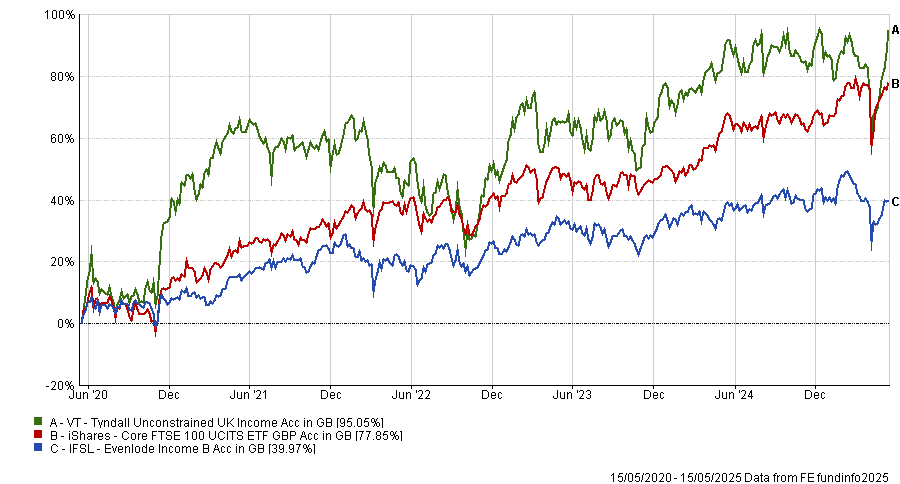

Tracking the FTSE 100 index is not a bad place to start given it yields 3.5%, said Edward Allen, private client investment director at Tyndall Investment Management. He uses the iShares Core FTSE 100 UCITS ETF alongside Evenlode Income and the VT Tyndall Unconstrained UK Income fund, managed by his colleague Simon Murphy.

Performance of funds over 5yrs

Source: FE Analytics

Murphy focuses on growing the income stream of his fund, which has a 4.5% historic yield. The litmus test of his approach was Covid-19 and indeed, the fund’s yield fell far less than the broader market in 2020, Allen said.

This is an all-cap fund with a concentrated portfolio of 30-40 names and a mid-cap bias, thereby providing diversification away from the largest income-paying stocks.

Evenlode Income pays a lower yield of 2.9% and sits in the IA UK All Companies sector. Its managers, Hugh Yarrow and Ben Peters, have a strict quality discipline and avoid banks and oil companies, thereby missing out on many of benchmark’s larger dividend payers, Allen explained.

“They don’t like things they can’t easily model,” he said. “They don’t want to be buffeted around by the market so they are happy to buy a lower income that they can see growing consistently over time.”

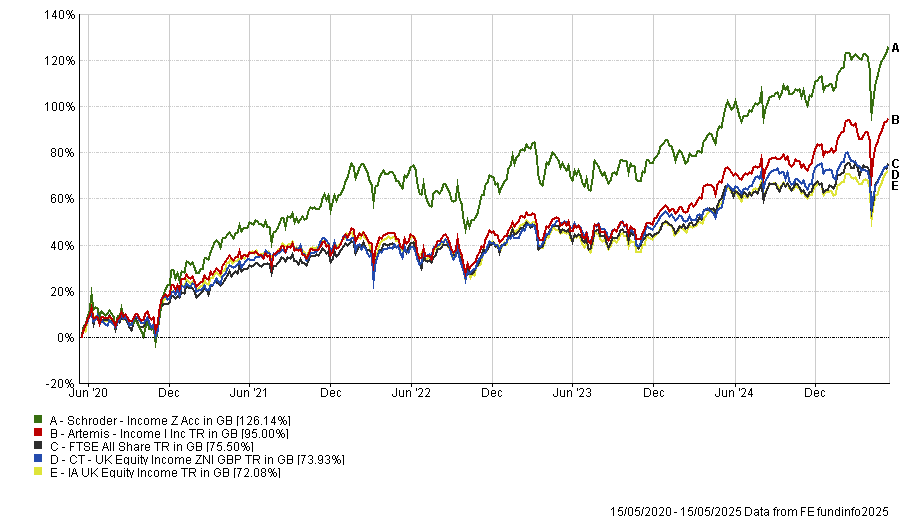

Canaccord Wealth uses a trio of UK equity income funds to mine the rich seam of dividend-paying domestic stocks: CT UK Equity Income, Artemis Income and Schroder Income.

Warraich said: “Those traditional, more value and contrarian-style income funds have produced excellent risk-adjusted returns over the past three to five years and they’ve given you a growing dividend to boot, so that’s been a really good story.”

