Manager departures can be big moments for a fund, particularly when the managers have been around for as long as David Gait and Sashi Reddy at Stewart Investors.

Following news that Gait, Reddy and their colleague Sujaya Desai have departed the firm, investors might question if some of their previously managed funds are still worth holding.

The three managers were responsible for several strategies at Stewart Investors, with FE Fundinfo Alpha Managers Gait and Reddy leading the flagship £5.5bn Stewart Investors Asia Pacific Leaders fund.

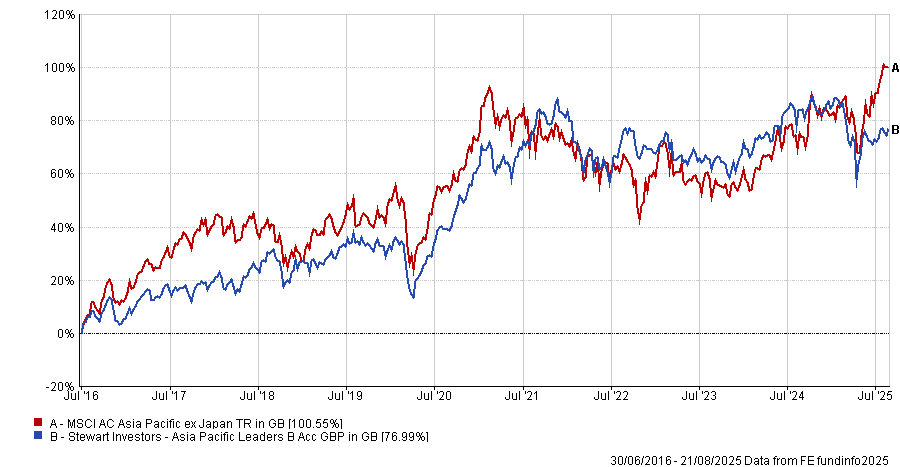

Since the two took over on 30 June 2016, the fund is up 77.1%. This is behind the MSCI AC Asia Pacific ex Japan benchmark index, as the below table shows.

Performance of fund vs benchmark since manager start

Source: FE Analytics. Data in sterling.

The fund proved very popular among experts under their leadership, featuring on the Square Mile Academy of Funds list and the Fidelity Select 50.

But should the sudden departure of three managers from the firm cause investors to reconsider the fund?

Darius McDermott, managing director at Chelsea Financial Services, did not think so.

“There’s no hard and fast rule when it comes to manager departures, but for me it’s a hold,” he said.

While the lead managers leaving the team “absolutely has an impact”, McDermott explained that Gait and Reddy followed a pre-existing process and philosophy that has existed for almost 30 years.

That originated from former manager Angus Tulloch, who has been retired for more than eight years, demonstrating that the fund can continue to perform even as big-name managers depart, McDermott continued.

“There is a team of more than a dozen people left at the firm who are trained in the same way of investing as Gait and his colleagues.”

He conceded that, while recent performance has deteriorated, with the fund down around 4% year to date, this was due to its quality-growth style being “out of favour”, rather than any problems with the core process.

Ben Yearsley, director at Fairview Investing, agreed: “In the short term, I think this is not significant enough to justify selling”.

He agreed that Stewart investors follow a strong team-based approach to investing, with the philosophy and approach ingrained in the strategy from its inception.

“It’s a blow to the team to lose so many managers all at once, but the strategy of Asia Pacific Leaders has survived for years.”

He explained that investors should view this as an “evolution for the strategy, rather than a revolution”.

However, he said that over the medium term, this opinion might need to be revised. “You still need a manager to pull the trigger on the strategy, to make decisions about stocks and so on.” With three managers leaving, the team will need to find three replacements, at which point it will be up to the new managers to prove themselves, he explained.

However, not all platforms remained positive. Square Mile opted to remove the Stewart Investors Pacific Leaders Fund’s Responsible AA rating following the departure of Gait, Reddy and Desai.

Amaya Assan, head of fund origination at Square Mile, said: “We feel this is a significant change to what has been a very stable team for many years, with all three managers having been key members since they joined the firm.

“When key figures leave a business, not only is it immediately disruptive but it can impact the morale of the team members who remain.”

Finding suitable replacements takes time, Assan continued, meaning that some “essential skills may not be satisfactorily maintained”.

New team members also bring “new dynamics and personal biases” to the team. While these are not always bad things, it will require time for new managers to assimilate into the existing culture or “change it in their own image”.

“We’ve known this close-knit team for many years and until now it has been very stable,” Assan concluded.

Following the news, Hargreaves Lansdown chose to remove one of Reddy and Gait's other funds, the Stewart Investors Indian Subcontinent All Cap fund from it's Wealth Shortlist.

Tom James, investment analyst at Hargreaves Lansdown said: "The team at Stewart Investors has typically been stable over the years and the departure of Reddy and Gait is disappointing. They’re both experienced investors with long track records of investing across Asia, particularly in India. As two of the longest-serving team members, they’ve been crucial in developing the culture of stewardship amongst the wider team."