Much has been written about the dominance of the US mega-cap stocks, particularly those in the technology sphere, but the reality is that investors have not had to look elsewhere for returns – and have been actively worse off if they have strayed, according to data from FE Analytics.

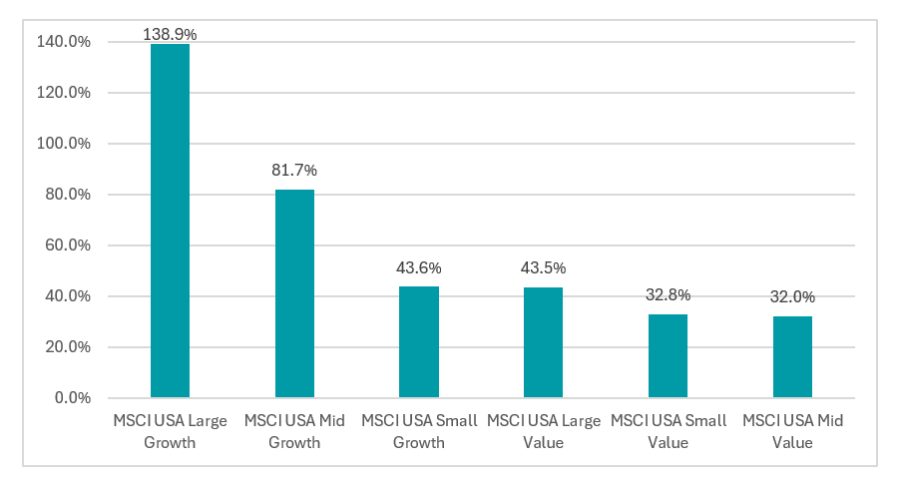

Companies such as the Magnificent Seven (Apple, Nvidia, Microsoft, Tesla, Amazon, Alphabet and Meta) have dominated the market and helped the MSCI USA Large Growth index surge 138.9% in the five years from the start of 2020 to today, outpacing its closest competitor (the MSCI US Mid Growth index) by more than 50 percentage points. By comparison the MSCI Large Value Index rose just 43.5%.

Growth also outperformed across all market capitalisations, as demonstrated by the chart below.

Performance of Indices since 2020

Source: FE Analytics

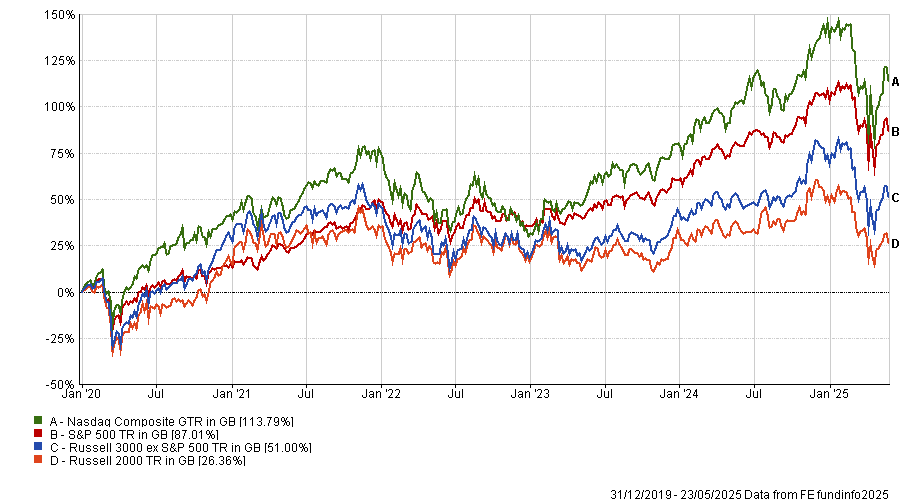

This trend of large-cap growth's outperformance continued when we examined market capitalisation. The S&P 500 is up by 76.3% since the start of 2020, outpacing the Russell 3000 ex S&P 500 (51%) and the Russell 2000 (26.4%).

The best market, however, has been the tech-heavy Nasdaq index, which made investors 113.8%, as the below chart shows.

