For an investor not prepared to fully immerse themselves in the volatile world of equities without a life raft, allocating a portion of their portfolio to more defensive asset classes can help cushion the blow if and when markets turn turbulent.

This is where the 80/20 portfolio comes in, as it still offers high equity exposure but with a layer of protection. Below, Rob Morgan, chief equity analyst at Charles Stanley, has outlined his perfect 80/20 allocation, blending global diversification with a defensive mindset.

Source: FE Analytics

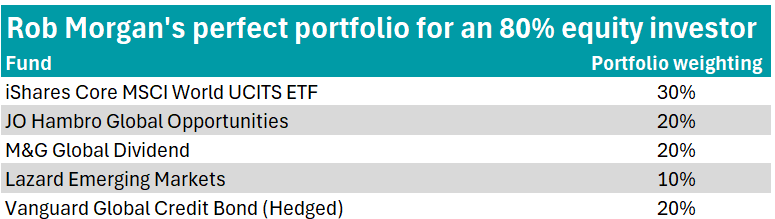

The core holding in the portfolio, with a 30% allocation, is iShares Core MSCI World UCITS ETF.

Morgan said it will offer investors “straightforward and low-cost exposure” to the world’s equity universe, including the US-based Magnificent Seven companies, thus “keeping a foot in the artificial intelligence camp for its long-term growth prospects”.

The exchange-traded fund has delivered strong returns over the medium to long term, and is in the first quartile in its sector across three years (57.9%), five years (94.9%) and 10 years (254.2%).

To diversify the passive core holding, Morgan suggested allocating 20% a piece to JO Hambro Global Opportunities and M&G Global Dividend.

The £739.9m JO Hambro Global Opportunities fund is a “blend of offence and defence” and is anchored by characteristics of both quality and value, according to Morgan.

As well as offering a concentrated portfolio, where stock-picking has a significant impact, he noted that the approach emphasises capital preservation.

“If insufficient attractive opportunities are identified, the managers are, unusually, prepared to hold some cash,” he said.

The managers, Ben Leyland and Robert Lancastle, stick to developed markets, hunting shares in high-quality businesses which they believe are underappreciated for the durability of their earnings and cashflow.

“The fund is neither growth or value-biased, instead exploring what the managers refer to as the ‘forgotten middle’ where quality, growth and value styles intersect,” Morgan explained.

Top holdings include global energy company Sempra, natural gas-only distributor Atmos Energy and CDW Corporation, an American multi-brand provider of information technology services.

Conversely to many global funds, JO Hambro Global Opportunities has nil weights to popular holdings such as Nvidia, Apple, Amazon, Meta, Broadcom and Taiwan Semiconductor Manufacturing Company, meaning it is more defensively minded compared to a global tracker, although this means the fund can be expected to lag when big tech is leading the market higher.

Indeed, over 10 years, the fund is in the third quartile in its sector for returns, gaining 160.2%.

RSMR analysts also rate the fund for its “differentiated investment style” and relatively low risk approach.

“Its valuation-conscious approach will always swing in and out of favour on a relative basis but has been resilient during choppier market periods,” the analysts added.

