The managers of the multi-asset Credo Dynamic fund have rotated out of real estate investment trusts (REITs) and into long/short alternatives this year, as narrowing discounts and takeovers shrank the opportunity set in listed property.

A range of hedge fund-style strategies have become the main beneficiary of the shift, with three new positions added to boost diversification and improve risk-adjusted returns.

“A couple of months ago, our big bet was investment trusts and REITs. We saw big opportunities in the discounts and that was a major differentiator for us over the past year,” said fund manager Ben Newton.

“But now that’s starting to tail off. Discounts have narrowed, peers have exited, or some holdings have been taken out altogether. There have been several takeovers – Harmony, Assura and Urban Logistics REIT just to name a few. So now, we’re seeing fewer opportunities in that space.”

At their highest, REITs made up 9.5% of Credo Dynamic; now that’s closer to 4.5%.

Newton and lead manager Rupert Silver are now seeing fewer opportunities across the board, and therefore added to a set of long/short strategies (which seek to profit from stock gains in their long positions as well as price declines in short positions).

“Long/short funds have essentially no correlation to equities, a big positive for us,” said Newton.

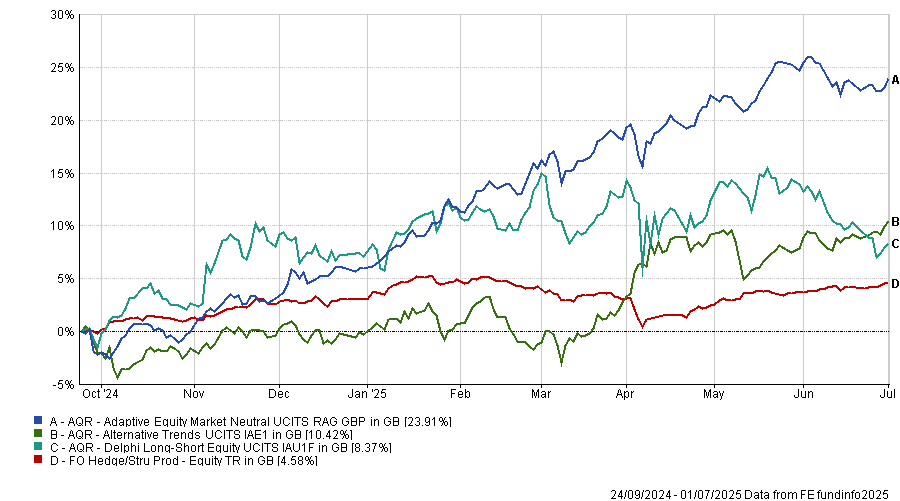

Their choice went to three strategies run by AQR Equity Market Neutral, Alternative Trends and Delphi Long/Short.

“AQR Equity Market Neutral uses 500 characteristics to screen positions – a kind of algorithm-led, AI-style approach. It’s very different from what we could do in-house, so we’re happy to allocate to a manager with strong intellectual property and a solid (albeit short) track record,” he continued.

Performance of funds against sector over 1yr

Source: FE Analytics

The managers said they want to avoid getting caught up in overly crowded trades, especially with signs of froth in areas like Bitcoin and treasuries.

“Delphi Long/Short is long value and quality, short overstretched areas of the market. That’s about diversifying the portfolio – we still hold tech and equities that would benefit in a boom, but if there’s a rotation or frothy behaviour, this helps protect against that,” said Newton.

Alternative Trends, meanwhile, focuses on momentum strategies in more esoteric asset classes. “It has low correlation and high potential returns, which makes the portfolio more robust,” he added. “These are liquid enough that we can rotate into equities or bonds if a better opportunity appears – or if discounts re-emerge.”

Silver and Newton run Credo Dynamic using a core-satellite structure. Around 50% of the portfolio is in core holdings: typically exchange-traded funds (ETFs) and corporate bonds, giving long-term exposure to global markets.

The rest, they explained, is more opportunistic, used to dial up risk when the environment justifies it through smaller companies and individual stocks or diversify through alternatives or at times aim to protect capital. They actively shift the balance based on bottom-up opportunities combined with more macro and valuation signals.

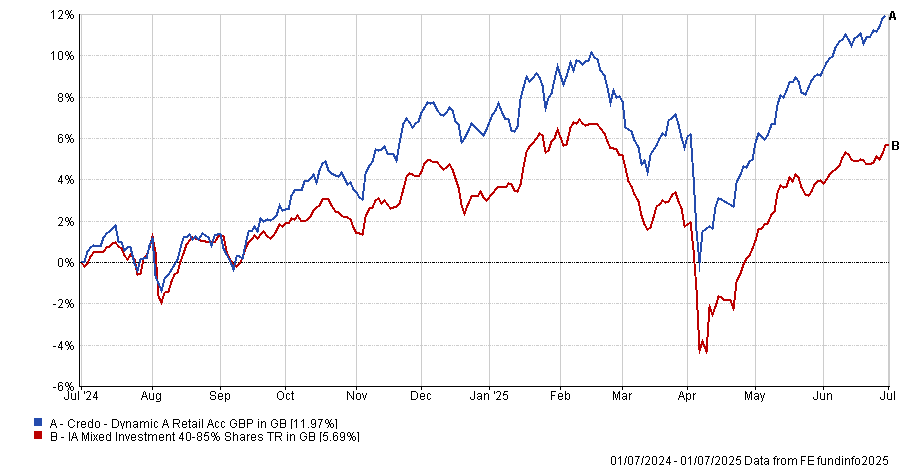

Alternatives, although a smaller allocation, have been a standout contributor in the past year, when the fund stood out against its average peer, as the chart below shows.

Performance of fund against sector over 1yr

Source: FE Analytics

“Alternatives have been especially important over the past 12 months – they’ve delivered the best returns, even though they’re a small part of the fund,” said Silver. “We like retaining that exposure when the future feels uncertain.”

That sense of uncertainty – combined with a lack of compelling opportunities – is exactly why they’ve chosen to focus on building a broad, balanced portfolio rather than making high-conviction macro calls.

“It’s a relatively uncertain environment on a number of metrics, but we’re not in risk-off mode. It’s about focusing on the type of risk you're taking. There’s no single area that stands out. It’s hard to know where to hang your hat, because we’re not seeing anything screamingly obvious,” said Newton.

That view has fed into their overall positioning, which currently sits at around 48% equity, just under 30% bonds and the remaining 20% in alternatives and cash.

While the managers are generally comfortable running a higher portfolio turnover than peers – “the satellite side of the portfolio can be highly active and opportunistic at times,” they said, noting their past focus on discounted investment trusts – recent turnover has been elevated due to the REIT unwind and rotation into alternatives. However, they expect it to fall back if no major new opportunities emerge in the coming months.

Newton summarised their outlook: “I don’t want to give the impression we’re preparing for a bearish scenario – we’re not building up a big cash buffer or waiting for a crash. We just think risks are elevated and obvious opportunities are scarce, so we’re asking: how can we still deliver strong returns from a very broad portfolio?”