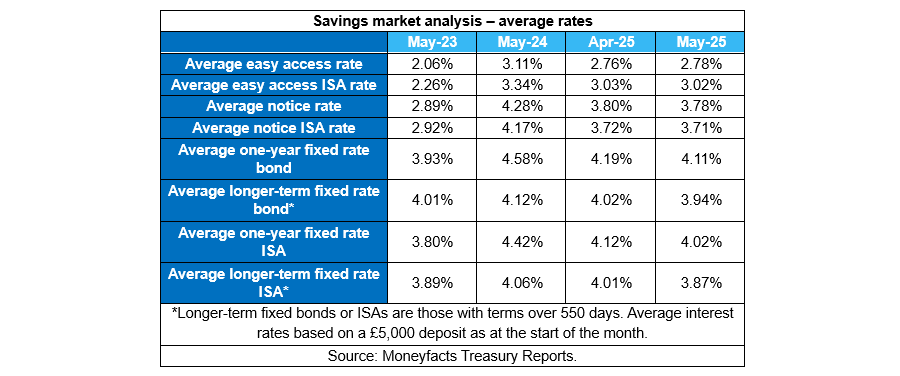

Fixed bond and cash ISA rates have dropped across the board as firms begin to price in future rate cuts, according to online comparison site Moneyfacts.

The average one-year fixed bond rate fell to 4.11%, its biggest month-on-month fall since October 2024, while longer-term fixed bonds fell to 3.94%, the biggest month-on-month fall since September 2024.

For those looking to shelter their cash in an ISA, the average one-year fixed bond rate fell to 4.02%, while those looking to put their money away for longer will now get an average payout of 3.87%. Both are the biggest falls in rates since the autumn of 2024.

The average easy-access ISA rate budged lower to 3.02%, while the average notice ISA rate fell to 3.71%, its lowest level for almost two years. The average notice rate also dropped to 3.78%, its lowest level since July 2023.

But there was some good news for savers, with the average easy access rate nudging higher to 2.78%.

Rachel Springall, finance expert at Moneyfacts, said: “Those savers looking for a flexible pot for their cash will find the average return on an easy-access account rose to 2.78%, but any calls for celebration are unlikely to last, due to the base rate cut.”

However, the emergence of challenger banks such as Spring, part of Paragon Bank, means the total number of providers has risen to new record highs.

“Savers looking to protect their hard-earned cash from tax may be pleased to see a widening in the pool of cash ISAs, where there are now 616 options,” she said.

Although there are more ISA account options, product choice overall fell month-on-month to 2,188 savings deals (including ISAs).

Overall, “savers will be disappointed to see all fixed rates fall across the spectrum month-on-month, which has not occurred for six months”, said Springall.

“The reduction in the average longer-term fixed bond and ISA rates are the most significant falls for more than six months and is a disheartening turn of events after they rose above 4% at the start of April.”

It “demonstrates the volatility in future rate expectations”, she said, with bond and cash rates expected to fall even further following this month’s Bank of England meeting, when the UK central bank cut rates to 4.25%, the second drop so far this year and the fourth in the past 12 months.

Savings markets have moved accordingly, said Springall, with the average one-year fixed bond rate down 0.47% year-on-year.

Despite the recent reduction in payouts, “fixed bonds and ISAs will still appeal to savers who want a guaranteed return on their investment”, she said.

There was a “mad dash” of providers improving rates towards the end of the tax year to lure in new customers, with rates falling back since, but Springall noted savers should still consider taking advantage of the ISA allowance despite any rate volatility.

“Cash ISAs will no doubt be popular as millions of people are expected to pay higher-rate tax at 40% this tax-year, which will see their £1,000 Personal Savings Allowance (PSA) effectively halve to £500 as a result. Savers must make every effort to review their pots and shop around for a better deal as providers work hard to entice new business.”