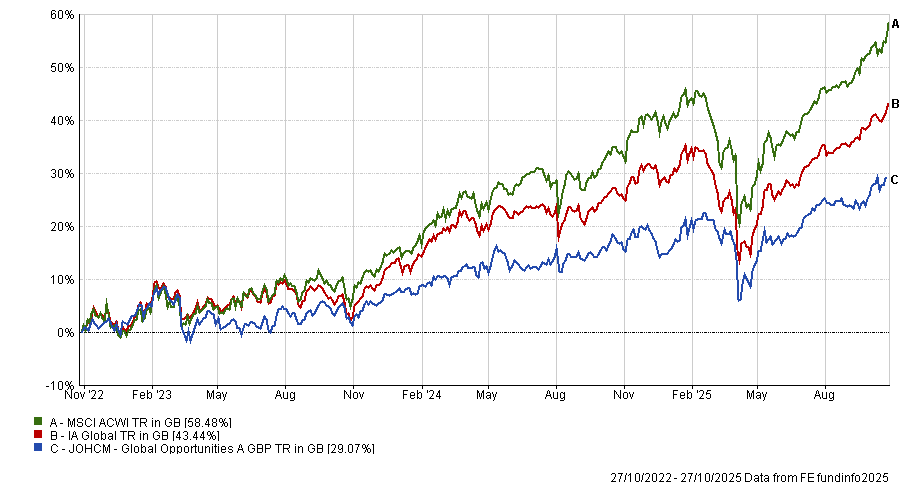

Performance of the fund vs sector and benchmark over 3yrs

Source: FE Analytics

Meanwhile, the £2.4bn M&G Global Dividend fund targets dividend-yielding stocks, offering investors exposure to more value-oriented and cashflow-producing areas, a characteristic which Morgan argued “offers some resilience in any leaner period for more richly-valued parts of the market”.

“The fund offers a pragmatic, well-rounded approach that targets a blend of companies with the prospect of growing dividends significantly over time, rather than having too much reliance on those with high starting yields but more limited prospects for increasing payouts,” he said.

The fund has been managed by Stuart Rhodes since it was launched in 2008 and John Weavers and Kathryn Leonard, with top holdings including global packaging company Amcor and methanol supplier and distributor Methanex Corporation.

Again, it could prove to be more lacklustre in times where growth stocks are leading the market, although it has managed top-quartile returns over three, five and 10 years, gaining 224.6% over the decade.

“Since launch, the fund has been a competitive performer against other global equity-income funds with stock selection being the main driver of returns, rather than sector or regional allocation, although at times it can be more volatile than others in the sector, due to its willingness to include more cyclical names with high growth potential,” RSMR analysts said.

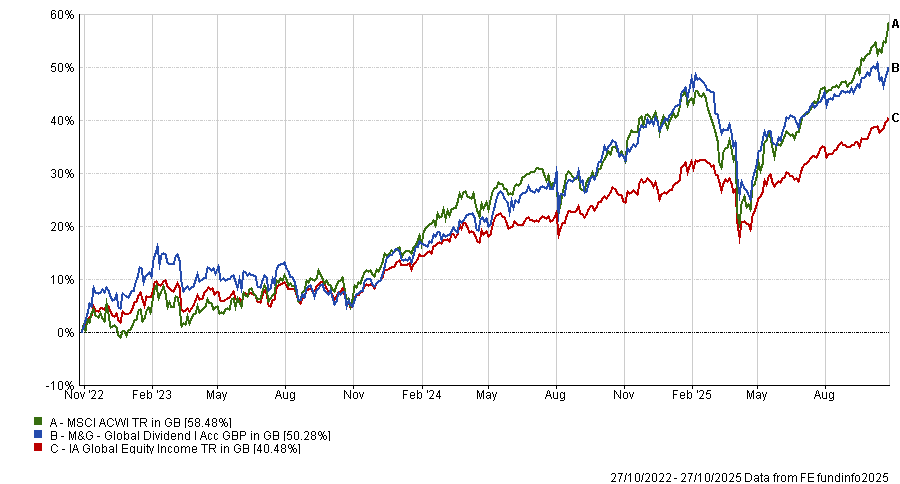

Performance of the fund vs sector and benchmark over 3yrs

Source: FE Analytics

Morgan then allocated 10% to Lazard Emerging Markets to “capture the important engines of growth outside the developed world – something absent from global passive funds and most global active manager’s portfolios, too”.

The £1.2bn fund has an FE fundinfo Crown Rating of five out of five and has managed first-quartile returns over one, three, five and 10 years.

“Investors that kept faith with manager James Donald and his team through a lean patch a few years ago have since been rewarded with excellent stock picking on top of decent returns from the asset class,” Morgan said, noting Donald’s “patient, value-based approach” that aims to buy out-of-favour stocks for the long term, while retaining a focus on quality that steers the portfolio away from governance pitfalls and value traps.

