Passive investing has been the best way to invest in the US over the past decade and a half, as the market has been dominated by US mega-caps. Over 15 years, no funds have beaten the Nasdaq index, while just a third have topped the S&P 500.

But if investors want to look towards active management, the $553.9m Alger American Asset Growth fund could be a compelling choice.

It has been one of the most consistent performers in the IA North America sector, making top 10 returns in the peer group over one, three and 10 years. It sat in the top quartile over five years, in 21st place.

It has also been one of the most consistently outperforming funds in the sector, with seven years of top-quartile Sharpe ratios.

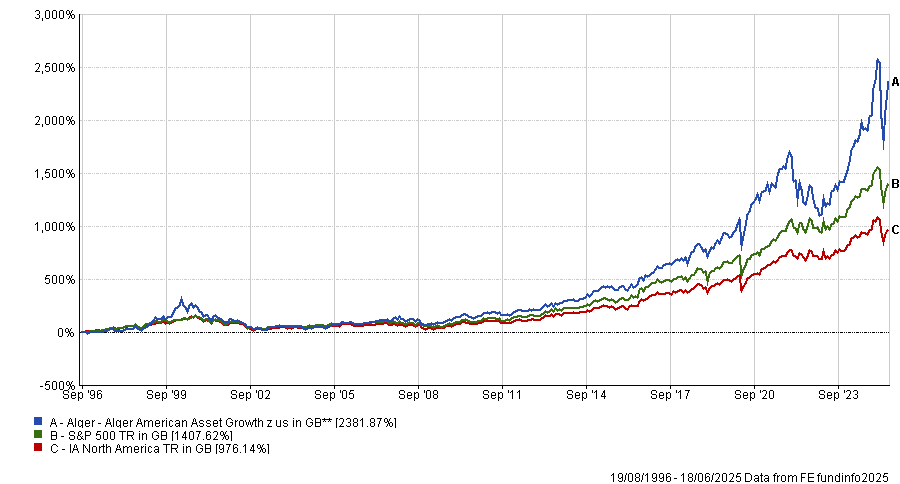

Over a decade and a half it is just behind the Nasdaq and is the second-best performing active fund among the sector. Meanwhile, since its inception in 1996 the fund is up more than 2,300%, as demonstrated by the chart below.

Performance of the fund vs the sector and benchmark since inception

Source: FE Analytics. Total return in sterling

For FE Fundinfo Alpha Manager Patrick Kelly, the recipe for this success is targeting companies in the US that are evolving their process.

Innovation is creating “big winners and big losers” and, while that includes names such as the Magnificent Seven, there are several other opportunities in the market beyond mega-cap tech.

“If you’re not innovating in the US, you’re going to struggle to compete.”

Below, he explains why bottom-up stock picking still works, why he is backing utility businesses for the first time in two decades, and why artificial intelligence (AI) still has plenty of room left to run.

What is the fund’s process?

Our investment thesis revolves around the idea that companies undergoing dynamic, positive change and evolution are the best investment opportunities.

We tend to group stocks into two buckets. The first is high-unit growth stocks, which are the companies taking market share in high-growth areas. The second is what we call a life cycle change story, where innovations or a change in regulation led to renewed revenue and earnings growth.

What should investors hold your fund?

We think this is one of the most innovative times in history, even before the inflexion in generative AI. Innovation will continue from here, creating both big winners and big losers.

It’s not just about picking the winners, it’s about being overweight and underweight, the right ones, even in these larger names. With all this innovation, we think it’s an ideal environment for our stock picking approach.

What were your best and worst calls in recent years

One of our better calls was Talen Energy. For the past 20 years, we have never invested in power producers or utility stocks. It’s just not a usual growth market. These were not good companies because they benefit from higher power demand, which has been flat for two decades.

But the electrification of the economy and the rise of AI have created much greater demand for power, with large hyperscalers needing to secure long-term contracts with companies such as Talen. It’s a great example of those life cycle stocks we mentioned earlier. It’s up 63% since we bought it.

Our biggest detractor is Pinterest. Our thesis is that it’s a tech firm using AI to improve advertising targeting, but it has suffered and is down more than 20% over the past year.

It had a concentration of advertisers in the consumer staples and home improvement industries, which have been impacted by the trade war. This obfuscated a lot of the benefits from its underlying product improvements in AI.

We continue to hold it and are optimistic about the long term, especially given its implementation of AI.

Where are you finding new ideas beyond tech?

While there are plenty of opportunities in these larger tech names, there are also underappreciated opportunities outside of them.

We’re also big fans of Robinhood, which we’re bullish about over the long term. That’s another great example of a company that’s innovating at a rapid pace and expanding its market opportunities and platforms by offering things like banking and credit cards.

We also currently like HEICO, which is a tech company, but it is an aerospace and defence supplier rather than a generator or big user of AI.

How much further can AI run?

For us, it’s one of the most important technology advances in history, targeting such a massive total addressable market.

When you think of its ability to replace or enhance the productivity of human labour, that means AI is targeting a labour market of more than $30trn, and it's going to be such a massive revenue generator. We also think there’s still room left to run in terms of things like sovereign AI, where individual countries will want to create unique AI offerings.

In terms of the size of the market that it’s targeting, it dwarfs prior developments such as cloud computing.

What do you do outside of fund management?

I spend a lot of time with my three kids, and I play virtually every sport I can. I’ve moved on from football and basketball and now play mostly tennis and golf, where there is less risk of injury.