The Murray Income trust is facing a “surprise” strategic review launched to improve long-term returns and address a persistent discount.

The board of the £931m FTSE 250-listed trust managed by Aberdeen said it would examine a range of options with the aim of boosting shareholder value, while continuing to deliver an attractive yield.

This follows a “detailed evaluation of performance”, which the board said has been "below expectations for some time".

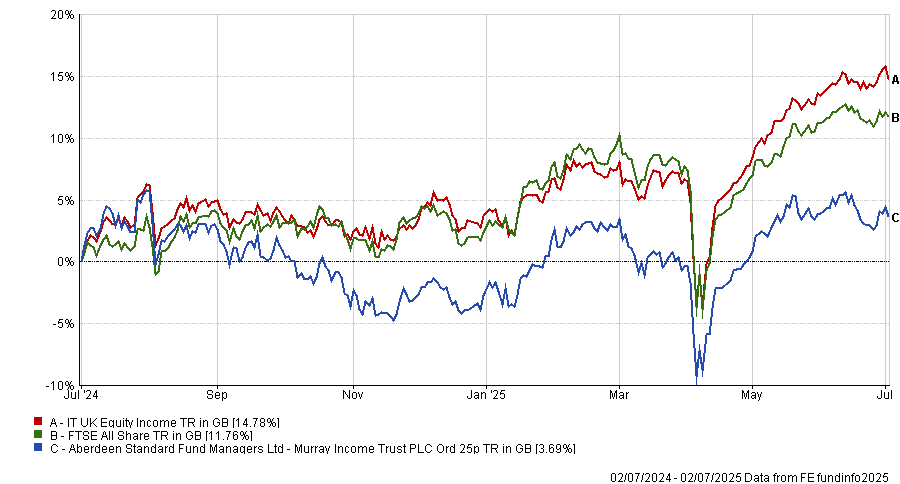

Performance of trust against index and sector over 1yr Source: FE Analytics

Source: FE Analytics

QuotedData’s James Carthew described the announcement as a surprise, noting that last year’s annual report contained no direct criticism of the trust’s performance.

He highlighted that the trust currently trades on a 10.3% discount, which is unusually wide for a large-cap income-focused vehicle. “That sort of level is bound to attract attention from discount-driven investors,” he said. Emma Bird, head of investment trust research at Winterflood, noted that Murray Income’s discount has averaged 9.3% since the start of 2023, which is currently the second-widest in its peer group.

When it comes to performance, the trust has ranked last among its 18-strong UK Equity Income peer group over the past year, underperforming the sector-leading Temple Bar Investment Trust by more than 20 percentage points. It also sits close to the bottom of the fourth quartile over both three and five years.

Bird welcomed the board’s decision to act, as strategic reviews have been increasingly prevalent in the investment trust sector in recent years, particularly among smaller, sub-scale funds.

“This is clearly not the case for Murray Income, which has a market cap of over £800m, but we commend the board for seeking to address the other issues facing the fund,” she said.

A merger could be "a plausible outcome", she added, particularly in a crowded sector where more than half of the trusts have market caps below £500m. Bird pointed to the possibility of a combination with one of Aberdeen’s other UK equity income mandates – Aberdeen Equity Income, Dunedin Income Growth or Shires Income – all of which are smaller and trade on tighter discounts or small premiums.

The board said it would make further announcements in due course.