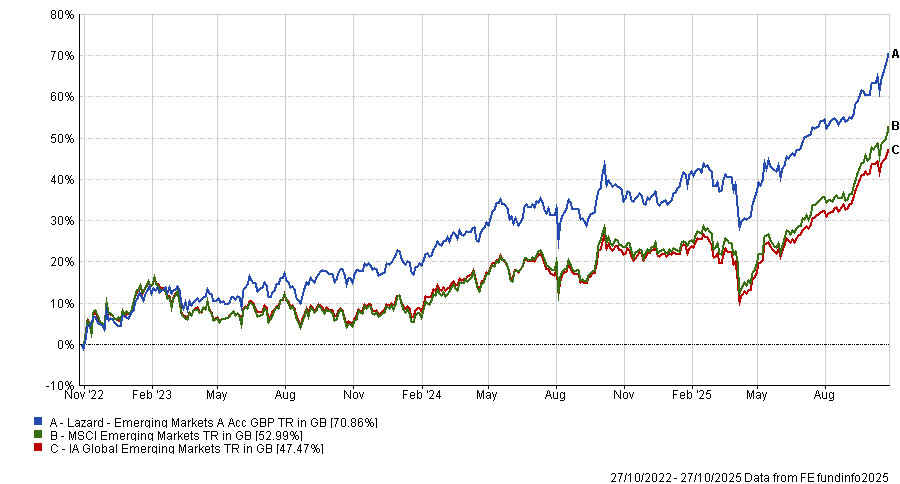

Performance of the fund vs sector and benchmark over 3yrs

Source: FE Analytics

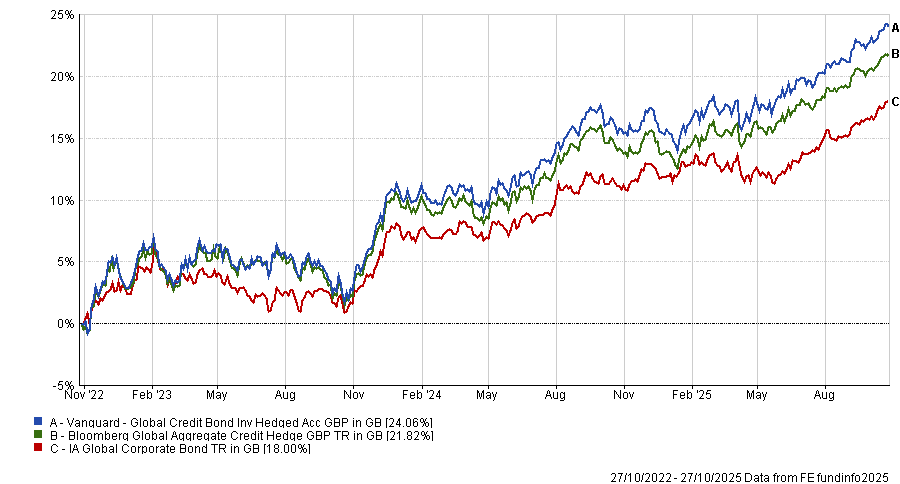

Finally, for the 20% not invested in equities, Morgan turned to bonds – specifically, Vanguard Global Credit Bond Fund (Hedged).

“Rather than pick a somewhat narrow sterling corporate bond fund for core fixed-interest exposure, it is better to widen the opportunity set and take a global approach,” he explained.

The fund offers a diversified portfolio of global corporate bonds with a focus on developed-market investment-grade securities. However, it also has scope to buy high-yield investment-grade emerging market bonds and other asset classes.

“Vanguard’s worldwide fixed income research capability, credit and sector selection are likely to be the primary drivers of relative performance, with interest rate sensitivity kept close to that of the benchmark,” Morgan added.

Selecting the hedged unit class removes currency fluctuations from returns for UK investors, “meaning this fund can make a simple but effective building block for the fixed-interest component of a portfolio”, Morgan explained.

Inflation and interest rate sensitivity will remain an ongoing risk for the fund, given the limited tools to adjust duration, he warned.

Performance of the fund vs sector and benchmark over 3yrs

Source: FE Analytics