Simply combining multiple index trackers in a portfolio can carry a “hidden risk” that increases volatility and impacts returns, according to Vanguard.

Blending index funds or exchange-traded funds (ETFs) is a commonly adopted strategy to build low-cost portfolios but analysis by the passive giant has identified how differences in index construction can result in material deviations in portfolio performance.

Although trackers may look the same on the surface, the ways in which index providers define and track value, growth or market capitalisation can vary significantly, Vanguard said, warning that this can lead to significant deviations from benchmark exposures – inadvertently driving up portfolio volatility and affecting returns.

Vanguard’s Andrey Kotlyarenko, equity index senior investment product manager, and William Coleman, head of the US ETF capital markets team, said: “These problems are often invisible until market volatility occurs.

“When turbulence hits, investors can start to see that their portfolios are riskier than the market or than they intended.”

CJ Cowan, portfolio manager on Quilter Investors’ Cirilium range, agreed with the broad point of the research, though he added a note of caution about tone: “While the summary is perhaps more simplistic than we might wish it to be and has more negative connotations than we would want to imply, overall, yes. If you use different index providers, it can lead to increased risk if not managed properly.”

For example, S&P, Russell and CRSP all apply different sets of financial metrics to determine whether a stock is ‘value’ or ‘growth’, Vanguard noted. While they all use price-to-book ratios to assess a company’s value factor, their models promptly diverge, with CRSP using 10 total factors, S&P six and Russell three.

As a result, the three providers categorise the style of 46% of large-cap stocks differently.

Russell and S&P also allow overlap – so the same stock could be in both a growth and a value index. CRSP will allocate each stock exclusively to one style.

The same inconsistency applies to market cap, the Vanguard research noted.

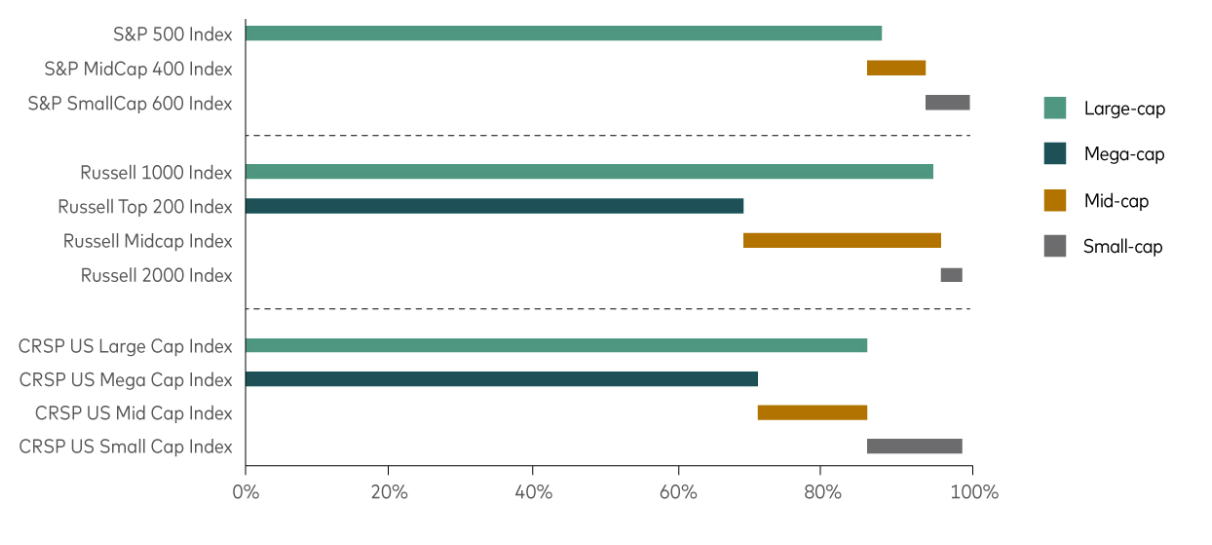

Market cap split across S&P, Russell and CRSP

Source: Vanguard calculations using FactSet data as at 1 Mar 2025

Russell and S&P use static stock counts to classify equities based on size, with the Russell 1000 covering 94% of total market capitalisation and the S&P 500 covering 87.5%. The latter also applies a profitability screen which excludes companies and depends on a committee to have the final say as to whether a company merits inclusion.