All three funds have managers with a long tenure who are a “safe pair of hands”, he said. They have achieved their objectives over many years, providing stable, attractive income with “exceptional” dividend growth since inception.

Schroder Income has a 5% dividend, CT UK Equity Income has a 3.8% historic yield and Artemis Income’s is 3.4%.

Schroder Income and Artemis Income are amongst the five best-performing funds in the IA UK Equity Income sector on a total return basis for the year ending 15 May 2025 – a feat which Artemis also achieved over three and 10 years and Schroders attained over five years. Schroder Income was within its peer group’s top 10 over three and 10 years.

Performance of funds vs benchmark & sector over 5yrs

Source: FE Analytics

The teams have undergone a few changes in recent years. Richard Colwell, head of UK equities at Columbia Threadneedle Investments, retired in 2022 and was replaced on the £2.6bn CT UK Equity Income fund by Jeremy Smith.

Warraich described Smith as an experienced, deeply contrarian investor. “[He has] a lot of insights and comes out with some really interesting data points about markets.”

Meanwhile, Kevin Murphy, who launched the Schroder Income fund with Nick Kirrage, has joined his brother Dermot at Ben Whitmore’s boutique Brickwood Asset Management.

Warraich’s conviction in the fund was not shaken by Murphy’s departure, as Kirrage has a “brilliant mind” and is “one of the preeminent value investors of our modern times”.

Adrian Frost has managed the £5bn Artemis Income fund since 2002. He lost his co-manager and namesake, Adrian Gosden, to GAM in 2017 (Gosden moved to Jupiter Asset Management in 2023) but was joined by Nick Shenton in 2012 and Andy Marsh in 2018 and the trio pursue a team-based approach.

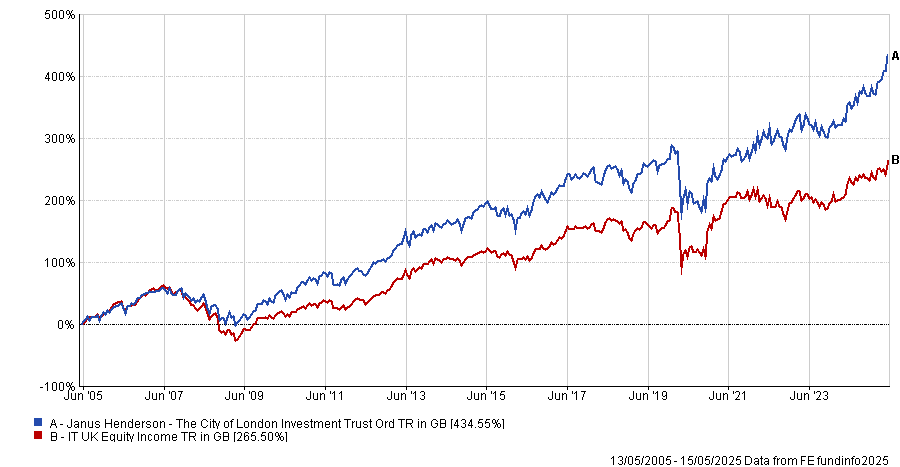

Moving beyond open-ended funds, investment trusts can add a lot of value to an income-generating mandate, according to CJ Cowan, a portfolio manager of the Quilter Investors Monthly Income portfolios.

Investment trusts are not compelled to pay out all the income they receive each year and can hang onto reserves, which enables them to maintain dividends even at times such as the Covid pandemic, when companies are cutting their payouts.

Cowan said the investment companies he holds, such as The City of London Investment Trust, cushioned his funds’ income stream during the pandemic.

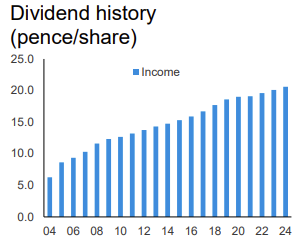

City of London’s dividend history over 20yrs

Source: The City of London Investment Trust’s 31 Mar 2025 factsheet, Janus Henderson Investors

City of London, which has been managed by Job Curtis since 1991, is an Association of Investment Companies ‘dividend hero’ with an unbroken 58-year track record of increasing its dividend.

Performance of trust vs sector over 20yrs

Source: FE Analytics

Bevan Blair, chief investment officer of One Four Nine Portfolio Management, also holds City of London. “While this trust has a good starting yield, currently 4.4%, it is the fact that the fund has grown its dividend year-on-year for the past 20 years which attracts us. Even through the pandemic, it was able to maintain the dividend,” he said.