UK income funds often have to leave environmental, governance or sustainability (ESG) philosophies at the door, with the most common dividend-paying stocks coming from 'old economy' areas, such as oil and gas and mining, that can be at odds with a sustainable mandate.

However, the £598m Janus Henderson UK Responsible Income fund manages to do both, providing income while avoiding problematic areas. It applies screens to UK income investing that prevent it from buying controversial stocks but does not sacrifice its payouts.

This carries risks, and the strategy has swung between the top and the bottom of the IA UK Equity Income sector in recent years.

It sat in the top quartile of the peer group in back-to-back years in 2019 and 2020, as well as being the second-best performer in 2023. Yet there have been years when the strategy struggled – most notably in 2021 and 2024, when it was one of the worst funds in the sector. This year so far has been better, with the portfolio above the sector average.

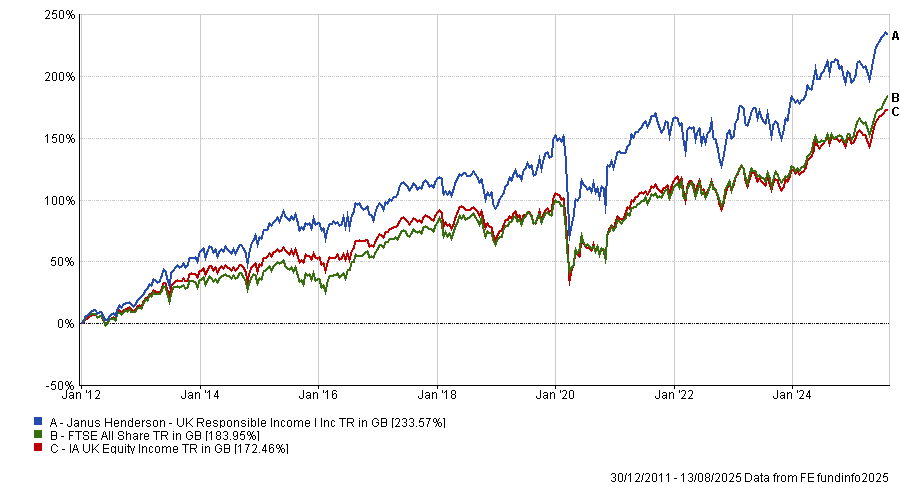

But what is important to co-manager Andrew Jones is the long run – the fund has beaten both the FTSE All Share and most peers since Jones took charge in 2012, as the chart below shows.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Below, he explains how he navigates the constraints of strict ESG screens and why he is adding to some of his worst performers of the past year.

How do you manage the fund?

The UK Responsible Income fund has ESG exclusion criteria at its core. It excludes areas such as oil, tobacco, gambling, and alcohol, and aims to have significantly lower carbon exposure than the benchmark overall.

We also want a growing income over time by focusing on dividend growth as much as the headline level of yield. We aim to grow the income while maintaining sufficient yield to stay in the income sector and be about the same as the FTSE All Share overall.

How much of the index do you exclude?

By percentage of market cap, it’s probably 37-38% excluded at the moment from the FTSE All-Share. By number of stocks, it’s around 20%. The market cap figure is closer to double because some very large companies are excluded. If you’re excluding BP and Shell, that’s nearly 10% gone with just two names.

This gives us enough diversification to deliver income and strong performance over time, both relative to the peer group and the benchmark.

The market-cap figure varies slightly, because with a lot of ESG strategies there’s a degree of subjectivity and companies coming in and out of eligibility.

What sectors or companies have had their ESG credential re-assessed and who makes that call?

We seek feedback from clients, many of whom have been with these ethical portfolios for a very long time, so they expect certain things. For example, there's an ongoing debate about whether exposure to defence companies should be reconsidered, given the difficult geopolitical situation in various parts of the world. But whenever we talk to clients, there’s no desire to change the criteria.

Similarly, in banking, people often prefer us to have exposure to domestic retail banking rather than investment banks, which have had more conduct issues historically. So we have a large position in NatWest, but we don’t own Barclays or HSBC.

Have you made any changes to the exclusion list recently?

No. We continue to ask clients whether the exclusions are appropriate, and they still seem to think they are. The reason they’re comfortable is that over the short term, excluding 30% to 40% of the market cap can cause performance differences versus the benchmark and peers, but over time it evens out.

Sometimes exclusions help, sometimes they hurt, but over the long term it’s more about what we own than what we don’t.

Since launch, the fund has outperformed the benchmark by 1 percentage point per annum on average, and it’s done even better in the time we’ve run it on our desk. If the performance is there over the long term, people are generally comfortable. That’s how they square the circle.

Long-term performance has been strong, the short term was more volatile – why?

2022 was one of the more extreme years for ESG funds. That was when the Ukraine invasion happened, defence stocks rerated and commodities spiked. You had everything moving against us at once.

Also, inflation expectations shifted, which moved markets from growth to value. As an income fund, that wasn't a problem for us, but the exclusions were. So 2022 wasn’t great versus unconstrained peers or the benchmark, but relative to other ESG funds, we did pretty well. 2023 saw a partial reversal.

While 2022 and 2023 were ESG-related, last year’s underperformance was more about our domestic bias. Some domestic names were weak in the fourth quarter, and that drove underperformance.

What were the best calls over the past year?

We’ve had quite big weights in the insurance sector. M&G, Aviva and Phoenix, which are among the highest yielders in the portfolio, have all performed well, adding 51bps, 45bps and 40bps, respectively.

Their yields have come down a bit as people realised the dividends are sustainable and the valuations attractive, but they still yield over 8% on average.

BT was also good. It has a new CEO who’s speaking confidently about long-term cashflow growth and the broadband business. 3i has continued to perform very well, largely driven by its stake in Action, the discount retailer, which is a phenomenal growth story in Europe.

We still like the long-term prospects for insurers and BT but we’ve trimmed 3i. It’s still a good compounder, but after strong performance, we’ve reduced the position slightly.

Which positions hurt the most?

Not owning Rolls-Royce or BAE has been negative from a benchmark point of view. But among the stocks we do own, I’d group the negatives into two buckets: international growth cyclicals and UK domestics.

The international cyclicals are stocks such as manufacturing and research company Oxford Instruments (which makes up 1.1% of the portfolio), engineering enterprise Renishaw (also 1.1%) and electronics provider RS Group (1.4%), which together detracted around 130bps from performance.

With global growth uncertain and tariffs introduced, those longer-term growth stories have underperformed. However, we’ve actually added to these names over time. They’re cyclical, but we believe the long-term growth story is intact.

What do you do in your spare time?

I like going to concerts, I saw Oasis recently, which was lucky. I also enjoy theatre and watching rugby. I’m Welsh, so I’ve enjoyed getting behind the Lions recently.