UK inflation has come in at 3.5% year-on-year in April, up from the 2.6% reported in March and reaching the highest level in over a year.

The jump was always on the cards due to the rise in energy and water bills, but the reading has exceeded forecasts by 2 basis points. With this, the UK's disinflation story “has gone down the drain”, according to Nicholas Hyett, investment manager at the Wealth Club.

The price of household services rose by 7% year-on-year, while water and sewerage costs alone were up 26.1% month-on-month.

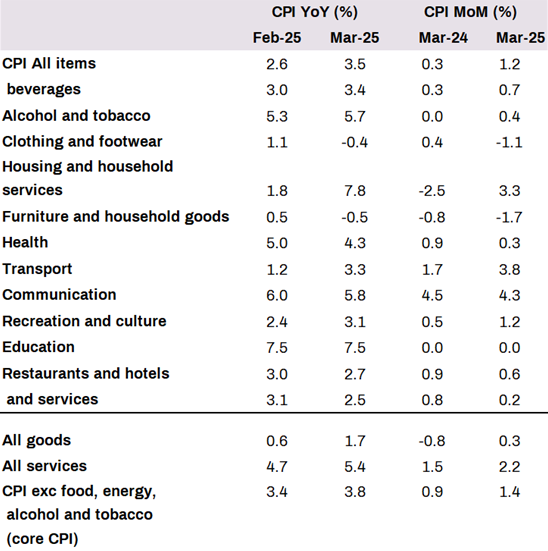

CPI Inflation by major component

Source: Office For National Statistics

“The spike could cause a bit of a stink at the Bank of England, which cut interest rates just a couple of weeks ago only to see inflation smash through the 2% target,” Hyett said.

“Two members of the MPC wanted to leave rates unchanged and may well feel vindicated by today's number.”

Higher core inflation (which strips out volatile food and fuel prices) will be “particularly concerning”, since this measure of domestically generated inflation should be easier for the Bank to influence.

Markets have now priced out any chance of a June rate cut and are only pricing in a 40% chance that rate setters will make a move in August.

However, the answer to the question of what happens next remains “difficult to fathom”, said Danni Hewson, AJ Bell head of financial analysis, as we still have to “wait and see how recent trade deals impact prices and whether Donald Trump can strike other agreements to prevent further disruption.”

To end on a positive note, Hewson noted how the strength of the pound “will help make our money go further when it comes to all the goods we import from around the world, and concerns about the global economy have suppressed the price of oil,” she concluded.

Britons should use perspective when approaching these figures, according to Myron Jobson, senior personal finance analyst at interactive investor.

“Everyone has an inflation rate that is unique to them, depending on their individual spending habits,” he said.

“It’s crucial to focus on maintaining financial resilience in uncertain times – whether by reviewing budgets, building up emergency savings, or managing debt – to better weather any bumps along the road ahead.”

Also, some of these factors might be temporary and only due to specific, policy-related factors, said Daniele Antonucci, chief investment officer at Brown Shipley’s Quintet Private Bank.

“First, the effect of the increase in Ofgem's household energy price cap is a one-off impact. Second, higher water bills contributed to a higher inflation rate – also a one-and-done, at least for now. Lastly, fiscal policy is playing a role as well: the increase in employer national insurance contributions is likely to have had an effect,” he said.

Despite the rise in inflation, Brown Shipley’s sterling equity portfolios have now increased exposure to UK equities – “a defensive play that's attractively valued versus global peers”, Antonucci explained.