Meanwhile, CRSP defines large-cap as the top 85% of the market by capitalisation.

Although Quilter’s Cirilium passive range does not use style or market cap ETFs, the firm has found that the index divergence displayed above also spills into regional classifications, particularly in emerging markets, according to Cowan.

“MSCI includes South Korea in its emerging market equity index, FTSE does not, which has led to a noticeable performance difference,” he said. “In this instance we would want to make sure we hold an exact match and indeed this is a change we recently made in our own funds in buying the Amundi MSCI Emerging Markets II ETF.”

While the FTSE Emerging index has zero exposure to South Korean companies, the MSCI Emerging Markets index has a 9.6% weighting to the country with Samsung Electronics being the fourth largest constituent.

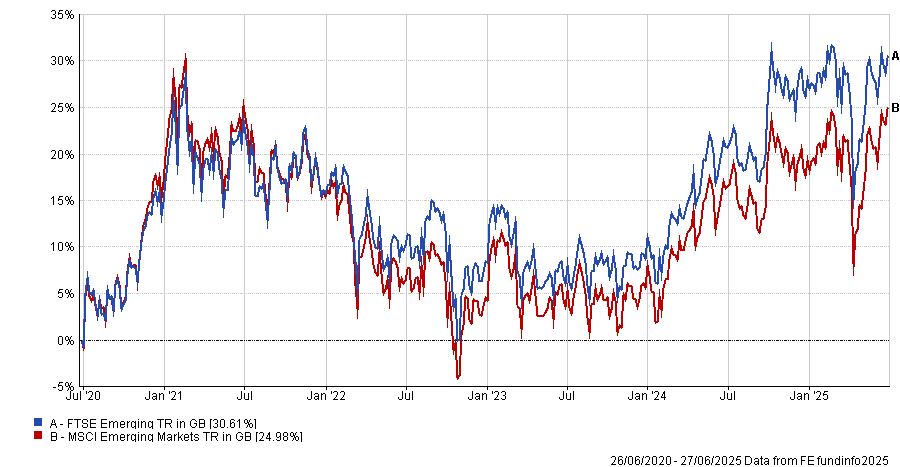

Performance of indices over 5yrs

Source: FE Analytics

FE Analytics shows the FTSE Emerging index has outperformed the MSCI Emerging Markets index by almost five percentage points over the past five years, albeit with more volatility and a higher maximum drawdown.

The impact of any of the above variations means picking two index funds with similar names may result in an investor inadvertently doubling up on certain holdings or introducing style drift into the portfolio. This, in turn, may also heighten risk and impact the portfolio’s performance.

Looking under the bonnet

This doesn’t mean mixing funds is a bad idea – only that it requires advisers and investors to review the underlying index methodologies in close detail.

Vanguard's Kotlyarenko and Coleman said: “Understanding the nuances of index construction methodologies and how well funds align with each other can help reduce unintended active risk.

“The fund name or classification is only the start of the story. A small-cap fund following one index provider may include a surprising number of companies that a different provider considers to be large-cap.”

One potential solution may be to stick with a single index provider where possible, Vanguard suggested – a move which would keep exposures consistent, simplify rebalancing and reduce the chance of overlap or misalignment.

Cowan agreed that “within an asset class you should use the same index provider for your strategic asset allocation” to avoid doubling up or missing out on exposures.

However, within actively managed portfolios, there can be benefits to working with multiple index providers, according to Tom Buffham, portfolio manager at RBC Brewin Dolphin.

“The main advantage of using multiple providers is being able to reduce the cost to clients by choosing the provider that is most competitive in any specific asset class or region,” he said.

“Additionally, there may be more targeted strategies, such as small-caps, that we want to incorporate in portfolios.”