Money market funds have proven increasingly attractive among cautious savers, but with the Bank of England expected to cut interest rates later this year, the appeal of these funds may wane.

As such, risk-averse savers overly dependent on cash need to be thinking about longer term options, according to Sam Benstead, fixed income lead at interactive investor.

Chancellor Rachel Reeves’ unpopular suggestion that the cash ISA allowance should be cut was missing from her Mansion House speech yesterday (so no action on this… yet).

But before she rowed back, it prompted many to make the case for money market funds as an alternative home for cash savings. In a nutshell, these are high liquidity funds that invest in short-term and high-quality debt instruments.

“They allow investors to earn income on their cash with minimal risk,” Benstead explained.

Yields normally sit just above the Bank of England interest rate, currently 4.25%, which is more competitive than a regular savings account.

With interest rates high in recent years, money market funds have been a great option for savers looking to gain a little more bang for their buck.

“There is a large part of our customer base that are drawn to the high yields [currently offered by money market funds] – particularly versus a couple years ago,” said Benstead.

“They are happy to return less than equity markets over the long run, but actually park their money in a safe product, get rid of the stock or bond market volatility and pick up more than 4% in income.”

For Fidelity, its Fidelity Cash Fund has been its best-selling fund this year, according to Ed Monk, associate director at Fidelity International.

Alongside this, there is also demand for well-performing money market funds such as Royal London Short Term Money Market Fund and the Legal & General Cash Trust.

Investors who have traditionally favoured the predictability of cash will find that money market funds “can provide a reassuring first step into investing”, said Monk.

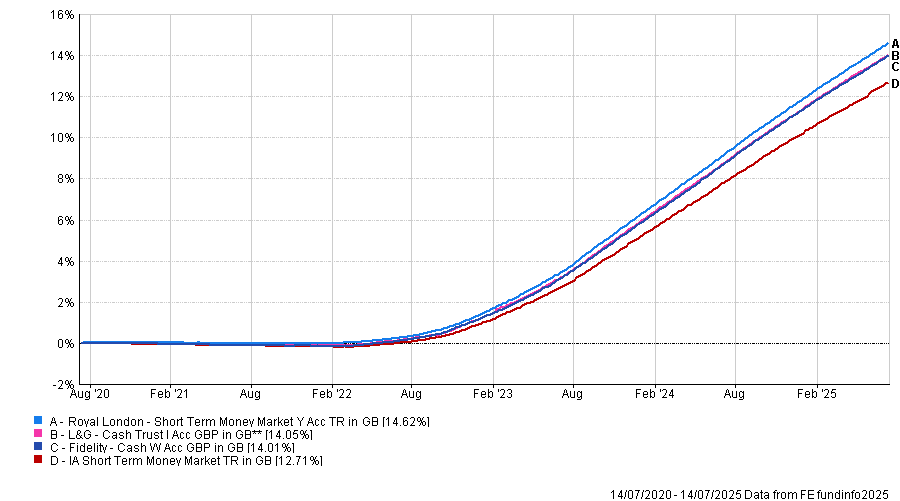

Performance of above funds vs IA Short Term Money Market over 5yr

Source: FE Analytics

Paul Angell, head of investment research at AJ Bell, noted that money market funds are also “keenly priced” at around 0.1 to 0.15% and deliver a return profile that “closely follows the Bank of England deposit rate”.

However, when comparing the performance of money market funds against the UK inflation rate, which sat at 3.6% in June, Benstead pointed out “isn’t a great real return”.

It is also important to think about where interest rates go from here, he argued.

“More cuts are expected later this year. If we go from 4.25% to 3.75%, that means returns on money market funds are going to fall as well – and that might be in the context of lower inflation, which allows the central bank to cut interest rates, or it might not be,” Benstead said.

So while money market funds will likely remain an attractive option for savers wanting to ensure they have a short term “cash bucket”, he noted, they are going to be less appropriate for those with a longer-term view on saving.

Ultimately, it’s about educating the public on other options for the money stashed away in cash ISAs to ensure they get a better return, Benstead said. This will inevitably involve being prepared to take slightly more risk.

For those inexperienced investors looking to invest in the long run, Benstead pointed to managed funds that can be accessed through stocks and shares ISAs, such as Vanguard LifeStrategy, L&G Multi-Index, BlackRock MyMap and ii Managed ISA.

Fees are typically low and they give investors widespread exposure across equities and fixed income, based on risk tolerance.