Gold miners, defence and European equities have all surged this year, but some funds that have benefited the most might be completely off grid due to their classification.

The IA Unclassified sector is home to 936 funds that cannot or do not want to be classified into other Investment Association (IA) sectors, such as private funds or funds which have been removed from other sectors due to non-compliance, according to IA guidelines.

For fund selectors, these could fall through the cracks as they are not as easily comparable – but they can deliver strong returns when the conditions are right.

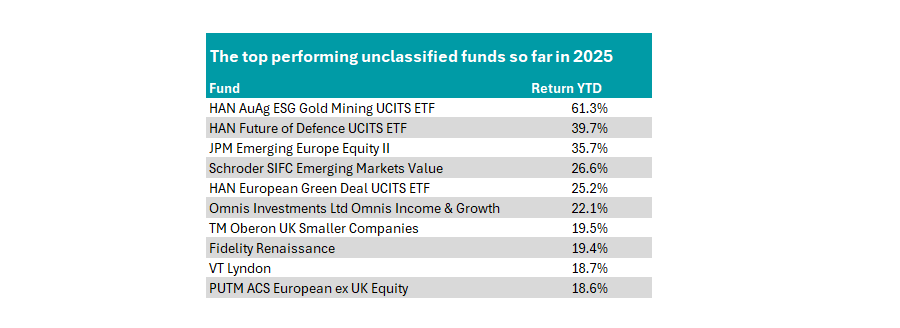

As such, Trustnet highlights below the top funds in the oft-overlooked sector.

At the top of the list is the HAN AuAg ESG Gold Mining UCITS ETF, which has made 61.3% in 2025 so far. If compared to other commodity specialists in the IA Commodity/Natural Resources sector, it would sit in third place.

The £21m portfolio invests in 25 environmental, social and governance (ESG)-screened stocks that are “active in the gold mining industry”, by tracking the Solactive AuAg ESG Gold Mining index.

The portfolio is 51.8% weighted to Canadian companies, 17% in South African businesses and around 7% in US and Australian firms.

On its website, HanETF outlined the reasons why investors might be interested in such a product. “During periods of economic uncertainty, gold is often favoured as its variable price can offset currency devaluations,” it said.

“Gold mining can be used as a leveraged play on gold, potentially benefiting from a supply and demand imbalance. Many believe gold miners have been historically undervalued, which could create upside potential.”

Another HanETF exchange-traded fund – HAN Future of Defence UCITS ETF – takes the second spot on the below list with gains of 39.7%. If it were to join peers in the IA Global sector (which is an imperfect comparison but home to many other sector-specific funds) it would be the second -best performer behind the iShares

Gold Producers UCITS ETF.

The £2bn fund was launched in 2023 but has blossomed this year as defence stocks have surged on the back of growing geopolitical instability in the Middle East, the continuing war between Russia and Ukraine and the threat of increased tensions in other parts of the world.

US president Donald Trump has also boosted the sector by strongarming trading partners to increase their spending, with the likes of the UK and Germany promising to significantly up their budgets in the coming years.

This fund invests in companies that generate revenues from NATO defence and cybersecurity spending. It is 59% weighted to the US – by far the largest single-country allocation – with no other countries contributing more than 10% to the fund.

Source: FE Analytics

In third place is the £19.6m JPM Emerging Europe Equity II fund, the first actively managed portfolio on the table above.

Managed by Oleg Biryulyov and Luis Carrillo, it invests in European countries that are classed as emerging markets, such as Poland, Greece, Turkey and Hungary.

It is dominated by financials, with eight of the fund’s top 10 holdings situated in the sector, giving it a 62.3% allocation overall.

Up 35.7% in 2025 so far, this would place it as the third-best fund in the IA Europe Excluding UK sector and the top performer in the IA Global Emerging Markets peer group.

Schroder SIFC Emerging Markets Value sits in fourth place. The £88.2m fund’s 26.6% return would place it as the top performer in the IA Global Emerging Markets sector, which investors could use as an appropriate barometer, as this portfolio aims to beat the MSCI Emerging Markets index over three to five years.

Run by Juan Torres and Vera German, the value-orientated portfolio is underweight China, instead prioritising markets such as Brazil, Korea and Hong Kong. Launched in 2024, 84.9% of the portfolio is invested in emerging market stocks, with 7.6% in developed Asian companies and 6% in cash.

Rounding out the top five is the HAN European Green Deal UCITS ETF – the third portfolio from the passive fund house.

It tracks the SGI European Green Deal ESG Screened index, investing in stocks based on four key policy areas: clean energy; sustainable mobility; building and renovation; and the circular economy.

The fund’s factsheet states: “The European Green Deal is set to mobilise over £1trn of investment designed to make Europe the first climate neutral continent – representing 30% of the EU budget.

“Europe wants to be at the forefront of the green revolution. Alongside climate concerns, there are geopolitical concerns, which means reducing reliance on energy imports, particularly from hostile geopolitical actors.”

Launched in 2023, this £7.7m fund had a strong year, up 25.2% so far in 2025 – good enough to place it in the top quartile of the IA Europe Excluding UK funds sector, which could be viewed as its most comparable peer group.