Performance of sectors since 2020

Source: FE Analytics

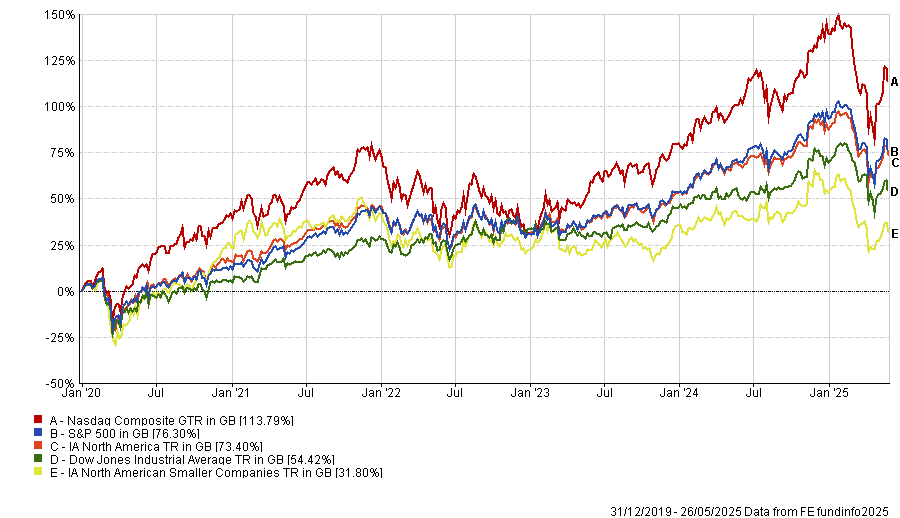

This environment has made it particularly difficult for active managers to outperform. There were no funds in the IA North American Smaller companies sector able to match the Nasdaq, while in the IA North America sector just nine active funds managed to deliver a result that beat this, although two were passive funds that tracked the index.

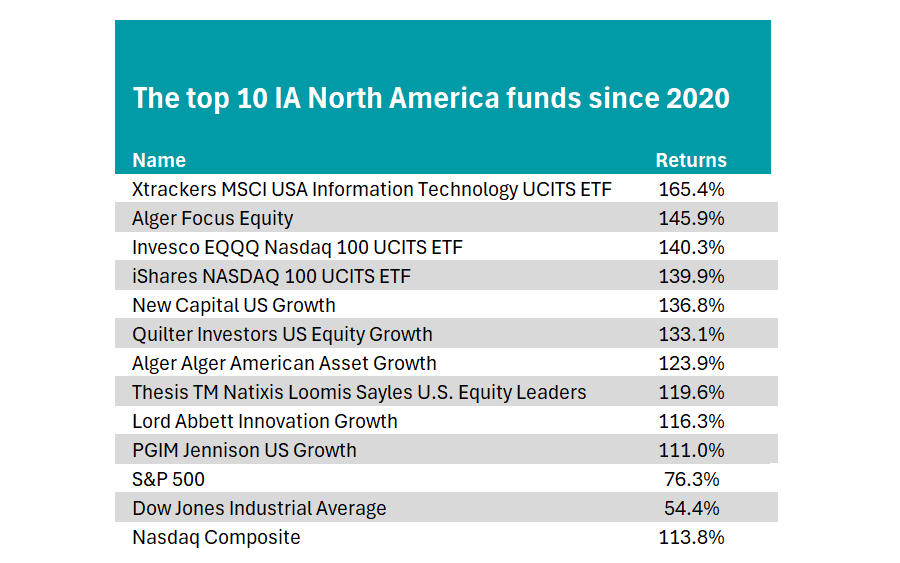

While the Xtrackers MSCI USA Information Technology UCITS ETF was the best-performing fund in the entire IA North American peer group during this period, up by 165.4%, Invesco EQQQ Nasdaq 100 UCITS ETF and iShares Nasdaq 100 UCITS ETF were up 140.3% and 139.9%, the third and fourth-best-performing funds in the market.

Performance of sectors vs indices since 2020

Source: FE Analytics

Looking at active funds, the average IA North American peer is up 73.5% over the past five years, trailing the S&P 500 by 3 percentage points. When compared with the tech-focused Nasdaq the results are worse, with a difference of almost 40 percentage points.

Gerrit Smit, FE fundinfo Alpha Manager of Stonehage Fleming Global Best Ideas Equity, argued now might be the time to invest in an active fund, however, as president Donald Trump’s aggressive approach to trade and tariffs is sending shockwaves through the US market, causing some managers to conclude there is a potential for a recession this year.

“Passive investors dump their holdings irrespective of the outlook or valuations, when stocks with the largest index weightings, e.g. the S&P 500, experience unnaturally high selling pressures", making it a compelling time for active management in the US, he suggested.

While few have succeeded in recent years, there are some that have beaten the Nasdaq index. Among the 10 best funds Below, the remaining seven funds among the 10 best performing IA North America portfolios all invest with an active manager and six beat the tech-heavy benchmark over the period.

Alger Focus Equity managed by FE fundinfo Alpha Managers Ankur Crawford and Patrick Kelly, has been the second best-performing strategy in the market from the start of 2020. The fund has a high allocation towards top-performing tech stocks, with five of the Magnificent Seven featured in its top 10 holdings.

Also managed by Crawford and Kelly the Alger American Asset Growth delivered a return of 112.3%.

The top 10 US funds since 2020

Source: FE Analytics

Alpha manager Aziz Hamzaogullari's $1.9bn Natixis Loomis Sayles US Equity Leaders fund delivered a return of 119% during this period, beating the Nasdaq. Earlier this year Hamzaogullari attributed this outperformance to holding six of the 'Magnificent Seven' as long-term allocations, whereas most competitors were attempting to tactically trade them.

Other actively managed funds within the top 10 included; New Capital US Growth, Quilter Investors US Equity Growth, Lord Abbett Innovation Growth and PGIM US Growth.

This is part of an ongoing series in which Trustnet examine different markets based on market capitalisation and investment style, as well as looking at the difference between active and passive funds, to determine what has been the best way to invest since 2020. Previously, we have looked at the UK, European, and global markets.