Investors seem to be finally taking note of the opportunities in emerging markets, with attractive starting valuations, a weaker dollar and emerging markets companies' roles in the artificial intelligence supply chain, all contributing to a resurgence for the asset class.

The MSCI Emerging Markets index has surged 11.4% so far this year, more than double the MSCI World index of global developed markets, which is up just 4.2%.

While there are plenty of reasons to be positive on emerging markets, Chris Tennant, co-manager on Fidelity Emerging Markets, argued there are some areas of the market investors should avoid.

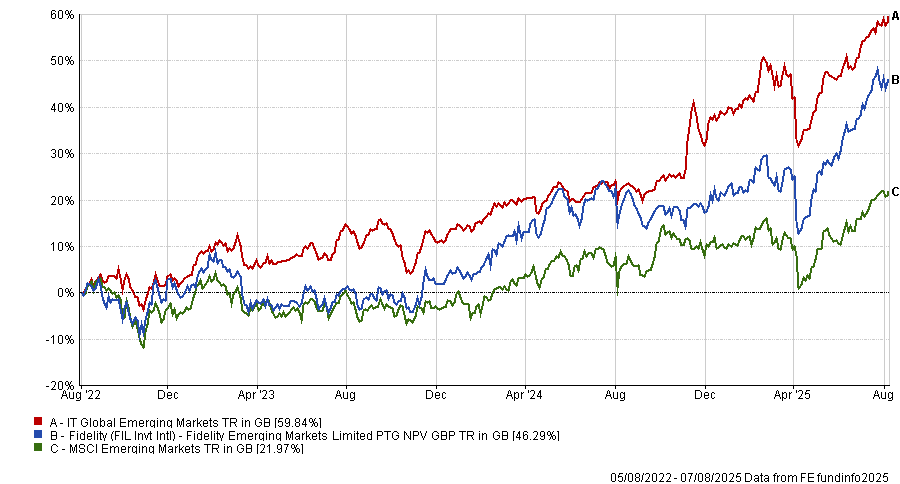

This thinking has helped the trust over the past three years, with Fidelity Emerging Markets delivering a total return of 46.3%, beating the MSCI Emerging Markets benchmark.

Performance of trust vs sector and benchmark over 3yrs

Source: FE Analytics

He is particularly against state-owned enterprises, such as Chinese state-owned banks, which might be encouraged by the government to support sectors such as property, “even if it’s not the most sensible thing to do for minority shareholders,” he said.

“There are plenty of examples in emerging markets of when a state-owned entity is encouraged to do something to the detriment of shareholders. That sort of thing happens fairly frequently.”

As a result, there are “big chunks of the market that are important to avoid" when investing in the region, said Tennant.

Below, he explains why China has gone from one of its best performers to one of its biggest challenges and why he is betting on mid-cap miners.

What is the trust’s process?

It is a bottom-up stock-picking strategy, using the 50 emerging market analysts on the Fidelity team. We’re centred around quality businesses that can generate returns on invested capital higher than the industry and competitors.

Our analysts spend most of their time trying to understand how these companies create that growth and how sustainable it is.

What differentiates the trust?

I don’t think there are many managers with an emerging market team as extensive as Fidelity. That, along with the fact we’re a closed-ended vehicle, means we can go much deeper down the market-cap spectrum, into more illiquid names, which we often think are much more exciting.

As mentioned, the ability to use both long and short is also key. We extend the long book to about 130, while our short book is about 30% of net asset value, so our active money exposure is 125%. We think that has been a key contributor to recent performance.

The philosophy behind our short book is that we’re trying to identify businesses in structural and cyclical decline that have several ‘red flags’, for example, in terms of corporate governance.

Why are the more illiquid names exciting?

There are just a lot of under-the-radar opportunities that investors are missing out on. We’re finding a lot of interesting opportunities in the materials/mining bucket in that sort of mid-tier market-cap bracket. The gold price has performed well over the past few years, and I don’t think many of these mid-cap names reflect that.

Almost every week we’re seeing a surge in merger and acquisition (M&A) activity because these emerging market gold miners are just so incredibly cheap.

For example, Buenaventura in Peru produces both gold and precious metals and has a stake in one of the most profitable global copper mines, along with a pipeline of attractive developmental projects. Despite all of that, I still think it's just extremely undervalued at around 9x earnings.

What was your best-performing holding in recent years?

The standout contributor has been TBC Bank, a Georgian-based bank, which has a shareholder return of 300% over three years and has added 250 basis points of performance.

Despite strong results, it has only risen from about 4x to 6x earnings, so it is still extremely cheap and faces extremely low competition. It has been expanding into countries such as Uzbekistan, which has almost 10x Georgia’s population, massively expanding its addressable market and giving it potential for sustained long-term growth.

And your worst?

We’ve struggled in China, particularly in the consumer space, which hit China Mengniu Dairy quite hard.

We overestimated its pricing power given the tough macro backdrop for the consumer, and structural concerns around the declining population and low birth rate in China. That put it in a position where the thesis had to be reassessed and we eventually concluded that the thesis was no longer valid. We sold out of it last year.

[Over the past five years, the stock price has slid more than 50%]

Has a low allocation to China been a long-term trend?

Actually no. Since we launched the open-ended version of the strategy in 2011, China has been one of our top positive contributors, but the past few years have become challenging.

There have been stylistic headwinds in China, with a flight to yield as interest rates have been consistently cut, benefiting businesses like financials that we were underweight. By contrast, we had a lot of exposure in that consumer space where we saw higher return businesses, which have struggled.

But there are still opportunities to invest in high-quality businesses. We like Tencent Music, for example, as essentially the Spotify of China, trading on a fraction of its multiple.

What do you do outside of fund management?

I’ve got two children who take up most of my time. In terms of hobbies, I’m quite into hiking. I go to the Lake District a few times a year with friends and colleagues.

I’m also a big fan of various sports. I’m quite into cycling and running. I’ve got a marathon in a few weeks in France.