Defence stocks have been a lucrative trade for investors this year as geopolitical tensions have forced governments to step up their military capabilities.

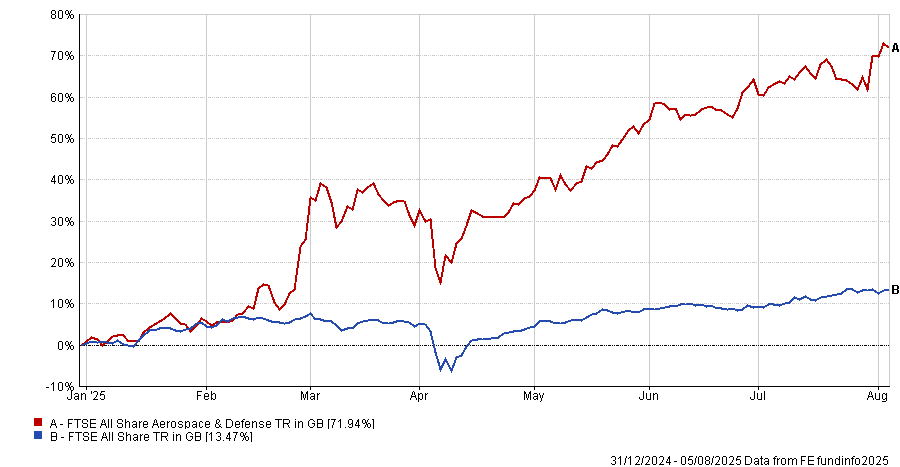

As a result, defence companies have surged in 2025 with the FTSE All Share Aerospace and Defence index up by 71.9%. By comparison, the FTSE All Share is up just 13.5%, a difference of almost 60 percentage points.

Performance of indices YTD

Source: FE Analytics

Investors have been taking note, with recent research from IG finding that defence has overtaken artificial intelligence (AI) as the growth industry that UK investors have the most confidence in this year.

This is backed up by fund flow data, which shows defence-focused funds have become incredibly popular this year, with the WisdomTree European Defence UCITS ETF accruing more than $3bn in assets under management in just three months.

However, despite a stellar return for defence stocks, Laura Foll, co-manager of the £1.3bn Law Debenture Corporation Trust, has been reducing her defensive holdings, including Rolls-Royce and Babcock, which have been big recent winners for her trust.

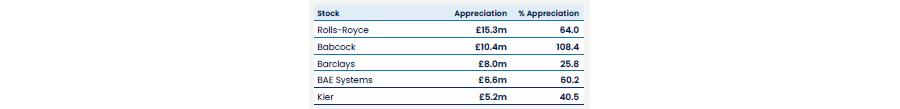

Law Debentures top 5 contributors in H1 2025

Source: Law Debenture. Data is in share price terms.

These businesses have benefited from a rising interest from the wider market and from internal self-help. For example, Babcock’s new management team has “returned the business to its roots” as the second biggest supplier to the Ministry of Defence, Foll explained.

However, despite these strong recent performances and a supportive macro-environment, Foll argued that now felt like a “good exit point”.

“Selling something at the right time is just as important as buying something at the right time,” she said.

Due to strong recent performances, valuations and earnings forecasts for these defence companies have moved higher. Babcock is a prime example, with its current valuation the highest it has been for many years, Foll said.

While they certainly could impress from here, the potential downside has become much greater, making the risk-reward for owning these companies less favourable, she noted.

Additionally, valuations and margins on defence businesses are essentially capped, she explained. The Single Source Regulations Office (SSRO) says that when only one company can supply a specific service to the government, there is a cap placed on the margin it can make.

Foll argued that this means there is a “realistic upper limit on the margins Babcock and other defence companies can make on sales to the UK government”.

By contrast, other businesses supplying the private sector do not have this limitation on margins and can make much better returns, she said.

“You need to keep moving on in actively managed portfolios to make sure you’ve got a good balance of upside across the portfolio. Otherwise, you’ll be left in yesterday’s winners instead of looking for the potential next Babcock,” Foll explained.

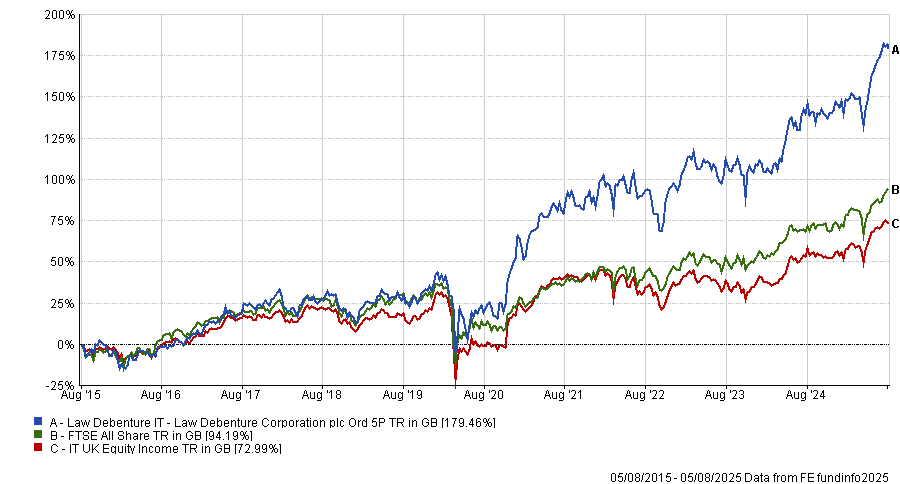

This approach seems to have paid off for Law Debenture. Over the past decade, it has been the top-performing investment trust in the IT UK Equity Income sector, outpacing its closest competitor by almost 60 percentage points.

Some of this performance will have come from the trust’s independent professional services business, which is a unique selling point to the investment company, while some will come from the stockpicking of managers Foll and James Henderson, who oversee the stock portfolio.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics.

The rotation away from some of these top-performing defence businesses has funded some new additions to the portfolio, such as rival asset management group Aberdeen.

The investment case for Aberdeen depends on its cheap valuation and ownership of the investment platform, interactive investor (ii), which has successfully grown its customer base due to its flat-fee structure.

If a competitor such as AJ Bell is listed on a compelling multiple, Foll argued that “I think it is fair to say that ii should be worth something similar”. This implies there could be upside for the share price of parent company Aberdeen.

Foll and Henderson have also taken a holding in wealth management firm Rathbones. A new chief executive and the recent merger with wealth manager Investec are allowing the management team to “take the blinkers off” and focus on improving growth.

While this will not be a “flick of the switch”, the shares currently trade at around 10x earnings and it also has an “attractive dividend”.